Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Fact Book 2005 - NASDAQ OMX Trader Nordic

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

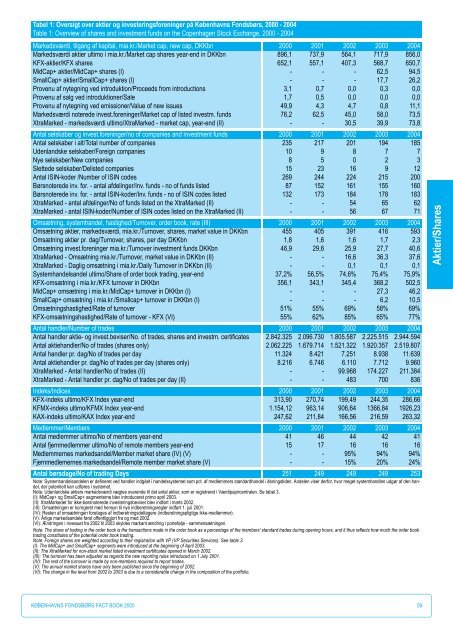

Tabel 1: Oversigt over aktier og investeringsforeninger på Københavns Fondsbørs, 2000 - 2004<br />

Table 1: Overview of shares and investment funds on the Copenhagen Stock Exchange, 2000 - 2004<br />

Markedsværdi, tilgang af kapital, mia.kr./Market cap, new cap, DKKbn 2000 2001 2002 2003 2004<br />

Markedsværdi aktier ultimo i mia.kr./Market cap shares year-end in DKKbn 896,1 737,9 564,1 717,9 856,0<br />

KFX-aktier/KFX shares 652,1 557,1 407,3 568,7 650,7<br />

MidCap+ aktier/MidCap+ shares (I) - - - 62,5 94,5<br />

SmallCap+ aktier/SmallCap+ shares (I) - - - 17,7 26,2<br />

Provenu af nytegning ved introduktion/Proceeds from introductions 3,1 0,7 0,0 0,3 0,0<br />

Provenu af salg ved introduktioner/Sale 1,7 0,5 0,0 0,0 0,0<br />

Provenu af nytegning ved emissioner/Value of new issues 49,9 4,3 4,7 0,8 11,1<br />

Markedsværdi noterede invest.foreninger/Market cap of listed investm. funds 76,2 62,5 45,0 58,0 73,5<br />

XtraMarked - markedsværdi ultimo/XtraMarked - market cap, year-end (II) - - 30,5 39,9 73,8<br />

Antal selskaber og invest.foreninger/no of companies and investment funds 2000 2001 2002 2003 2004<br />

Antal selskaber i alt/Total number of companies 235 217 201 194 185<br />

Udenlandske selskaber/Foreign companies 10 9 8 7 7<br />

Nye selskaber/New companies 8 5 0 2 3<br />

Slettede selskaber/Delisted companies 15 23 16 9 12<br />

Antal ISIN-koder /Number of ISIN codes 269 244 224 215 200<br />

Børsnoterede inv. for. - antal afdelinger/Inv. funds - no of funds listed 87 152 161 155 160<br />

Børsnoterede inv. for. - antal ISIN-koder/Inv. funds - no of ISIN codes listed 132 173 184 178 183<br />

XtraMarked - antal afdelinger/No of funds listed on the XtraMarked (II) - - 54 65 62<br />

XtraMarked - antal ISIN-koder/Number of ISIN codes listed on the XtraMarked (II) - - 56 67 71<br />

Omsætning, systemhandel, hastighed/Turnover, order book, rate (III) 2000 2001 2002 2003 2004<br />

Omsætning aktier, markedsværdi, mia.kr./Turnover, shares, market value in DKKbn 455 405 391 416 593<br />

Omsætning aktier pr. dag/Turnover, shares, per day DKKbn 1,8 1,6 1,6 1,7 2,3<br />

Omsætning invest.foreninger mia.kr./Turnover investment funds DKKbn 46,9 29,6 25,9 27,7 40,6<br />

XtraMarked - Omsætning mia.kr./Turnover, market value in DKKbn (II) - - 16,6 36,3 37,6<br />

XtraMarked - Daglig omsætning i mia.kr./Daily Turnover in DKKbn (II) - - 0,1 0,1 0,1<br />

Systemhandelsandel ultimo/Share of order book trading, year-end 37,2% 56,5% 74,6% 75,4% 75,9%<br />

