Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

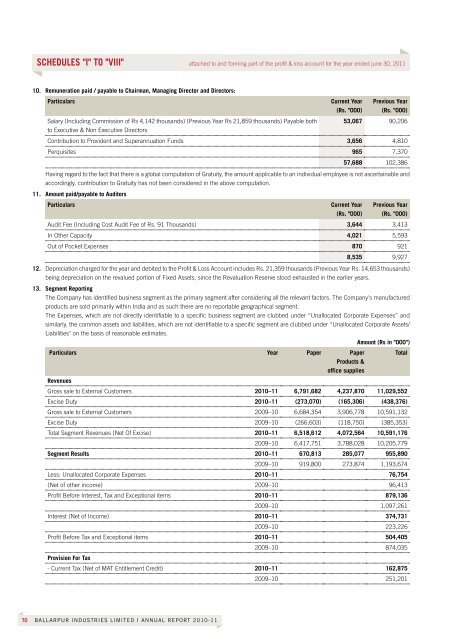

ScheDUleS "I" tO "VIII" attached to and forming part of the profit & loss account for the year ended june 30, <strong>2011</strong><br />

10. Remuneration paid / payable to chairman, Managing Director and Directors:<br />

Particulars current Year<br />

Salary (Including Commission of Rs 4,142 thousands) (previous Year Rs 21,859 thousands) payable both<br />

to Executive & Non Executive Directors<br />

70 <strong>Ballarpur</strong> IndustrIes lImIted I annual report 2010-11<br />

(Rs. "000)<br />

Previous Year<br />

(Rs. "000)<br />

53,067 90,206<br />

Contribution to provident and Superannuation Funds 3,656 4,810<br />

perquisites 965 7,370<br />

57,688 102,386<br />

Having regard to the fact that there is a global computation of Gratuity, the amount applicable to an individual employee is not ascertainable and<br />

accordingly, contribution to Gratuity has not been considered in the above computation.<br />

11. amount paid/payable to auditors<br />

Particulars current Year<br />

(Rs. "000)<br />

Previous Year<br />

(Rs. "000)<br />

Audit Fee (Including Cost Audit Fee of Rs. 91 thousands) 3,644 3,413<br />

In other Capacity 4,021 5,593<br />

out of pocket Expenses 870 921<br />

8,535 9,927<br />

12. Depreciation charged for the year and debited to the profit & Loss Account includes Rs. 21,359 thousands (previous Year Rs. 14,653 thousands)<br />

being depreciation on the revalued portion of Fixed Assets, since the Revaluation Reserve stood exhausted in the earlier years.<br />

13. Segment <strong>Report</strong>ing<br />

the Company has identified business segment as the primary segment after considering all the relevant factors. the Company's manufactured<br />

products are sold primarily within India and as such there are no reportable geographical segment.<br />

the Expenses, which are not directly identifiable to a specific business segment are clubbed under “Unallocated Corporate Expenses” and<br />

similarly, the common assets and liabilities, which are not identifiable to a specific segment are clubbed under “Unallocated Corporate Assets/<br />

Liabilities" on the basis of reasonable estimates.<br />

amount (Rs in "000")<br />

Particulars Year Paper Paper<br />

Products &<br />

office supplies<br />

Revenues<br />

Gross sale to External Customers 2010–11 6,791,682 4,237,870 11,029,552<br />

Excise Duty 2010–11 (273,070) (165,306) (438,376)<br />

Gross sale to External Customers 2009–10 6,684,354 3,906,778 10,591,132<br />

Excise Duty 2009–10 (266,603) (118,750) (385,353)<br />

total Segment Revenues (Net of Excise) 2010–11 6,518,612 4,072,564 10,591,176<br />

2009–10 6,417,751 3,788,028 10,205,779<br />

Segment Results 2010–11 670,813 285,077 955,890<br />

2009–10 919,800 273,874 1,193,674<br />

Less: Unallocated Corporate Expenses 2010–11 76,754<br />

(Net of other income) 2009–10 96,413<br />

profit Before Interest, tax and Exceptional items 2010–11 879,136<br />

2009–10 1,097,261<br />

Interest (Net of Income) 2010–11 374,731<br />

2009–10 223,226<br />

profit Before tax and Exceptional items 2010–11 504,405<br />

Provision For tax<br />

2009–10 874,035<br />

- Current tax (Net of MAt Entitlement Credit) 2010–11 162,875<br />

2009–10 251,201<br />

total