2009 Issue 1 - Sabre Airline Solutions

2009 Issue 1 - Sabre Airline Solutions

2009 Issue 1 - Sabre Airline Solutions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

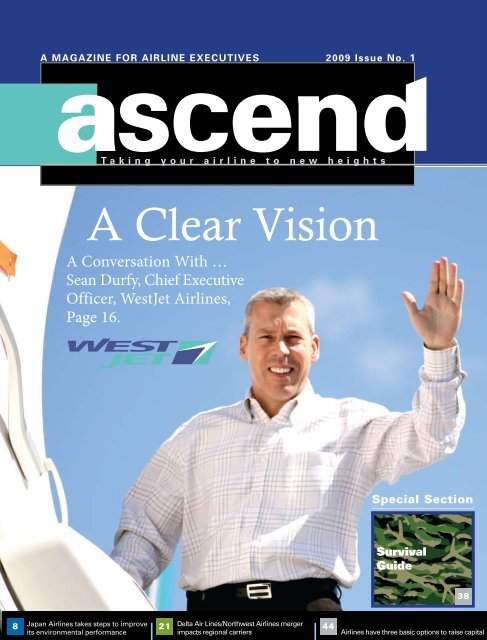

A MAgAzINe for AIrlINe executIves <strong>2009</strong> <strong>Issue</strong> No. 1<br />

taking your airline to new heights<br />

A Clear Vision<br />

A Conversation With …<br />

Sean Durfy, Chief Executive<br />

Officer, WestJet <strong>Airline</strong>s,<br />

Page 16.<br />

8 Japan <strong>Airline</strong>s takes steps to improve 21 Delta Air Lines/Northwest <strong>Airline</strong>s merger 44<br />

