Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

Merger Controls First Edition - J Sagar Associates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Osler, Hoskin & Harcourt LLP Canada<br />

affirmative comfort from the Commissioner before completing the transaction rather than simply closing upon the expiry<br />

of the statutory waiting period, even where an SIR has not been issued and even where there is no timing agreement. In<br />

other words, parties do not regard the expiry of the initial waiting period without an agreement with the Bureau to delay<br />

closing as sufficient comfort to close a transaction.<br />

To a significant degree, the continued practice of seeking affirmative comfort from the Bureau is in response to indications<br />

from the Bureau that expiry of the initial waiting period cannot be regarded as a signal that a proposed transaction does<br />

not raise significant competition concerns in respect of which remedies may be required. In this regard, the Bureau review<br />

process typically begins with an assessment of the level of “complexity” of the review required. The purpose of this<br />

assessment is to provide the parties to the transaction with a sense of the expected (but non-binding) practical timeframe<br />

for the Bureau’s review.<br />

Under the previous merger regime, the Bureau had three levels of complexity; however, the new regime as set out in the Fees<br />

and Service Standards Handbook only contemplates two levels of complexity. “Non-complex” transactions are those that “are<br />

readily identifiable by the clear absence of competition issues” as there is no/minimal overlap. “Complex” transactions are<br />

those between competitors, or between customers and suppliers, where there are indications that the transaction may, or is<br />

likely to, create, maintain or enhance market power. Non-complex transactions have a 14-day service standard whereas complex<br />

transactions have a 45-day service standard. Where a SIR is issued, the applicable service standard terminates 30 days after<br />

the parties comply with the SIR (i.e., is aligned with the statutory waiting period). 2 However, there are many transactions<br />

designated as “complex” where no SIR is issued. In these cases, the Bureau’s practical timeframe for review extends well<br />

beyond the 30-day waiting period. In addition, it is important to note that the applicable service standard only commences<br />

once the Bureau is satisfied that it has all of the information necessary to conduct its analysis, and can be suspended if the<br />

parties do not respond to subsequent questions from the Bureau in a timely manner.<br />

Accordingly, as a practical matter, parties can expect to be faced with an SIR or at the very least a demand for a timing<br />

agreement for transactions that are likely to raise serious competition concerns. However, the expiry of the initial 30calendar<br />

day waiting period in Canada does not amount to substantive comfort that the Commissioner has concluded that<br />

a transaction does not raise competition issues, as the Bureau’s review may well be ongoing at the time.<br />

(v) Can the merger review process be expedited through pre-filing dialogue?<br />

The Bureau does not have a formal pre-merger notification consultation process but encourages consultation prior to, or<br />

as soon as possible after, submission of a merger notification. The <strong>Merger</strong> Review Process Guidelines explain that early<br />

consultation can facilitate a more efficient review process, and may reduce the scope of, or necessity for, a SIR. 3<br />

It is standard practice for the Bureau to communicate with market participants (e.g., customers, suppliers and competitors).<br />

At least some market contacts will be made for even non-complex mergers with no or minimal overlap “unless it is very<br />

clear that there is no need to go to the market”. 4 The applicable service standard or statutory waiting period will usually<br />

not commence until such time as the Bureau is able to conduct market contacts.<br />

(vi) What are the penalties for gun jumping?<br />

The March 2009 amendments to the CA enhanced the penalties for actual or likely non-compliance with the waiting<br />

periods, including structural penalties such as dissolution or divestiture, and a monetary penalty of up to C$10,000 per<br />

day where parties have not complied with the filing requirements. However, we are not aware of any action having been<br />

taken in Canada under the new gun jumping provisions.<br />

In addition, failure to notify the Bureau of a transaction “without good and sufficient cause” is a criminal offence under<br />

the CA and punishable by a fine of up to C$50,000 (the equivalent of the filing fee). Proceedings may be commenced not<br />

only against a corporation but also against individual officers and directors. Failure to notify may also serve as the basis<br />

for an interim injunction to prevent a transaction from proceeding.<br />

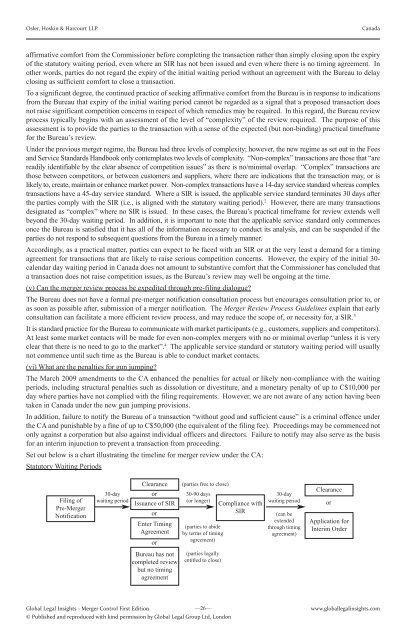

Set out below is a chart illustrating the timeline for merger review under the CA:<br />

Statutory Waiting Periods<br />

Filing of<br />

Pre-<strong>Merger</strong><br />

Notification<br />

30-day<br />

waiting period<br />

Clearance<br />

or<br />

Issuance of SIR<br />

or<br />

Enter Timing<br />

Agreement<br />

Global Legal Insights <strong>Merger</strong> Control <strong>First</strong> <strong>Edition</strong><br />

—26—<br />

© Published and reproduced with kind permission by Global Legal Group Ltd, London<br />

or<br />

Bureau has not<br />

completed review<br />

but no timing<br />

agreement<br />

(parties free to close)<br />

30-90 days<br />

(or longer)<br />

(parties to abide<br />

by terms of timing<br />

agreement)<br />

(parties legally<br />

entitled to close)<br />

Compliance with<br />

SIR<br />

30-day<br />

waiting period<br />

(can be<br />

extended<br />

through timing<br />

agreement)<br />

Clearance<br />

or<br />

Application for<br />

Interim Order<br />

www.globallegalinsights.com