Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

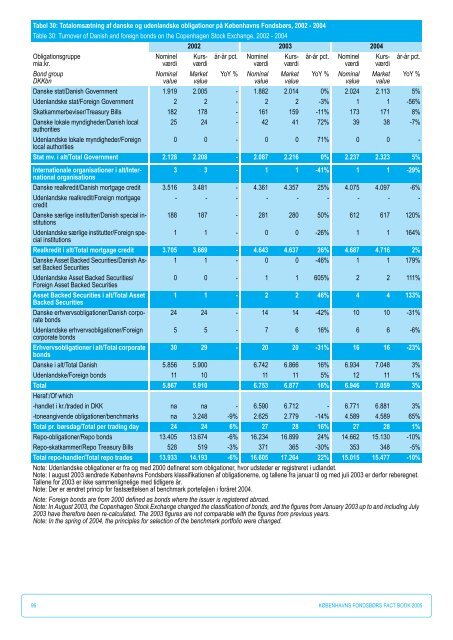

Tabel 30: Totalomsætning af danske og udenlandske obligationer på Københavns Fondsbørs, 2002 - 2004<br />

Table 30: Turnover of Danish and foreign bonds on the Copenhagen Stock Exchange, 2002 - 2004<br />

2002 2003 2004<br />

Obligationsgruppe<br />

mia.kr.<br />

Bond group<br />

DKKbn<br />

Nominel<br />

værdi<br />

Nominal<br />

value<br />

Kursværdi<br />

Market<br />

value<br />

år-år pct. Nominel<br />

værdi<br />

YoY % Nominal<br />

value<br />

Kursværdi<br />

Market<br />

value<br />

år-år pct. Nominel<br />

værdi<br />

YoY % Nominal<br />

value<br />

Kursværdi<br />

Market<br />

value<br />

år-år pct.<br />

Danske stat/Danish Government 1.919 2.005 - 1.882 2.014 0% 2.024 2.113 5%<br />

Udenlandske stat/Foreign Government 2 2 - 2 2 -3% 1 1 -56%<br />

Skatkammerbeviser/Treasury Bills 182 178 - 161 159 -11% 173 171 8%<br />

Danske lokale myndigheder/Danish local<br />

authorities<br />

25 24 - 42 41 72% 39 38 -7%<br />

Udenlandske lokale myndigheder/Foreign<br />

local authorities<br />

0 0 - 0 0 71% 0 0 -<br />

Stat mv. i alt/Total Government 2.128 2.208 - 2.087 2.216 0% 2.237 2.323 5%<br />

Internationale organisationer i alt/International<br />

organisations<br />

3 3 - 1 1 -41% 1 1 -29%<br />

Danske realkredit/Danish mortgage credit 3.516 3.481 - 4.361 4.357 25% 4.075 4.097 -6%<br />

Udenlandske realkredit/Foreign mortgage<br />

credit<br />

- - - - - - - - -<br />

Danske særlige institutter/Danish special institutions<br />

188 187 - 281 280 50% 612 617 120%<br />

Udenlandske særlige institutter/Foreign special<br />

institutions<br />

1 1 - 0 0 -26% 1 1 164%<br />

Realkredit i alt/Total mortgage credit 3.705 3.669 - 4.643 4.637 26% 4.687 4.716 2%<br />

Danske Asset Backed Securities/Danish Asset<br />

Backed Securities<br />

1 1 - 0 0 -46% 1 1 179%<br />

Udenlandske Asset Backed Securities/<br />

Foreign Asset Backed Securities<br />

0 0 - 1 1 605% 2 2 111%<br />

Asset Backed Securities i alt/Total Asset<br />

Backed Securities<br />

1 1 - 2 2 46% 4 4 133%<br />

Danske erhvervsobligationer/Danish corporate<br />

bonds<br />

24 24 - 14 14 -42% 10 10 -31%<br />

Udenlandske erhvervsobligationer/Foreign<br />

corporate bonds<br />

5 5 - 7 6 16% 6 6 -6%<br />

Erhvervsobligationer i alt/Total corporate<br />

bonds<br />

30 29 - 20 20 -31% 16 16 -23%<br />

Danske i alt/Total Danish 5.856 5.900 6.742 6.866 16% 6.934 7.048 3%<br />

Udenlandske/Foreign bonds 11 10 11 11 5% 12 11 1%<br />

Total<br />

Heraf:/Of which<br />

5.867 5.910 6.753 6.877 16% 6.946 7.059 3%<br />

-handlet i kr./traded in DKK na na - 6.590 6.712 - 6.771 6.881 3%<br />

-toneangivende obligationer/benchmarks na 3.248 -9% 2.625 2.779 -14% 4.589 4.589 65%<br />

Total pr. børsdag/Total per trading day 24 24 6% 27 28 16% 27 28 1%<br />

Repo-obligationer/Repo bonds 13.405 13.674 -6% 16.234 16.899 24% 14.662 15.130 -10%<br />

Repo-skatkammer/Repo Treasury Bills 528 519 -3% 371 365 -30% 353 348 -5%<br />

Total repo-handler/Total repo trades 13.933 14.193 -6% 16.605 17.264 22% 15.015 15.477 -10%<br />

Note: Udenlandske obligationer er fra og med 2000 defineret som obligationer, hvor udsteder er registreret i udlandet.<br />

Note: I august 2003 ændrede Københavns Fondsbørs klassifikationen af obligationerne, og tallene fra januar til og med juli 2003 er derfor reberegnet.<br />

Tallene for 2003 er ikke sammenlignelige med tidligere år.<br />

Note: Der er ændret princip for fastsættelsen af benchmark porteføjlen i foråret 2004.<br />

Note: Foreign bonds are from 2000 defined as bonds where the issuer is registered abroad.<br />

Note: In August 2003, the Copenhagen Stock Exchange changed the classification of bonds, and the figures from January 2003 up to and including July<br />

2003 have therefore been re-calculated. The 2003 figures are not comparable with the figures from previous years.<br />

Note: In the spring of 2004, the principles for selection of the benchmark portfolio were changed.<br />

96 KØBENHAVNS FONDSBØRS FACT BOOK <strong>2005</strong><br />

YoY %