its environmental performance<br />

impacts regional carriers<br />

Special Section<br />

Survival<br />

Guide<br />

38<br />

<strong>Airline</strong>s have three basic options to raise capital

taking your airline to new heights<br />

<strong>2009</strong> <strong>Issue</strong> No. 1<br />

editor in chief<br />

Stephani Hawkins<br />

Managing editor<br />

B. Scott Hunt<br />

Art Direction/Design<br />

Charles Urich<br />

contributors<br />

Khaled Al-Eisawi, Edward Bowman, Stan<br />

Boyer, Steve Clampett, Dennis Crosby, Jeanette<br />

Frick, Greg Gilchrist, Carla Jensen, Christine<br />

Kretschmar, Gordon Locke, Craig MacFarlane,<br />

Tim Maher, Kazuya Ohta, Dave Roberts, Tim<br />

Sutton, Jeremy Sykes, Fionna Wee.<br />

Publisher<br />

George Lynch<br />

3150 <strong>Sabre</strong> Drive<br />

Southlake, Texas 76092<br />

www.sabreairlinesolutions.com<br />

Awards<br />

2008 Awards for Publication Excellence,<br />

International Association of Business<br />

Communicators Bronze Quill and Silver<br />

Quill, Hermes Creative Award, The<br />

Communicator Award<br />

2007 Awards for Publication Excellence,<br />

International Association of Business<br />

Communicators Bronze Quill<br />

2006 Awards for Publication Excellence,<br />

International Association of Business<br />

Communicators Bronze Quill, Silver Quill<br />

and Gold Quill<br />

2005 Awards for Publication Excellence,<br />

International Association of Business<br />

Communicators Bronze Quill, Silver<br />

Quill and Gold Quill<br />

2004 Awards for Publication Excellence,<br />

International Association of Business<br />

Communicators Bronze Quill and Silver Quill<br />

reader Inquiries<br />

If you have questions about this publication<br />

or suggested topics for future articles, please<br />

send an e-mail to wearelistening@sabre.com.<br />

making<br />

contact<br />

To suggest a topic for a possible<br />

future article, change your<br />

address or add someone to the<br />

mailing list, please send an<br />

e-mail message to the Ascend<br />

staff at wearelistening@sabre.com.<br />

Asia/Pacific<br />

David Chambers<br />

Vice President<br />

3 Church Street, #15-02 Samsung Hub<br />

Singapore 049483 SG<br />

Phone: +65 6511 3210<br />

E-mail: david.chambers@sabre.com<br />

europe<br />

Alessandro Ciancimino<br />

Vice President<br />

Via Appia Nuova 990<br />

00178 Rome, Italy<br />

Phone: +39 348 3708240<br />

E-mail: alessandro.ciancimino@sabre.com.<br />

India/south Asia<br />

Vish Viswanathan<br />

Vice President<br />

187, Royapettah High Road, Flat A-7<br />

Mylapore<br />

Chennai, India<br />

Phone: +1 682 605 4544<br />

Cell: United States +1 817 312 2830<br />

Cell: International +91 98404 96765<br />

E-mail: vish.viswanathan@sabre.com<br />

<strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong>, the <strong>Sabre</strong><br />

<strong>Airline</strong> <strong>Solutions</strong> logo and products<br />

noted in italics in this publication are<br />

trademarks and/or service marks of an<br />

affiliate of <strong>Sabre</strong> Holdings Corp. All<br />

other trademarks, service marks and<br />

trade names are the property of their<br />

respective owners. ©<strong>2009</strong> <strong>Sabre</strong> Inc.<br />

All rights reserved. Printed in the USA.<br />

