Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Australia<br />

Elizabeth Avery & Gina CassGottlieb<br />

Gilbert + Tobin<br />

Overview of merger control activity during the last 12 months<br />

The Australian Competition and Consumer Commission (ACCC) is responsible for administering the Competition and<br />

Consumer Act 2010 (Cth) (CCA), including the prohibition on acquisitions of shares or assets that have the effect, or<br />

would be likely to have the effect, of substantially lessening competition in a market in Australia, under s 50 of the CCA.<br />

Although there is no compulsory pre-clearance regime, in practice a well established informal clearance process has<br />

developed, as the statistics below indicate. The degree of recent merger control activity is best illustrated by comparison<br />

with activity in prior years1 .<br />

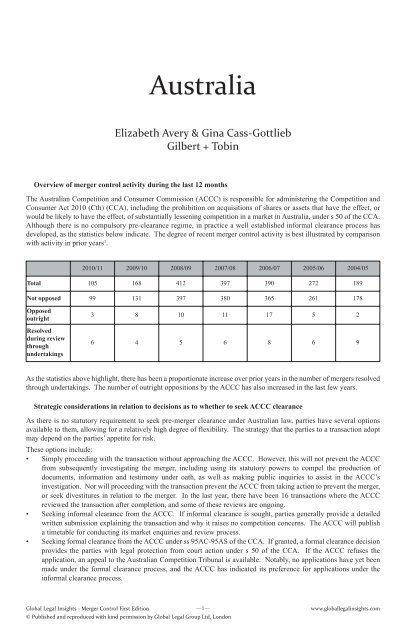

2010/11 2009/10 2008/09 2007/08 2006/07 2005/06 2004/05<br />

Total 105 168 412 397 390 272 189<br />

Not opposed 99 131 397 380 365 261 178<br />

Opposed<br />

outright<br />

Resolved<br />

during review<br />

through<br />

undertakings<br />

3 8 10 11 17 5 2<br />

6 4 5 6 8 6 9<br />

As the statistics above highlight, there has been a proportionate increase over prior years in the number of mergers resolved<br />

through undertakings. The number of outright oppositions by the ACCC has also increased in the last few years.<br />

Strategic considerations in relation to decisions as to whether to seek ACCC clearance<br />

As there is no statutory requirement to seek pre-merger clearance under Australian law, parties have several options<br />

available to them, allowing for a relatively high degree of flexibility. The strategy that the parties to a transaction adopt<br />

may depend on the parties’ appetite for risk.<br />

These options include:<br />

• Simply proceeding with the transaction without approaching the ACCC. However, this will not prevent the ACCC<br />

from subsequently investigating the merger, including using its statutory powers to compel the production of<br />

documents, information and testimony under oath, as well as making public inquiries to assist in the ACCC’s<br />

investigation. Nor will proceeding with the transaction prevent the ACCC from taking action to prevent the merger,<br />

or seek divestitures in relation to the merger. In the last year, there have been 16 transactions where the ACCC<br />

reviewed the transaction after completion, and some of these reviews are ongoing.<br />

• Seeking informal clearance from the ACCC. If informal clearance is sought, parties generally provide a detailed<br />

written submission explaining the transaction and why it raises no competition concerns. The ACCC will publish<br />

a timetable for conducting its market enquiries and review process.<br />

• Seeking formal clearance from the ACCC under ss 95AC-95AS of the CCA. If granted, a formal clearance decision<br />

provides the parties with legal protection from court action under s 50 of the CCA. If the ACCC refuses the<br />

application, an appeal to the Australian Competition Tribunal is available. Notably, no applications have yet been<br />

made under the formal clearance process, and the ACCC has indicated its preference for applications under the<br />

informal clearance process.<br />

Global Legal Insights <strong>Merger</strong> Control <strong>First</strong> <strong>Edition</strong><br />

—1—<br />

© Published and reproduced with kind permission by Global Legal Group Ltd, London<br />

www.globallegalinsights.com