RESEARCH FOR

RESEARCH FOR

RESEARCH FOR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Kristaps Makovskis, Dagnija Lazdiņa, Ligita Bite<br />

ReseaRch foR RuRal Development 2012<br />

ECONOMIC CALCULATION OF SHORT<br />

ROTATION WILLOW PLANTATIONS IN LATVIA<br />

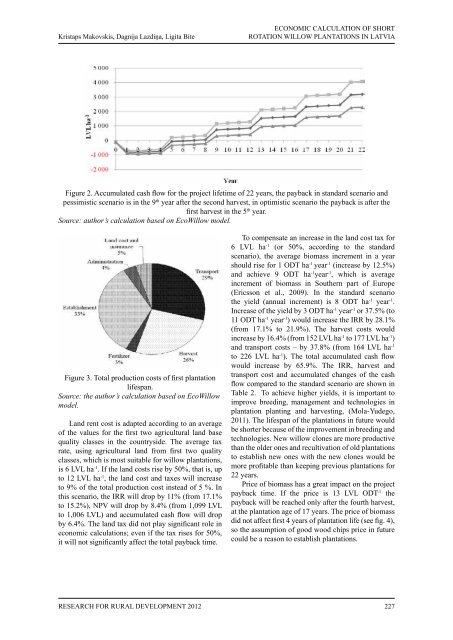

Figure 2. Accumulated cash flow for the project lifetime of 22 years, the payback in standard scenario and<br />

pessimistic scenario is in the 9 th year after the second harvest, in optimistic scenario the payback is after the<br />

first harvest in the 5 th year.<br />

Source: author’s calculation based on EcoWillow model.<br />

Figure 3. Total production costs of first plantation<br />

lifespan.<br />

Source: the author’s calculation based on EcoWillow<br />

model.<br />

Land rent cost is adapted according to an average<br />

of the values for the first two agricultural land base<br />

quality classes in the countryside. The average tax<br />

rate, using agricultural land from first two quality<br />

classes, which is most suitable for willow plantations,<br />

is 6 LVL ha -1 . If the land costs rise by 50%, that is, up<br />

to 12 LVL ha -1 , the land cost and taxes will increase<br />

to 9% of the total production cost instead of 5 %. In<br />

this scenario, the IRR will drop by 11% (from 17.1%<br />

to 15.2%), NPV will drop by 8.4% (from 1,099 LVL<br />

to 1,006 LVL) and accumulated cash flow will drop<br />

by 6.4%. The land tax did not play significant role in<br />

economic calculations; even if the tax rises for 50%,<br />

it will not significantly affect the total payback time.<br />

To compensate an increase in the land cost tax for<br />

6 LVL ha -1 (or 50%, according to the standard<br />

scenario), the average biomass increment in a year<br />

should rise for 1 ODT ha -1 year -1 (increase by 12.5%)<br />

and achieve 9 ODT ha -1 year -1 , which is average<br />

increment of biomass in Southern part of Europe<br />

(Ericsson et al., 2009). In the standard scenario<br />

the yield (annual increment) is 8 ODT ha -1 year -1 .<br />

Increase of the yield by 3 ODT ha -1 year -1 or 37.5% (to<br />

11 ODT ha -1 year -1 ) would increase the IRR by 28.1%<br />

(from 17.1% to 21.9%). The harvest costs would<br />

increase by 16.4% (from 152 LVL ha -1 to 177 LVL ha -1 )<br />

and transport costs – by 37.8% (from 164 LVL ha -1<br />

to 226 LVL ha -1 ). The total accumulated cash flow<br />

would increase by 65.9%. The IRR, harvest and<br />

transport cost and accumulated changes of the cash<br />

flow compared to the standard scenario are shown in<br />

Table 2. To achieve higher yields, it is important to<br />

improve breeding, management and technologies in<br />

plantation planting and harvesting, (Mola-Yudego,<br />

2011). The lifespan of the plantations in future would<br />

be shorter because of the improvement in breeding and<br />

technologies. New willow clones are more productive<br />

than the older ones and recultivation of old plantations<br />

to establish new ones with the new clones would be<br />

more profitable than keeping previous plantations for<br />

22 years.<br />

Price of biomass has a great impact on the project<br />

payback time. If the price is 13 LVL ODT -1 the<br />

payback will be reached only after the fourth harvest,<br />

at the plantation age of 17 years. The price of biomass<br />

did not affect first 4 years of plantation life (see fig. 4),<br />

so the assumption of good wood chips price in future<br />

could be a reason to establish plantations.<br />

227