For more information about<br />

products and services featured in this<br />

issue of Ascend, please visit our Web<br />

site at www.sabreairlinesolutions.com<br />

or contact one of the following<br />

<strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong> regional<br />

representatives:<br />

latin America<br />

Kamal Qatato<br />

Vice President<br />

3150 <strong>Sabre</strong> Drive<br />

Southlake, Texas 76092<br />

Phone: +1 682 605 5399<br />

Middle east and Africa<br />

Maher Koubaa<br />

Regional Head<br />

77 Rue de la Boetie<br />

Paris, France 75008<br />

Phone: +33 1 44 20 7657<br />

E-mail: maher.koubaa@sabre.com<br />

North America<br />

Kristen Fritschel<br />

Vice President<br />

3150 <strong>Sabre</strong> Drive<br />

Southlake, Texas 76092<br />

Phone: +1 682 605 5335<br />

E-mail: kristen.fritschel@sabre.com<br />

Worldwide<br />

Shane Batt<br />

Executive <strong>Solutions</strong> Partner<br />

Phone: +44 7717 495 129<br />

E-mail: shane.batt@sabre.com<br />

Address corrections<br />

Please send address corrections via<br />

e-mail to wearelistening@sabre.com.

I<br />

find the aviation industry’s “try-and-tryagain”<br />

philosophy to be quite remarkable.<br />

With it, there are no failures, just<br />

experiences that lead to greater successes.<br />

No matter how far back in history you<br />

go, you’ll find the same level of optimism.<br />

If you look back to 1799 at Sir George<br />

Cayley, sometimes known as the “father of<br />

aerodynamics,” or today at any number of<br />

airline leaders, they approach aviation with<br />

buoyancy. No task is beyond reach, and<br />

there’s always room to expand and improve.<br />

Doesn’t matter how old this way of thinking<br />

is, I always find it refreshing and worthy of<br />

discussion.<br />

It was 210 years ago that Cayley began<br />

his crusade to get man off the ground and<br />

into the air. For 50 years, Cayley designed<br />

an array of gliders that would help set the<br />

foundation for the airline industry. Adding to<br />

Cayley’s work, German engineer Otto Lilienthal<br />

designed the first glider that could fly a person<br />

long distances. And physicist and astronomer<br />

Samuel Langley recognized a power engine<br />

was necessary to help man fly.<br />

Based on the studies and experiments<br />

of Cayley, Langley and Lilienthal, 110 years<br />

ago the Wright Brothers designed their first<br />

aircraft. And in 1908, a friend of the Wright<br />

Brothers became the first passenger of their<br />

fixed-wing aircraft.<br />

As I look back on the work of Cayley,<br />

Langley, Lilienthal and the Wright Brothers,<br />

it’s apparent they set out to accomplish great<br />

things, and they did. It took a lot of perseverance,<br />

trial and error, and setbacks, but they<br />

didn’t give up. And their enthusiasm clearly<br />

carries over into the industry we know today.<br />

What started out as a mission to put<br />

a human being in the air has progressed<br />

into an ever-evolving business that brings<br />

together millions of people from all cor-<br />

perspective<br />

with Tom Klein<br />

Group President, <strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong>/<strong>Sabre</strong> Travel Network<br />

