RESEARCH FOR

RESEARCH FOR

RESEARCH FOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECONOMIC CALCULATION OF SHORT<br />

ROTATION WILLOW PLANTATIONS IN LATVIA<br />

Kristaps Makovskis, Dagnija Lazdiņa, Ligita Bite<br />

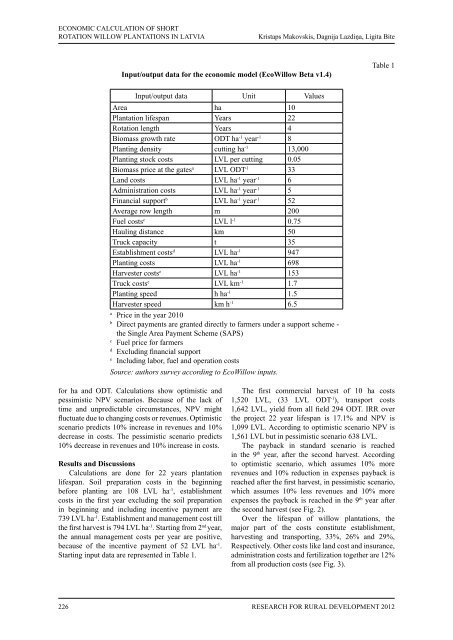

Input/output data for the economic model (ecoWillow beta v1.4)<br />

Input/output data Unit Values<br />

Area ha 10<br />

Plantation lifespan Years 22<br />

Rotation length Years 4<br />

Biomass growth rate ODT ha-1 year-1 8<br />

Planting density cutting ha-1 13,000<br />

Planting stock costs LVL per cutting 0.05<br />

Biomass price at the gatesa LVL ODT-1 33<br />

Land costs LVL ha-1 year-1 6<br />

Administration costs LVL ha-1 year-1 5<br />

Financial supportb LVL ha-1 year-1 52<br />

Average row length m 200<br />

Fuel costsc LVL l-1 0.75<br />

Hauling distance km 50<br />

Truck capacity t 35<br />

Establishment costsd LVL ha-1 947<br />

Planting costs LVL ha-1 698<br />

Harvester costse LVL ha-1 153<br />

Truck costse LVL km-1 1.7<br />

Planting speed h ha-1 1.5<br />

Harvester speed km h-1 a Price in the year 2010<br />

6.5<br />

b Direct payments are granted directly to farmers under a support scheme -<br />

the Single Area Payment Scheme (SAPS)<br />

c Fuel price for farmers<br />

d Excluding financial support<br />

e Including labor, fuel and operation costs<br />

Source: authors survey according to EcoWillow inputs.<br />

for ha and ODT. Calculations show optimistic and<br />

pessimistic NPV scenarios. Because of the lack of<br />

time and unpredictable circumstances, NPV might<br />

fluctuate due to changing costs or revenues. Optimistic<br />

scenario predicts 10% increase in revenues and 10%<br />

decrease in costs. The pessimistic scenario predicts<br />

10% decrease in revenues and 10% increase in costs.<br />

results and discussions<br />

Calculations are done for 22 years plantation<br />

lifespan. Soil preparation costs in the beginning<br />

before planting are 108 LVL ha -1 , establishment<br />

costs in the first year excluding the soil preparation<br />

in beginning and including incentive payment are<br />

739 LVL ha -1 . Establishment and management cost till<br />

the first harvest is 794 LVL ha -1 . Starting from 2 nd year,<br />

the annual management costs per year are positive,<br />

because of the incentive payment of 52 LVL ha -1 .<br />

Starting input data are represented in Table 1.<br />

Table 1<br />

The first commercial harvest of 10 ha costs<br />

1,520 LVL, (33 LVL ODT -1 ), transport costs<br />

1,642 LVL, yield from all field 294 ODT. IRR over<br />

the project 22 year lifespan is 17.1% and NPV is<br />

1,099 LVL. According to optimistic scenario NPV is<br />

1,561 LVL but in pessimistic scenario 638 LVL.<br />

The payback in standard scenario is reached<br />

in the 9 th year, after the second harvest. According<br />

to optimistic scenario, which assumes 10% more<br />

revenues and 10% reduction in expenses payback is<br />

reached after the first harvest, in pessimistic scenario,<br />

which assumes 10% less revenues and 10% more<br />

expenses the payback is reached in the 9 th year after<br />

the second harvest (see Fig. 2).<br />

Over the lifespan of willow plantations, the<br />

major part of the costs constitute establishment,<br />

harvesting and transporting, 33%, 26% and 29%,<br />

Respectively. Other costs like land cost and insurance,<br />

administration costs and fertilization together are 12%<br />

from all production costs (see Fig. 3).<br />

226 ReseaRch foR RuRal Development 2012