Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

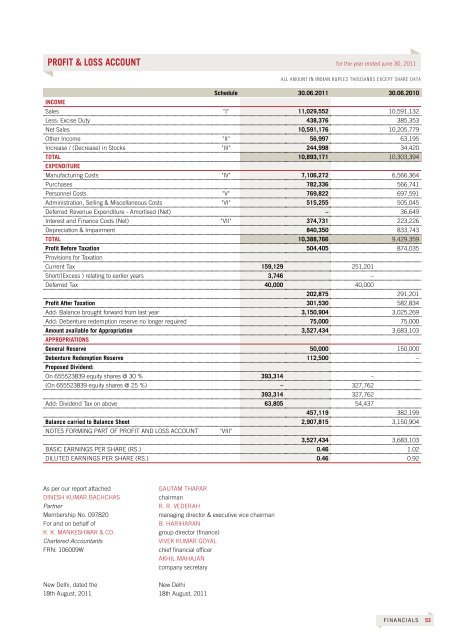

PROFIt & lOSS accOUnt for the year ended june 30, <strong>2011</strong><br />

IncOMe<br />

As per our report attached<br />

DINESH KUMAR BACHCHAS<br />

Partner<br />

Membership No. 097820<br />

For and on behalf of<br />

K. K. MANKESHwAR & Co.<br />

Chartered Accountants<br />

FRN: 106009w<br />

New Delhi, dated the<br />

18th August, <strong>2011</strong><br />

GAUtAM tHApAR<br />

chairman<br />

R. R. VEDERAH<br />

managing director & executive vice chairman<br />

B. HARIHARAN<br />

group director (finance)<br />

VIVEK KUMAR GoYAL<br />

chief financial officer<br />

AKHIL MAHAJAN<br />

company secretary<br />

New Delhi<br />

18th August, <strong>2011</strong><br />

All Amount in indiAn Rupees thousAnds except shARe dAtA<br />

Schedule 30.06.<strong>2011</strong> 30.06.2010<br />

Sales "I" 11,029,552 10,591,132<br />

Less: Excise Duty 438,376 385,353<br />

Net Sales 10,591,176 10,205,779<br />

other Income "II" 56,997 63,195<br />

Increase / (Decrease) in Stocks "III" 244,998 34,420<br />

tOtal 10,893,171 10,303,394<br />

eXPenDItURe<br />

Manufacturing Costs "IV" 7,106,272 6,566,364<br />

purchases 782,336 566,741<br />

personnel Costs "V" 769,822 697,591<br />

Administration, Selling & Miscellaneous Costs "VI" 515,255 505,045<br />

Deferred Revenue Expenditure - Amortised (Net) – 36,649<br />

Interest and Finance Costs (Net) "VII" 374,731 223,226<br />

Depreciation & Impairment 840,350 833,743<br />

tOtal 10,388,766 9,429,359<br />

Profit Before taxation<br />

provisions for taxation<br />

504,405 874,035<br />

Current tax 159,129 251,201<br />

Short/(Excess ) relating to earlier years 3,746 –<br />

Deferred tax 40,000 40,000<br />

202,875 291,201<br />

Profit after taxation 301,530 582,834<br />

Add: Balance brought forward from last year 3,150,904 3,025,269<br />

Add: Debenture redemption reserve no longer required 75,000 75,000<br />

amount available for appropriation<br />

aPPROPRIatIOnS<br />

3,527,434 3,683,103<br />

General Reserve 50,000 150,000<br />

Debenture Redemption Reserve<br />

Proposed Dividend:<br />

112,500 –<br />

on 655523839 equity shares @ 30 % 393,314 –<br />

(on 655523839 equity shares @ 25 %) – 327,762<br />

393,314 327,762<br />

Add: Dividend tax on above 63,805 54,437<br />

457,119 382,199<br />

Balance carried to Balance Sheet 2,907,815 3,150,904<br />

NotES FoRMING pARt oF pRoFIt AND LoSS ACCoUNt "VIII"<br />

3,527,434 3,683,103<br />

BASIC EARNINGS pER SHARE (RS.) 0.46 1.02<br />

DILUtED EARNINGS pER SHARE (RS.) 0.46 0.92<br />

FInancIals<br />

53