ners of the world and creates millions of<br />

employment opportunities in thousands of<br />

communities. And it’s only made possible<br />

by the very people who continue pushing<br />

the boundaries to secure the future of air<br />

transportation.<br />

Air New Zealand, (see pg. 12) for<br />

example, proactively set forth to reduce<br />

fuel burn and CO 2 emissions on its longhaul<br />

flights. During its ASPIRE flight last<br />

September from Auckland to California,<br />

the carrier saved nearly 1,200 gallons of<br />

fuel and reduced CO2 emissions by more<br />

than 11,200 kilograms using advanced<br />

flight planning techniques, datalink<br />

communications and air traffic control<br />

advancements.<br />

Japan <strong>Airline</strong>s (see pg. 8) made<br />

history in January as the first airline to<br />

conduct a demonstration flight using 50<br />

percent biofuel blend and 50 percent Jet-A<br />

fuel in one of the four engines on a Boeing<br />

747-300 aircraft. The test flight not only<br />

reduced CO2 emissions, it also brought<br />

the airline industry that much closer to<br />

reducing its dependence on today’s petroleum-based<br />

fuels.<br />

These are just two examples of how<br />

airlines have worked diligently to move<br />

the industry forward. And we consistently<br />

see this level of enthusiasm from airlines<br />

around the world.<br />

On our cover, WestJet <strong>Airline</strong>s Chief<br />

Executive Officer Sean Durfy discusses<br />

his plans of continuing to grow the airline,<br />

the recently announced codeshare agreements<br />

with two of the world’s leading<br />

airlines and how staying true to its initial<br />

vision has kept the airline’s foundation<br />

strong and thriving. He doesn’t hesitate<br />

or re-think his strategy. He’s identified<br />

the best course of action, and he’ll move<br />

forward with grace for the good of his<br />

airline, the communities it serves and the<br />

entire industry.<br />

Likewise, aircraft manufacturers continue<br />

building innovative aircraft that, during<br />

the course of the next 20 years, will fill our<br />

skies with planes that are far more efficient<br />

than those in service today. Technology<br />

providers will continue to develop software<br />

that enables carriers to operate with precision<br />

and at optimal levels.<br />

And even the new U.S. administration<br />

is giving it a run with US$800 million<br />

earmarked for air traffic control upgrades.<br />

Albeit it’s US$25 billion short, it’s certainly<br />

a step in the right direction. All of this is<br />

possible because of the try-and-try-again<br />

approach. We’re getting better with each<br />

try, and we never stop trying.<br />

I assume that like me, many of you<br />

have been mentioning to family members,<br />

friends and colleagues that you are tired of<br />

hearing and reading nothing but pessimistic<br />

and bad news. This perspective is one guy’s<br />

attempt to find the bright side.<br />

Looking at the airline industry as a<br />

whole, I’m impressed with the many carriers<br />

that recognized the trends in demand last<br />

year and made necessary capacity adjustments<br />

to help keep the industry healthy.<br />

What we see time and time again, just<br />

like in the early days of aviation, is airlines’<br />

innate ability to move the industry forward<br />

with confidence.<br />

Bravo airline industry … take a bow!