KFX-omsætning i mia.kr./KFX turnover in DKKbn 356,1 343,1 345,4 368,2 502,5<br />

MidCap+ omsætning i mia.kr./MidCap+ turnover in DKKbn (I) - - - 27,3 46,2<br />

SmallCap+ omsætning i mia.kr./Smallcap+ turnover in DKKbn (I) - - - 6,2 10,5<br />

Omsætningshastighed/Rate of turnover 51% 55% 69% 58% 69%<br />

KFX-omsætningshastighed/Rate of turnover - KFX (VI) 55% 62% 85% 65% 77%<br />

Antal handler/Number of trades 2000 2001 2002 2003 2004<br />

Antal handler aktie- og invest.beviser/No. of trades, shares and investm. certificates 2.842.325 2.096.730 1.805.587 2.225.515 2.944.594<br />

Antal aktiehandler/No of trades (shares only) 2.062.225 1.679.714 1.521.322 1.920.357 2.519.807<br />

Antal handler pr. dag/No of trades per day 11.324 8.421 7.251 8.938 11.639<br />

Antal aktiehandler pr. dag/No of trades per day (shares only) 8.216 6.746 6.110 7.712 9.960<br />

XtraMarked - Antal handler/No of trades (II) - - 99.968 174.227 211.384<br />

XtraMarked - Antal handler pr. dag/No of trades per day (II) - - 483 700 836<br />

Indeks/Indices 2000 2001 2002 2003 2004<br />

KFX-indeks ultimo/KFX Index year-end 313,90 270,74 199,49 244,35 286,66<br />

KFMX-indeks ultimo/KFMX Index year-end 1.154,12 963,14 906,64 1366,84 1926,23<br />

KAX-indeks ultimo/KAX Index year-end 247,62 211,84 166,56 216,59 263,32<br />

Medlemmer/Members 2000 2001 2002 2003 2004<br />

Antal medlemmer ultimo/No of members year-end 41 46 44 42 41<br />

Antal fjernmedlemmer ultimo/No of remote members year-end 15 17 16 16 16<br />

Medlemmernes markedsandel/Member market share (IV) (V) - - 95% 94% 94%<br />

Fjernmedlemernes markedsandel/Remote member market share (V) - - 15% 20% 24%<br />

Antal børsdage/No of trading Days 251 249 249 249 253<br />

Note: Systemhandelsandelen er defineret ved handler indgået i handelssystemet som pct. af medlemmers standardhandel i åbningstiden. Andelen viser derfor, hvor meget systemhandlen udgør af den handel,<br />

der potentielt kan udføres i systemet.<br />

Note: Udenlandske aktiers markedsværdi vægtes svarende til det antal aktier, som er registreret i Værdipapircentralen. Se tabel 3.<br />

(I): MidCap+ og SmallCap+ segmenterne blev introduceret primo april 2003.<br />

(II): XtraMarkedet for ikke-børsnoterede investeringsbeviser blev indført i marts 2002.<br />

(III): Omsætningen er korrigeret med hensyn til nye indberetningsregler indført 1. juli 2001.<br />

(IV): Resten af omsætningen foretages af indberetningsdeltagere (indberetningspligtige ikke-medlemmer).<br />

(V): Årlige markedsandele først offentliggjort fra og med 2002.<br />

(VI): Ændringen i niveauet fra 2002 til 2003 skyldes markant ændring i portefølje - sammensætningen.<br />

Note: The share of trading in the order book is the transactions made in the order book as a percentage of the members' standard trades during opening hours, and it thus reflects how much the order book<br />

trading constitutes of the potential order book trading.<br />

Note: Foreign shares are weighted according to their registration with VP (VP Securities Services). See table 3.<br />

(I): The MidCap+ and SmallCap+ segments were introduced at the beginning of April 2003.<br />

(II): The XtraMarked for non-stock market listed investment certificates opened in March 2002.<br />

(III): The turnover has been adjusted as regards the new reporting rules introduced on 1 July 2001.<br />

(IV): The rest of the turnover is made by non-members required to report trades.<br />

(V): The annual market shares have only been published since the beginning of 2002.<br />

(VI): The change in the level from 2002 to 2003 is due to a considerable change in the composition of the portfolio.<br />

KØBENHAVNS FONDSBØRS FACT BOOK <strong>2005</strong> 59<br />

Aktier/Shares