Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report 20<strong>06</strong><br />

The members of the board were elected at the<br />

ordinary shareholders meeting held on April 12,<br />

2004 for a period of three years. Consequently,<br />

the meeting now called should elect the persons to<br />

form the board for the next three years.<br />

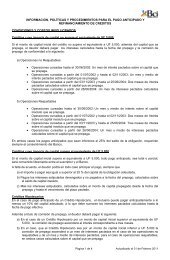

The board is constantly dictating the principal<br />

policies governing the Bank’s actions including<br />

commercial strategy, budget review, portfolio<br />

diversification, credit risk, financial risk,<br />

operational risk and external markets risk, the<br />

equity position, profitability, sufficiency of<br />

allowances, voluntary allowances, service quality<br />

and working conditions.<br />

It receives monthly a complete presentation on the<br />

performance of <strong>Bci</strong> and the results being obtained.<br />

Since 2000, it analyzes and pronounces every<br />

year on the results of the performance evaluation<br />

process carried out by the offices, both of the<br />

Bank and of its subsidiaries, following a procedure<br />

that takes into account an extensive separated<br />

composition of activities in the different risk areas.<br />

As well as knowing the performance report, the<br />

board examines the actions or measures to be<br />

adopted to resolve those activities in which some<br />

risks are noted that have an inadequate cover.<br />

It is also informed monthly of matters of a special<br />

nature examined or approved in its Executive,<br />

Directors’ and Corporate Governance and<br />

Corporate Social Responsibility committees.<br />

The chief executive officer, Lionel Olavarría Leyton, acts as the secretary of board<br />

meetings, assisted by the advisor to the chairman and chief executive officer, Humberto<br />

Béjares Jara, and the senior legal counsel, Pedro Balla Friedmann.<br />

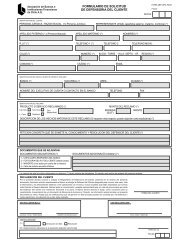

Executive Committee of the Board<br />

The Executive Committee meets twice a week and has full powers delegated by the<br />

board to resolve on many matters, principally of a credit and commercial nature, credit,<br />

financial, operating and market risks, the opening of branches, management powers,<br />

etc.<br />

It periodically revises the degree of concentration of different sectors of business<br />

activity that the Bank is financing and sets lending limits for these.<br />

It examines monthly the Bank’s market risk levels compared to the different limits set<br />

by the Committee. It is also informed of and approves the financial strategy the Bank<br />

will follow during the next month.<br />

The Executive Committee is composed of five members, these being Luis Enrique Yarur<br />

Rey, Jorge Cauas Lama (chairman and vice-chairman respectively), Modesto Collados<br />

Núñez, Manuel Valdés Valdés and Sergio De Amesti Heusser. Dionisio Romero<br />

Seminario, Pedro Corona Bozzo, Alberto López-Hermida Hermida and Daniel Yarur<br />

Elsaca are alternate members. The advisor to the chairman and chief executive officer,<br />

Humberto Béjares Jara, also normally takes part.<br />

The chief executive officer, Lionel Olavarría Leyton, acts as secretary to the committee,<br />

assisted by the risk advisor, Andrés Atala Hanna, on credit matters, and the senior legal<br />

counsel, Andrés Atala Hanna, on other matters.<br />

.1953<br />

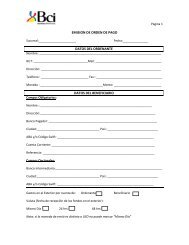

Directors’ Committee<br />

Constantly functioning since 2001, the members<br />

of this Committee are Alberto López-Hermida<br />

Hermida (chairman), Jorge Cauas Lama and<br />

Manuel Valdés Valdés. The advisor to the chairman<br />

and chief executive officer, Humberto Béjares Jara,<br />

acts as the secretary.<br />

Since October 19, 2004 and by resolution of the<br />

board, the Committee assumed those functions<br />

reserved for the Audit Committee, as established<br />

by the Superintendency of Banks and Financial<br />

Institutions.<br />

Among its functions, it is informed of the<br />

principal risks existing in the control systems,<br />

processes and procedures of the Bank and its<br />

subsidiaries, examines the annual audit plans and<br />

is informed about the policies applied to prevent<br />

suspicious asset-laundering and terrorist financing<br />

transactions.<br />

At the meeting held on December 21, 20<strong>06</strong>,<br />

the Directors’ Committee examined the report<br />

containing recommendations for improving<br />

administrative-accounting controls issued by<br />

PriceWaterhouseCoopers, usually called the<br />

internal control report, in the presence of the<br />

external auditors. Later the Committee revises the<br />

follow-up of the recommendations made in the<br />

report.<br />

In carrying out its functions and in accordance<br />

with the law, the Directors’ Committee met on<br />

January 30, 2007 to examine the balance sheet and<br />

financial statements of the Bank, unconsolidated<br />

and consolidated, for the year 20<strong>06</strong>, in the<br />

presence of representatives of the external auditors<br />

PriceWaterhouseCoopers.<br />

The Committee increased its own appreciation of<br />

the financial statements following the explanations<br />

<strong>BOARD</strong> <strong>OF</strong> <strong>DIRECTORS</strong><br />

and analysis provided by the external auditors, bearing in mind that the monthly<br />

balance sheets are known in advance by the board’s Executive Committee and widely<br />

analyzed at the ordinary board meetings, when the chief executive officer provides<br />

a detailed presentation based on the monthly report of the performance control<br />

management.<br />

The Directors’ Committee expressed its agreement with the contents of the financial<br />

statements, plus those of all the <strong>Bci</strong> companies, whose respective auditors’ opinions<br />

were unqualified.<br />

This pronouncement was reported to the board on February 27, 2007, with the<br />

proposal to suggest to the ordinary shareholders meeting that the services of<br />

PriceWaterhouseCoopers be maintained for auditing the balance sheet for 2007, as well<br />

as the services of the private credit-rating agencies Feller Rate and Fitch Ratings.<br />

The other activities of the Directors’ Committee, discussed at different meetings, were<br />

directed to examining transactions with related parties, especially those referred to in<br />

clauses 44 and 89 of the Corporations Law, taking into account the resolution adopted<br />

by the board concerning transactions for the supply of goods and services for the<br />

normal functioning of the Bank contracted with related parties. Among the related-party<br />

transactions examined by the Committee was the acquisition of shares in Credicorp<br />

Ltd., a company controlled by Banco de Crédito del Perú (BCP), in an amount similar to<br />

the 450,000 shares sold by Empresas Juan Yarur S.A.C. In any event, this transaction<br />

was made under the reciprocal investment agreements between <strong>Bci</strong> and that bank, and<br />

was authorized by the Superintendency of Banks and Financial Institutions and the<br />

Central Bank of Chile, and carried out through the New York Stock Exchange.<br />

The Committee examined in good time the state of compliance with the comments<br />

made by PriceWaterhouseCoopers in its internal control reports and the<br />

Superintendency of Banks and Financial Institutions in its inspection reports.<br />

26<br />

27