Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

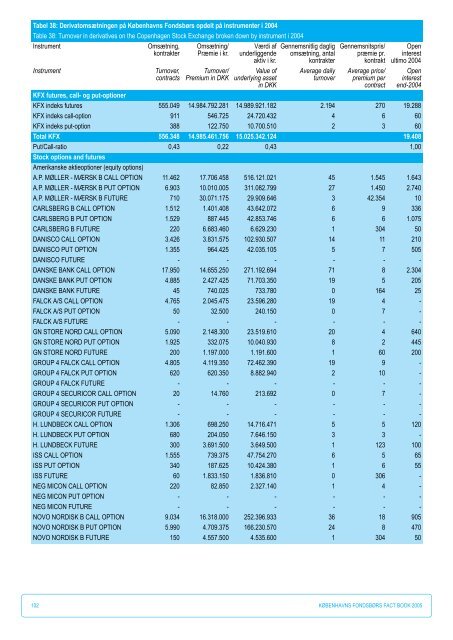

Tabel 38: Derivatomsætningen på Københavns Fondsbørs opdelt på instrumenter i 2004<br />

Table 38: Turnover in derivatives on the Copenhagen Stock Exchange broken down by instrument i 2004<br />

Instrument Omsætning,<br />

kontrakter<br />

Instrument Turnover,<br />

contracts<br />

Omsætning/<br />

Præmie i kr.<br />

Turnover/<br />

Premium in DKK<br />

Værdi af<br />

underliggende<br />

aktiv i kr.<br />

Value of<br />

underlying asset<br />

in DKK<br />

Gennemsnitlig daglig<br />

omsætning, antal<br />

kontrakter<br />

Average daily<br />

turnover<br />

Gennemsnitspris/<br />

præmie pr.<br />

kontrakt<br />

Average price/<br />

premium per<br />

contract<br />

Open<br />

interest<br />

ultimo 2004<br />

Open<br />

interest<br />

end-2004<br />

KFX futures, call- og put-optioner<br />

KFX indeks futures 555.049 14.984.792.281 14.989.921.182 2.194 270 19.288<br />

KFX indeks call-option 911 546.725 24.720.432 4 6 60<br />

KFX indeks put-option 388 122.750 10.700.510 2 3 60<br />

Total KFX 556.348 14.985.461.756 15.025.342.124 19.408<br />

Put/Call-ratio 0,43 0,22 0,43 1,00<br />

Stock options and futures<br />

Amerikanske aktieoptioner (equity options)<br />

A.P. MØLLER - MÆRSK B CALL OPTION 11.462 17.706.458 516.121.021 45 1.545 1.643<br />

A.P. MØLLER - MÆRSK B PUT OPTION 6.903 10.010.005 311.082.799 27 1.450 2.740<br />

A.P. MØLLER - MÆRSK B FUTURE 710 30.071.175 29.909.646 3 42.354 10<br />

CARLSBERG B CALL OPTION 1.512 1.401.408 43.642.072 6 9 336<br />

CARLSBERG B PUT OPTION 1.529 887.445 42.853.746 6 6 1.075<br />

CARLSBERG B FUTURE 220 6.683.460 6.629.230 1 304 50<br />

DANISCO CALL OPTION 3.426 3.831.575 102.930.507 14 11 210<br />

DANISCO PUT OPTION 1.355 964.425 42.035.105 5 7 505<br />

DANISCO FUTURE - - - - - -<br />

DANSKE BANK CALL OPTION 17.950 14.655.250 271.192.694 71 8 2.304<br />

DANSKE BANK PUT OPTION 4.885 2.427.425 71.703.350 19 5 205<br />

DANSKE BANK FUTURE 45 740.025 733.780 0 164 25<br />

FALCK A/S CALL OPTION 4.765 2.045.475 23.596.280 19 4 -<br />

FALCK A/S PUT OPTION 50 32.500 240.150 0 7 -<br />

FALCK A/S FUTURE - - - - - -<br />

GN STORE NORD CALL OPTION 5.090 2.148.300 23.519.610 20 4 640<br />

GN STORE NORD PUT OPTION 1.925 332.075 10.040.930 8 2 445<br />

GN STORE NORD FUTURE 200 1.197.000 1.191.600 1 60 200<br />

GROUP 4 FALCK CALL OPTION 4.805 4.119.350 72.462.390 19 9 -<br />

GROUP 4 FALCK PUT OPTION 620 620.350 8.882.940 2 10 -<br />

GROUP 4 FALCK FUTURE - - - - - -<br />

GROUP 4 SECURICOR CALL OPTION 20 14.760 213.692 0 7 -<br />

GROUP 4 SECURICOR PUT OPTION - - - - - -<br />

GROUP 4 SECURICOR FUTURE - - - - - -<br />

H. LUNDBECK CALL OPTION 1.306 698.250 14.716.471 5 5 120<br />

H. LUNDBECK PUT OPTION 680 204.050 7.646.150 3 3 -<br />

H. LUNDBECK FUTURE 300 3.691.500 3.649.500 1 123 100<br />

ISS CALL OPTION 1.555 739.375 47.754.270 6 5 65<br />

ISS PUT OPTION 340 187.625 10.424.380 1 6 55<br />

ISS FUTURE 60 1.833.150 1.836.810 0 306 -<br />

NEG MICON CALL OPTION 220 82.850 2.327.140 1 4 -<br />

NEG MICON PUT OPTION - - - - - -<br />

NEG MICON FUTURE - - - - - -<br />

NOVO NORDISK B CALL OPTION 9.034 16.318.000 252.396.933 36 18 905<br />

NOVO NORDISK B PUT OPTION 5.990 4.709.375 166.230.570 24 8 470<br />

NOVO NORDISK B FUTURE 150 4.557.500 4.535.600 1 304 50<br />

102 KØBENHAVNS FONDSBØRS FACT BOOK <strong>2005</strong>