Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

Annual Report 2011 - Ballarpur Industries Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

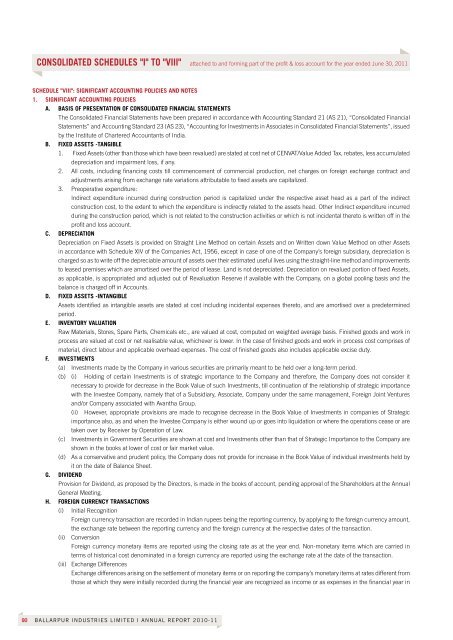

ConsoLIDATeD sCheDuLes "I" To "VIII" attached to and forming part of the profit & loss account for the year ended June 30, <strong>2011</strong><br />

sCheDuLe "VIII": sIGnIFICAnT ACCounTInG poLICIes AnD noTes<br />

1. sIGnIFICAnT ACCounTInG poLICIes<br />

A. BAsIs oF presenTATIon oF ConsoLIDATeD FInAnCIAL sTATemenTs<br />

The Consolidated Financial Statements have been prepared in accordance with Accounting Standard 21 (AS 21), “Consolidated Financial<br />

Statements” and Accounting Standard 23 (AS 23), “Accounting for Investments in Associates in Consolidated Financial Statements”, issued<br />

by the Institute of Chartered Accountants of India.<br />

B. FIXeD AsseTs -TAnGIBLe<br />

1. Fixed Assets (other than those which have been revalued) are stated at cost net of CeNVAT/Value Added Tax, rebates, less accumulated<br />

depreciation and impairment loss, if any.<br />

2. All costs, including financing costs till commencement of commercial production, net charges on foreign exchange contract and<br />

adjustments arising from exchange rate variations attributable to fixed assets are capitalized.<br />

3. Preoperative expenditure:<br />

Indirect expenditure incurred during construction period is capitalized under the respective asset head as a part of the indirect<br />

construction cost, to the extent to which the expenditure is indirectly related to the assets head. Other Indirect expenditure incurred<br />

during the construction period, which is not related to the construction activities or which is not incidental thereto is written off in the<br />

profit and loss account.<br />

C. DepreCIATIon<br />

Depreciation on Fixed Assets is provided on Straight Line Method on certain Assets and on Written down Value Method on other Assets<br />

in accordance with Schedule XIV of the Companies Act, 1956, except in case of one of the Company’s foreign subsidiary, depreciation is<br />

charged so as to write off the depreciable amount of assets over their estimated useful lives using the straight-line method and improvements<br />

to leased premises which are amortised over the period of lease. Land is not depreciated. Depreciation on revalued portion of fixed Assets,<br />

as applicable, is appropriated and adjusted out of revaluation reserve if available with the Company, on a global pooling basis and the<br />

balance is charged off in Accounts.<br />

D. FIXeD AsseTs -InTAnGIBLe<br />

Assets identified as intangible assets are stated at cost including incidental expenses thereto, and are amortised over a predetermined<br />

period.<br />

e. InVenTorY VALuATIon<br />

raw Materials, Stores, Spare Parts, Chemicals etc., are valued at cost, computed on weighted average basis. Finished goods and work in<br />

process are valued at cost or net realisable value, whichever is lower. In the case of finished goods and work in process cost comprises of<br />

material, direct labour and applicable overhead expenses. The cost of finished goods also includes applicable excise duty.<br />

F. InVesTmenTs<br />

(a) Investments made by the Company in various securities are primarily meant to be held over a long-term period.<br />

(b) (i) holding of certain Investments is of strategic importance to the Company and therefore, the Company does not consider it<br />

necessary to provide for decrease in the Book Value of such Investments, till continuation of the relationship of strategic importance<br />

with the Investee Company, namely that of a Subsidiary, Associate, Company under the same management, Foreign Joint Ventures<br />

and/or Company associated with Avantha Group.<br />

(ii) however, appropriate provisions are made to recognise decrease in the Book Value of Investments in companies of Strategic<br />

importance also, as and when the Investee Company is either wound up or goes into liquidation or where the operations cease or are<br />

taken over by receiver by Operation of Law.<br />

(c) Investments in Government Securities are shown at cost and Investments other than that of Strategic Importance to the Company are<br />

shown in the books at lower of cost or fair market value.<br />

(d) As a conservative and prudent policy, the Company does not provide for increase in the Book Value of individual investments held by<br />

it on the date of Balance Sheet.<br />

G. DIVIDenD<br />

Provision for Dividend, as proposed by the Directors, is made in the books of account, pending approval of the Shareholders at the <strong>Annual</strong><br />

General Meeting.<br />

h. ForeIGn CurrenCY TrAnsACTIons<br />

(i) Initial recognition<br />

Foreign currency transaction are recorded in Indian rupees being the reporting currency, by applying to the foreign currency amount,<br />

the exchange rate between the reporting currency and the foreign currency at the respective dates of the transaction.<br />

(ii) Conversion<br />

Foreign currency monetary items are reported using the closing rate as at the year end. Non-monetary items which are carried in<br />

terms of historical cost denominated in a foreign currency are reported using the exchange rate at the date of the transaction.<br />

(iii) exchange Differences<br />

exchange differences arising on the settlement of monetary items or on reporting the company’s monetary items at rates different from<br />

those at which they were initially recorded during the financial year are recognized as income or as expenses in the financial year in<br />

90 <strong>Ballarpur</strong> industries limited i annual report 2010-11