profile<br />

8<br />

ascend<br />

contents<br />

Japan’s green Machine<br />

Japan <strong>Airline</strong>s takes myriad<br />

sustainable actions to improve its<br />

environmental performance.<br />

12 forward leap<br />

Air New Zealand’s ASPIRE flight<br />

from Auckland to California saved<br />

approximately 1,174 U.S. gallons<br />

of fuel using a Boeing 777-200ER<br />

aircraft.<br />

16 A clear vision<br />

WestJet <strong>Airline</strong>s explains how it<br />

stays true to its vision.<br />

regional<br />

21 connecting the Dots<br />

Delta Air Lines and Northwest<br />

<strong>Airline</strong>s merger has significant<br />

impact on some regional carriers.<br />

24 Aeroflot’s revolution<br />

Aeroflot Russian <strong>Airline</strong>s reinvents<br />

itself through an extensive<br />

turnaround initiative.<br />

16<br />

36<br />

30<br />

industry<br />

26 fleet shuffle<br />

As a result of aircraft delivery<br />

delays, carriers around the world<br />

are forced to improvise until their<br />

new planes arrive.<br />

30 cutting up<br />

<strong>Airline</strong>s’ revenue management and<br />

pricing teams can offset the ill<br />

effects of capacity reductions and<br />

maximize their potential benefits.<br />

33 the KIss Principle<br />

Low-cost carriers are<br />

implementing traditional airline<br />

characteristics while network<br />

carriers remove some<br />

conventional attributes.<br />

36 Immense Intelligence<br />

<strong>Airline</strong>s can determine a successful<br />

course, effectively respond to<br />

change and measure their success<br />

using business intelligence.

special section<br />

40 Network checkup<br />

<strong>Airline</strong>s can follow basic<br />

guidelines to ensure the right<br />

markets are served at the right<br />

times.<br />

44<br />

captital uplifting<br />

<strong>Airline</strong>s that need to raise<br />

capital in a tight credit<br />

environment have three<br />

basic options.<br />

47 saving the Pie<br />

Choosing the right cooperative<br />

agreements helps airlines<br />

effectively compete.<br />

50 climate change<br />

<strong>Airline</strong>s need to prepare for<br />

new European legislation<br />

requiring them to report CO2<br />

emissions.<br />

Hedging Your<br />

56<br />

(Jet fuel) Bets<br />

Many airlines have come out on<br />

top after leveraging fuel-hedging<br />

opportunities, but those that<br />

hedged too far ahead are paying<br />

a price.<br />

looking Back<br />

60<br />

for tomorrow<br />

Despite the most significant<br />

challenges, some carriers have a<br />

natural ability to succeed during<br />

tough times.<br />

company<br />

64 the explorer<br />

<strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong> recently<br />

acquired Flight Explorer for its<br />

real-time tracking, reporting<br />

and display of enroute aircraft<br />

capabilities.<br />

sharpening the<br />

67 e-commerce edge<br />

The recent acquisition of EB2<br />

gives <strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong><br />

customers a broad range of Web<br />

options.<br />

40<br />

solutions<br />

70 Brainpower<br />

Business intelligence solutions<br />

enable airlines to broaden their<br />

analysis capabilities to include key<br />

performance data into their<br />

business strategies.<br />

service360°:<br />

72<br />

It’s All Around You<br />

Service360° SM<br />

Consistent<br />

Practices comprise five service<br />

practice areas to ensure airlines<br />

receive optimum solutions that<br />

drive the performance of their<br />

businesses.<br />

contents<br />

56<br />

ascend

y the numbers<br />

Absolute Change<br />

Traffic (RPK) or capacity (ASK) — billions<br />

2008 World traffic<br />

Source: <strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong> ® Global Demand Dataset<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Traffic %<br />

