You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>FIAT</strong> S.P.A.<br />

Operating Performance<br />

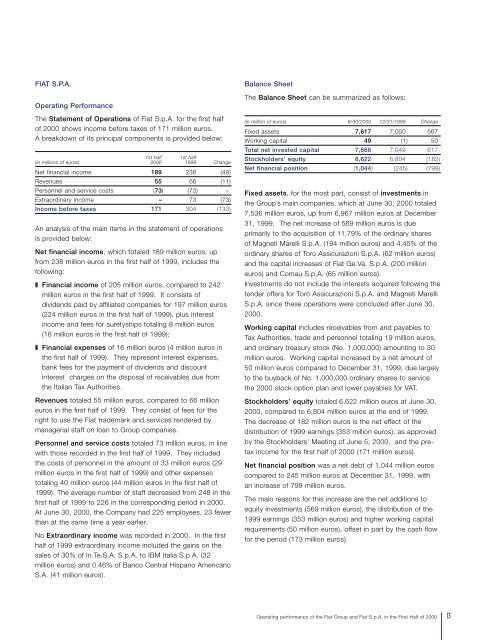

The Statement of Operations of Fiat S.p.A. for the first half<br />

of 2000 shows income before taxes of 171 million euros.<br />

A breakdown of its principal components is provided below:<br />

1st half 1st half<br />

(in millions of euros) 2000 1999 Change<br />

Net financial income 189 238 (49)<br />

Revenues 55 66 (11)<br />

Personnel and service costs (73) (73) –<br />

Extraordinary income – 73 (73)<br />

Income before taxes 171 304 (133)<br />

An analysis of the main items in the statement of operations<br />

is provided below:<br />

Net financial income, which totaled 189 million euros, up<br />

from 238 million euros in the first half of 1999, includes the<br />

following:<br />

❚ Financial income of 205 million euros, compared to 242<br />

million euros in the first half of 1999. It consists of<br />

dividends paid by affiliated companies for 197 million euros<br />

(224 million euros in the first half of 1999), plus interest<br />

income and fees for suretyships totaling 8 million euros<br />

(18 million euros in the first half of 1999);<br />

❚ Financial expenses of 16 million euros (4 million euros in<br />

the first half of 1999). They represent interest expenses,<br />

bank fees for the payment of dividends and discount<br />

interest charges on the disposal of receivables due from<br />

the Italian Tax Authorities.<br />

Revenues totaled 55 million euros, compared to 66 million<br />

euros in the first half of 1999. They consist of fees for the<br />

right to use the Fiat trademark and services rendered by<br />

managerial staff on loan to Group companies.<br />

Personnel and service costs totaled 73 million euros, in line<br />

with those recorded in the first half of 1999. They included<br />

the costs of personnel in the amount of 33 million euros (29<br />

million euros in the first half of 1999) and other expenses<br />

totaling 40 million euros (44 million euros in the first half of<br />

1999). The average number of staff decreased from 248 in the<br />

first half of 1999 to 226 in the corresponding period in 2000.<br />

At June 30, 2000, the Company had 225 employees, 23 fewer<br />

than at the same time a year earlier.<br />

No Extraordinary income was recorded in 2000. In the first<br />

half of 1999 extraordinary income included the gains on the<br />

sales of 30% of In.Te.S.A. S.p.A. to IBM Italia S.p.A. (32<br />

million euros) and 0.46% of Banco Central Hispano Americano<br />

S.A. (41 million euros).<br />

Balance Sheet<br />

The Balance Sheet can be summarized as follows:<br />

(in million of euros) 6/30/2000 12/31/1999 Change<br />

Fixed assets 7,617 7,050 567<br />

Working capital 49 (1) 50<br />

Total net invested capital 7,666 7,049 617<br />

Stockholders’ equity 6,622 6,804 (182)<br />

Net financial position (1,044) (245) (799)<br />

Fixed assets, for the most part, consist of investments in<br />

the Group’s main companies, which at June 30, 2000 totaled<br />

7,536 million euros, up from 6,967 million euros at December<br />

31, 1999. The net increase of 569 million euros is due<br />

primarily to the acquisition of 11.79% of the ordinary shares<br />

of Magneti Marelli S.p.A. (194 million euros) and 4.45% of the<br />

ordinary shares of Toro Assicurazioni S.p.A. (62 million euros)<br />

and the capital increases of Fiat Ge.Va. S.p.A. (200 million<br />

euros) and Comau S.p.A. (65 million euros).<br />

Investments do not include the interests acquired following the<br />

tender offers for Toro Assicurazioni S.p.A. and Magneti Marelli<br />

S.p.A. since these operations were concluded after June 30,<br />

2000.<br />

Working capital includes receivables from and payables to<br />

Tax Authorities, trade and personnel totaling 19 million euros,<br />

and ordinary treasury stock (No. 1,000,000) amounting to 30<br />

million euros. Working capital increased by a net amount of<br />

50 million euros compared to December 31, 1999, due largely<br />

to the buyback of No. 1,000,000 ordinary shares to service<br />

the 2000 stock option plan and lower payables for VAT.<br />

Stockholders’ equity totaled 6,622 million euros at June 30,<br />

2000, compared to 6,804 million euros at the end of 1999.<br />

The decrease of 182 million euros is the net effect of the<br />

distribution of 1999 earnings (353 million euros), as approved<br />

by the Stockholders’ Meeting of June 5, 2000, and the pretax<br />

income for the first half of 2000 (171 million euros).<br />

Net financial position was a net debt of 1,044 million euros<br />

compared to 245 million euros at December 31, 1999, with<br />

an increase of 799 million euros.<br />

The main reasons for this increase are the net additions to<br />

equity investments (569 million euros), the distribution of the<br />

1999 earnings (353 million euros) and higher working capital<br />

requirements (50 million euros), offset in part by the cash flow<br />

for the period (173 million euros).<br />

Operating performance of the Fiat Group and Fiat S.p.A. in the First Half of 2000<br />

13