Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Webber Wentzel South Africa<br />

this point was always difficult, but specifically referred to a company’s par value shares. With the move in the new<br />

Companies Act to do away with the concept of par value shares, this question will occupy legal minds for some time to<br />

come. The development has implications for transactions involving preference shares in particular, which has been a<br />

favourite mechanism used in structuring debt transactions, and it is envisaged that the Commission will need to issue a<br />

practice note to deal with the matter.<br />

The Commission has never issued formal guidelines on the substantive aspects of its merger control functions. It has<br />

however occasionally issued “Practitioner Updates” explaining its approach to various procedural issues, such as the<br />

application of the Competition Act’s provisions and regulations to joint ventures, but has not issued a Practitioner Update<br />

in several years.<br />

Industry sectors reviewed<br />

As mentioned above, many mergers notified occur in the property industry, and most of these are non-problematic. As<br />

South Africa is a country with a large agricultural sector and a significant mining industry, there are often mergers in these<br />

sectors too. Otherwise there is a spread of mergers across many sectors of the economy.<br />

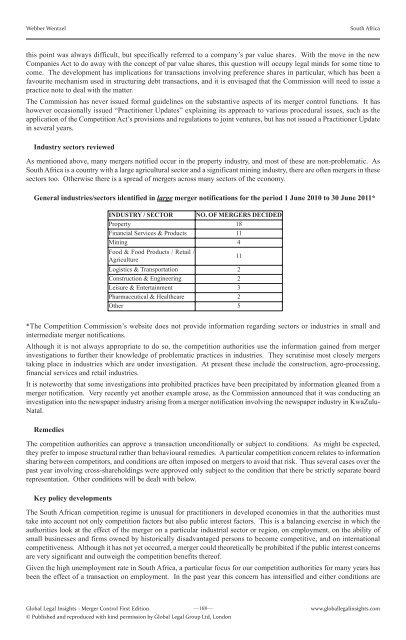

General industries/sectors identified in large merger notifications for the period 1 June 2010 to 30 June 2011*<br />

INDUSTRY / SECTOR NO. OF MERGERS DECIDED<br />

Property 18<br />

Financial Services & Products 11<br />

Mining 4<br />

Food & Food Products / Retail /<br />

Agriculture<br />

11<br />

Logistics & Transportation 2<br />

Construction & Engineering 2<br />

Leisure & Entertainment 3<br />

Pharmaceutical & Healthcare 2<br />

Other 5<br />

*The Competition Commission’s website does not provide information regarding sectors or industries in small and<br />

intermediate merger notifications.<br />

Although it is not always appropriate to do so, the competition authorities use the information gained from merger<br />

investigations to further their knowledge of problematic practices in industries. They scrutinise most closely mergers<br />

taking place in industries which are under investigation. At present these include the construction, agro-processing,<br />

financial services and retail industries.<br />

It is noteworthy that some investigations into prohibited practices have been precipitated by information gleaned from a<br />

merger notification. Very recently yet another example arose, as the Commission announced that it was conducting an<br />

investigation into the newspaper industry arising from a merger notification involving the newspaper industry in KwaZulu-<br />

Natal.<br />

Remedies<br />

The competition authorities can approve a transaction unconditionally or subject to conditions. As might be expected,<br />

they prefer to impose structural rather than behavioural remedies. A particular competition concern relates to information<br />

sharing between competitors, and conditions are often imposed on mergers to avoid that risk. Thus several cases over the<br />

past year involving cross-shareholdings were approved only subject to the condition that there be strictly separate board<br />

representation. Other conditions will be dealt with below.<br />

Key policy developments<br />

The South African competition regime is unusual for practitioners in developed economies in that the authorities must<br />

take into account not only competition factors but also public interest factors. This is a balancing exercise in which the<br />

authorities look at the effect of the merger on a particular industrial sector or region, on employment, on the ability of<br />

small businesses and firms owned by historically disadvantaged persons to become competitive, and on international<br />

competitiveness. Although it has not yet occurred, a merger could theoretically be prohibited if the public interest concerns<br />

are very significant and outweigh the competition benefits thereof.<br />

Given the high unemployment rate in South Africa, a particular focus for our competition authorities for many years has<br />

been the effect of a transaction on employment. In the past year this concern has intensified and either conditions are<br />

Global Legal Insights <strong>Merger</strong> Control <strong>First</strong> <strong>Edition</strong><br />

—168—<br />

© Published and reproduced with kind permission by Global Legal Group Ltd, London<br />

www.globallegalinsights.com