Capacity %<br />

By Chris Spidle and Paul Pederson | Ascend Contributors<br />

20<br />

40<br />

ascend<br />

North America continues to<br />

generate the largest share<br />

of worldwide production,<br />

accounting for 32 percent of<br />

global available seat kilometers<br />

last year. Asia/Pacific and<br />

Europe were comparable in<br />

size, and the three regions<br />

together account for 85<br />

percent of global capacity.<br />

}<br />

traffic And capacity changes<br />

full year 2008 versus full Year 2007<br />

2008 capacity Distribution By region (AsKs)<br />

Latin America<br />

Middle East<br />

6%<br />

Europe<br />

24%<br />

Industry North Asia/ Europe Middle Latin Africa<br />

America Pacific East America<br />

Percent Change<br />

2.2% -1.5% 2.8% 2.0% 11.2% 6.1% 5.3%<br />

2.2% -3.3% 5.1% 1.6% 14.1% 4.2% 4.7%<br />

6% 3%<br />

Africa<br />

North America<br />

32%<br />

Asia/Pacific<br />

29%<br />

{<br />

For the full year 2008, total worldwide<br />

industry capacity and traffic<br />

increased. All regions except North<br />

America increased (the decrease in<br />

North America was driven by the U.S.<br />

domestic market). The Middle East<br />

posted large percentage increases;<br />

however, this growth occurred on a<br />

comparatively small base of production.

Absolute Change<br />

Traffic (RPK) or Capacity (ASK) – billions<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Traffic %<br />

Capacity %<br />

Absolute Change<br />

Traffic (RPK) or capacity (ASK) — billions<br />

20<br />

40<br />

100<br />

80<br />

60<br />

40<br />

20<br />

20<br />

40<br />

0<br />

Traffic %<br />

Capacity %<br />

traffic And capacity changes<br />

January <strong>2009</strong> versus January 2008<br />

Industry North Asia/ Europe Middle Latin Africa<br />

America Pacific East America<br />

Percent Change<br />

-1.8% -6.0% 2.3% -4.4% 5.8% -1.1% 3.3%<br />

-2.4% -8.9% 1.8% -4.5% 13.2% 1.5% 2.6%<br />

traffic And capacity changes<br />

fourth Quarter 2008 versus fourth Quarter 2007<br />

Industry North Asia/ Europe Middle Latin Africa<br />

America Pacific East America<br />

Percent Change<br />

-2.7% -7.5% -0.3% -4.0% 11.5% 0.6% 3.0%<br />

-2.3% -8.7% 2.0% -4.5% 14.0% 2.3% 2.9%<br />

{<br />

{<br />

The trend of decreases accelerated in<br />

some areas such as North America;<br />

however, the percentage decrease in<br />

worldwide production for January was<br />

similar to the fourth quarter. Gains in<br />

the Middle East began to decrease.<br />

The trend in traffic and capacity shifted<br />

from increases to decreases during<br />

the fourth quarter, with North<br />

America posting the largest absolute<br />

decreases. Decreases in North<br />

America contributed significantly to<br />

the global decline; however, Europe<br />

also showed weakness. The Middle<br />

East continued to post large percentage<br />

increases on a comparatively<br />

small base of production.<br />

Chris Spidle is delivery director of research, analysis<br />

and modeling and Paul Pederson is an airline<br />

research principal for <strong>Sabre</strong> <strong>Airline</strong> <strong>Solutions</strong> ® .<br />

