Geschäftsbericht 2002 - Commerzbank International SA

Geschäftsbericht 2002 - Commerzbank International SA

Geschäftsbericht 2002 - Commerzbank International SA

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

individually-tailored investment strategies in an<br />

international context. Above all in the area of<br />

retirement planning, there was increased investment<br />

in the specialised training of advisors.<br />

The Eurolux System policy represents not only<br />

the ideal supplement to existing private provision<br />

– since it is becoming ever clearer that the<br />

statutory pension scheme and company pension<br />

provision, in their current form, will not be sufficient<br />

in future to safeguard the pension system<br />

in the long term – it is also an excellent instrument<br />

for retirement planning.<br />

The merger between Allianz AG and<br />

Dresdner Bank AG, and the resulting entry into<br />

the Allianz Group, serve to strengthen the future<br />

prospects of Dresdner Bank Luxembourg S.A.<br />

Bilateral contracts with the group companies of<br />

AGF (Assurances Générales de France) based<br />

in the Benelux countries were further developed<br />

during the year under review with the aim of<br />

offering the customers of both organisations<br />

new, innovative products and of being able<br />

to develop the regional markets even more effectively<br />

on a joint basis.<br />

The financial year <strong>2002</strong> was the third year<br />

in succession in which all leading share indexes<br />

recorded losses. Contrary to the expectations<br />

of many analysts, as in previous years, bond<br />

investments significantly outperformed equities.<br />

In this context, the Asset Management department<br />

was able to achieve a solid result for the<br />

moneys entrusted to the Bank. At the same time,<br />

through structural changes, the Asset Management<br />

department further improved its efficiency.<br />

Dresdner Bank Luxembourg, S.A. Sucursal<br />

Financeira Exterior (DBL NL Madeira), through<br />

which the Bank has a branch in Funchal,<br />

Madeira, almost doubled its turnover in its<br />

second full financial year, thus achieving a<br />

positive result. On the basis of double taxation<br />

agreements, Dresdner Bank Luxembourg S.A.<br />

offers commercial and private investors the<br />

possibility of obtaining an above-average net<br />

yield after tax by investing in the free trade zone<br />

of Madeira.<br />

With effect from 1 March <strong>2002</strong>, Dr. Joachim<br />

v. Harbou retired as Chairman of the Board<br />

of Directors and the Loan Committee. We wish<br />

to extend our thanks to Dr. v. Harbou for his<br />

services to Dresdner Bank Luxembourg S.A.<br />

The new Chairman of the Board of Directors is<br />

Dr. Bernd Fahrholz.<br />

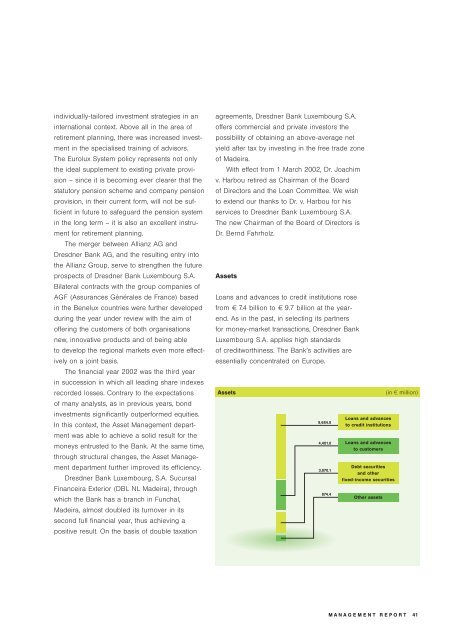

Assets<br />

Loans and advances to credit institutions rose<br />

from E 7.4 billion to E 9.7 billion at the yearend.<br />

As in the past, in selecting its partners<br />

for money-market transactions, Dresdner Bank<br />

Luxembourg S.A. applies high standards<br />

of creditworthiness. The Bank’s activities are<br />

essentially concentrated on Europe.<br />

Assets (in W million)<br />

9,684.0<br />

4,401.0<br />

3,070.1<br />

874.4<br />

Loans and advances<br />

to credit institutions<br />

Loans and advances<br />

to customers<br />

Debt securities<br />

and other<br />

fixed-income securities<br />

Other assets<br />

MANAGEMENT REPORT<br />

41