MANUAL -17 Chapter-18 OTHER USEFUL INFORMATION 1 ...

MANUAL -17 Chapter-18 OTHER USEFUL INFORMATION 1 ...

MANUAL -17 Chapter-18 OTHER USEFUL INFORMATION 1 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

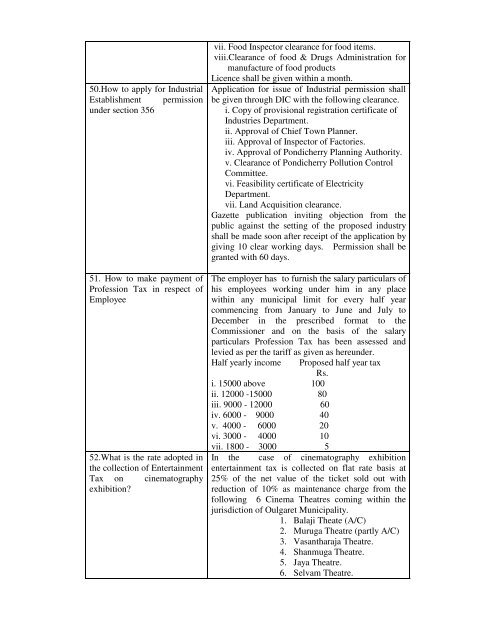

50.How to apply for Industrial<br />

Establishment permission<br />

under section 356<br />

51. How to make payment of<br />

Profession Tax in respect of<br />

Employee<br />

52.What is the rate adopted in<br />

the collection of Entertainment<br />

Tax on cinematography<br />

exhibition?<br />

vii. Food Inspector clearance for food items.<br />

viii.Clearance of food & Drugs Administration for<br />

manufacture of food products<br />

Licence shall be given within a month.<br />

Application for issue of Industrial permission shall<br />

be given through DIC with the following clearance.<br />

i. Copy of provisional registration certificate of<br />

Industries Department.<br />

ii. Approval of Chief Town Planner.<br />

iii. Approval of Inspector of Factories.<br />

iv. Approval of Pondicherry Planning Authority.<br />

v. Clearance of Pondicherry Pollution Control<br />

Committee.<br />

vi. Feasibility certificate of Electricity<br />

Department.<br />

vii. Land Acquisition clearance.<br />

Gazette publication inviting objection from the<br />

public against the setting of the proposed industry<br />

shall be made soon after receipt of the application by<br />

giving 10 clear working days. Permission shall be<br />

granted with 60 days.<br />

The employer has to furnish the salary particulars of<br />

his employees working under him in any place<br />

within any municipal limit for every half year<br />

commencing from January to June and July to<br />

December in the prescribed format to the<br />

Commissioner and on the basis of the salary<br />

particulars Profession Tax has been assessed and<br />

levied as per the tariff as given as hereunder.<br />

Half yearly income Proposed half year tax<br />

Rs.<br />

i. 15000 above 100<br />

ii. 12000 -15000 80<br />

iii. 9000 - 12000 60<br />

iv. 6000 - 9000 40<br />

v. 4000 - 6000 20<br />

vi. 3000 - 4000 10<br />

vii. <strong>18</strong>00 - 3000 5<br />

In the case of cinematography exhibition<br />

entertainment tax is collected on flat rate basis at<br />

25% of the net value of the ticket sold out with<br />

reduction of 10% as maintenance charge from the<br />

following 6 Cinema Theatres coming within the<br />

jurisdiction of Oulgaret Municipality.<br />

1. Balaji Theate (A/C)<br />

2. Muruga Theatre (partly A/C)<br />

3. Vasantharaja Theatre.<br />

4. Shanmuga Theatre.<br />

5. Jaya Theatre.<br />

6. Selvam Theatre.