They can be contacted at chris.spidle@sabre.com<br />

and paul.pederson@sabre.com.<br />

ascend<br />

by the numbers

Japan’s green<br />

Machine<br />

Among the world’s carriers that are<br />

serious about improving their environmental<br />

performance, Japan <strong>Airline</strong>s takes a<br />

multitude of sustainable actions.<br />

By Phil Johnson | Ascend Staff

During an era when environmental and<br />

greater sustainability issues have evolved<br />

into top priorities — both in the public mind<br />

and in the corporate boardroom — certain companies<br />

in various industries have taken it upon<br />

themselves to become environmental leaders.<br />

These companies are boldly asserting<br />

themselves in all things sustainable, to the extent<br />

that some of these environmentally conscientious<br />

companies have established the credibility to help<br />

set the standards for the environmental discussion,<br />

at least within their individual industry.<br />

In the global airline industry today, perhaps<br />

no carrier more thoroughly exemplifies what it<br />

means to be an advocate of “green” practices<br />

and technologies than Japan <strong>Airline</strong>s. In fact, the<br />

carrier’s management team has made clear its<br />

stance that even though the airline industry has<br />

a critical, positive part in bringing people from<br />

around the world together for business, pleasure<br />

and cultural exchange, JAL also understands the<br />

potentially detrimental impact that air transport<br />

business operations can have on the global<br />

environment.<br />

And regardless of the necessity of every<br />

business to forge ahead during this period of<br />

worldwide economic slowdown, JAL nonetheless<br />

also maintains 100 percent commitment to<br />

its obligations in relation to sustainability and the<br />

environment.<br />

The International Air Transport Association<br />

has estimated that the global airline industry is<br />

responsible for generating up to 3 percent of<br />

the current total man-made segment of climate<br />

change and that by 2050, there’s a possibility that<br />

the airline industry’s share of man-made climatechange<br />

responsibility could grow to as much as<br />

5 percent.<br />

Just in terms of carbon dioxide — strongly<br />

suspected of being one of the key culprits that<br />

may be causing measurable levels of global<br />

warming — aviation is estimated to be responsible<br />

for up to 2 percent of current worldwide<br />

CO 2 emissions.<br />

By industry (based on 2005 figures), transportation<br />

accounts for 20 percent of all CO2<br />

emissions in Japan, and looking solely at the<br />

airline industry, flights on Japan’s domestic routes<br />

account for 4 percent of all emissions in the<br />

transportation segment and 0.9 percent of all<br />

emissions generated by Japanese industries.<br />

“We have to think differently about CO2<br />

emissions than companies involved in businesses<br />

with low CO2 emissions,” said JAL President<br />

and Chief Executive Officer Haruka Nishimatsu.<br />

“Irrespective of the level of attention being paid<br />

to the environment by the public, at the JAL<br />

Group, environmental initiatives must be a core<br />

management issue, not a peripheral one.”<br />

So ensuring a healthy and bountiful global<br />

environment for future generations is fully<br />

acknowledged by JAL’s executives as one of the<br />

carrier’s greatest social responsibilities. And for<br />

more than 15 years, JAL has been implementing<br />

a variety of measures designed to reduce and<br />

offset the impact its business activities have on<br />

the environment.<br />

Compared with 1990 levels, the JAL<br />

Group has a goal to cut fuel consumption (and,<br />

therefore, CO2 emissions) by 20 percent in terms<br />

of transported capacity by fiscal year 2010. To<br />

date (since 1990), JAL has achieved a 16 percent<br />

reduction in fuel consumption in terms of transported<br />

capacity.<br />

JAL’s total CO2 emissions in fiscal 2007<br />

(the year ended March 31, 2008) totaled 15 million<br />

tons, down 0.77 million tons (or 4.9 percent)<br />

from the previous fiscal year. For perspective, this<br />

reduction by 0.77 million tons is approximately<br />

equivalent to the CO2 annually absorbed by 55<br />

million Japanese cedars.<br />

Management realizes that one of the most<br />

significant ways JAL can slim down its environmental<br />

footprint is by reducing — or more<br />

efficiently using — the fuel that powers its aircraft<br />

(the amount of CO2 emitted is approximately proportionate<br />

to the amount of fuel consumed).<br />

For example, on a long-haul international<br />

flight from Tokyo to London using a four-engine<br />

Boeing 747-400 with 303 passengers onboard,<br />

the aircraft’s engines would emit approximately<br />

356 tons of CO2, whereas using a twin-engine<br />

Boeing 777-200ER on the same route, with 12<br />

percent fewer passenger seats, the aircraft’s<br />

engines would emit almost 33 percent less CO2.<br />

JAL has therefore already replaced the<br />

Boeing 747-400 with the more fuel-efficient<br />

Boeing 777 aircraft on nearly all of its routes from<br />

Asia to Europe. And the carrier is now also gradually<br />

replacing the 747 aircraft it uses on its routes<br />

between Japan and the United States.<br />

Essential, then, to JAL achieving significant<br />

CO2-emission cuts is fleet renewal through<br />

the introduction of more-fuel-efficient aircraft<br />

equipped with state-of-the-art engines — combined<br />

with the retirement of older aircraft. Almost<br />

30 percent of the aircraft in JAL’s fleet have been<br />

delivered within the past five years as JAL has<br />

retired 90 older-model aircraft.<br />

JAL’s substantial investment in new, moreefficient<br />

aircraft continues, as the carrier still has<br />

outstanding orders for more than 80 new aircraft,<br />

including the advanced Boeing 787 equipped<br />

with GEnx engines, which are General Electric<br />

engines of next-generation-turbofan design,<br />

anticipated under normal circumstances to use<br />

20 percent less fuel than today’s comparable<br />

aircraft engines.<br />

Nonetheless, JAL is going even further<br />

in terms of its fuel-consumption reduction measures.<br />

The carrier’s planners have estimated that<br />

trimming just 1 kilogram (or about 2.2 pounds)<br />

from the weight of each aircraft will cumulatively<br />

reduce CO2 emissions across the JAL fleet by 76<br />

tons a year.<br />

In pursuit of such incremental weight<br />

reduction, JAL has been looking at its flight operations<br />

from every conceivable angle to find various<br />

innovative ways to reduce aircraft weight, even if<br />

just by a single gram.<br />

So among other things, JAL has been<br />

reducing both the weight and numbers of items<br />

onboard its aircraft, including equipment such<br />

as galleys, meal carts and trays, and meals and<br />

magazines.<br />

Several years ago, JAL introduced lightweight<br />

porcelain tableware, which is approxi-<br />

JAl became the first airline to conduct a demonstration flight using a sustainable biofuel,<br />

which consisted of a blend of 50 percent biofuel and 50 percent traditional Jet-A fuel in one<br />

of the four Pratt & Whitney Jt9D engines of a Boeing 747-300 aircraft.<br />

Photo courtesy of JAL<br />

9<br />

profile

profile<br />

10<br />

mately 20 percent lighter, for meal service in first<br />

and business class. Also, JAL has made in-flight<br />

cutlery in economy class — including premium<br />

economy — 2 grams lighter per item.<br />

Furthermore, JAL has found it can make<br />

an individual aircraft 23 kilograms lighter by reducing,<br />

for example, the number of newspapers and<br />

magazines carried onboard international flights.<br />

Through a combination of various methods, JAL,<br />

on one of its typical 777 aircraft, has managed an<br />

overall weight reduction of 500 kilograms.<br />

JAL has also reduced the average weight<br />

of cargo containers carried onboard its aircraft by<br />

26 kilograms per unit on international routes, and<br />

by 14 kilograms per unit on domestic Japanese<br />

routes.<br />

Previously, JAL cargo containers have all<br />

been made of aluminum alloy, but JAL, in fiscal<br />

year 2007, started using Twintex — a new material<br />

made of polypropylene and glass fibers — in<br />

the side panels of the containers. And JAL plans<br />

to steadily update its multipurpose containers<br />

on international routes with this material (at this<br />

point, more than 10 percent of JAL’s containers<br />

have been replaced with the new lighter<br />

version).<br />

The average number of these containers<br />

in the belly of one of JAL’s 777-300ER aircraft is<br />

44 (which translates to a total weight reduction,<br />

with the new material, of 1,144 kilograms), and<br />

in the belly of one of JAL’s 747-400 aircraft is<br />

30 (which translates to a total weight reduction,<br />

with the new material, of 780 kilograms).<br />

In terms of cargo aircraft, JAL is now<br />

operating more of its freighters in bare metal,<br />

saving the weight of paint. In 1992, JAL began<br />

operating 747 cargo aircraft with unpainted<br />

exteriors, helping to reduce weight by approximately<br />

150 to 200 kilograms per aircraft. And<br />

during fiscal year 2007, JAL took delivery of<br />

three 767-300F aircraft (all of these aircraft<br />

arrived and remain unpainted, which in effect<br />

reduces their weight by approximately 110<br />

kilograms per aircraft).<br />

By using hot water to regularly clean the<br />

jet engines of its large and midsize aircraft, JAL<br />

has managed to improve engine performance<br />

by approximately 1 percent.<br />

Having cleaned half of its aircraft engines<br />

in this manner, JAL estimates its fleet CO 2<br />

emissions have been reduced by about 53,000<br />

tons, which is equivalent to the emissions<br />

generated by 980 round trips between Tokyo<br />

and Sapporo (a city world-renowned as the host<br />

of the 1972 Winter Olympics, located on the<br />

northern Japanese island of Hokkaido).<br />

In early 1990, JAL flight crewmembers<br />

set up a fuel-efficiency committee to explore<br />

ways of flying in a more eco-friendly fashion.<br />

This committee has since been reorganized as<br />

the operations division team, with several members<br />

meeting every two months to discuss how<br />

to avoid excessive fuel usage and then communicating<br />

the results of these discussions to<br />

fellow flight crews.<br />

ascend<br />

JAl capt. Keiji Kobayashi (left), featured with JAl ceo Haruka Nishimatsu, piloted the<br />

industry’s first demonstration flight using a sustainable biofuel blend in one of the engines<br />

of a Boeing 747-300 aircraft.<br />

The team’s findings have led, for example,<br />

to a decrease in the use of auxiliary power units<br />

at the airport, more accurate measurement of<br />

fuel loaded onboard, more optimal timing and<br />

angle of flap operation, reduced use of reversethrust<br />

on landing, and turning off one of the four<br />

engines on 747 aircraft while taxiing.<br />

APUs onboard the aircraft provide electricity<br />

for onboard air conditioning and lighting<br />

while the aircraft is on the ground with the<br />

main engines disengaged. Since an operating<br />

APU consumes between 600 and 700 liters<br />

of fuel per hour, JAL pilots try not to start up<br />

these power units until shortly before takeoff,<br />

and they rely on ground power units at the<br />

airport for electricity and air conditioning. APUs<br />

generate approximately 1,200 kilograms of CO 2<br />

per hour, compared to 44 kilograms of CO2 for<br />

GPUs.<br />

To work toward greater fuel efficiency,<br />

the amount of fuel onboard an aircraft must<br />

be accurately measured. At one time, fuel<br />

was loaded onboard JAL aircraft in units of<br />

1,000 pounds (around 450 kilograms), but JAL<br />

decided to modify the fuel load to 100-pound<br />

(45-kilogram) units.<br />

More precise measures of the amount of<br />

fuel required for safe arrival at each destination<br />

has allowed JAL to achieve weight savings of<br />

approximately 400 kilograms per flight.<br />

In addition, JAL is committed to recycling<br />

every possible item, from aluminum cans and<br />

paper to old uniforms. The carrier has even adopted<br />

a green procurement policy. For example, it<br />

now only uses in-flight chopsticks that are made<br />

from certifiable Japanese wood obtained through<br />

domestic forest-thinning procedures.<br />

The bulk of paper onboard JAL’s aircraft<br />

is generally accounted for among the magazines<br />

offered to passengers, including Skyward, JAL’s<br />

in-flight magazine, and JEN Guide, JAL’s in-flightentertainment<br />

guide. Each month, JAL crews<br />

remove the old copies from all aircraft and replace<br />

them with new copies.<br />

Years ago, such waste was generally<br />

either burned or transported to landfills. In 2004,<br />

however, JAL at Narita, Kansai, Haneda and<br />

Fukuoka airports created special project teams<br />

to address this issue. And as a result, the airline<br />

introduced new storage carts that make it easier<br />

to collect magazines within the limited space of<br />

the aircraft cabin. Today, these airports recycle<br />

about 600 tons of magazines each year — almost<br />

equivalent to the maximum takeoff weight of two<br />

777-200ER aircraft.<br />

JAL executives have expressed interest<br />

in exploring ways to reduce reliance on conventional<br />

fuels, which would again contribute to an<br />

overall reduction of CO 2 emissions.<br />

In partnership with Boeing, Pratt &<br />

Whitney, and Honeywell’s universal oil products<br />

(a refining technology developer), JAL was the<br />

first carrier to conduct a demonstration flight<br />

using a sustainable biofuel refined primarily from<br />

Photo courtesy of JAL

camelina, an energy crop. This also represented<br />

the first biofuel demo by an Asian carrier as well<br />

as the first biofuel demo using Pratt & Whitney<br />

aircraft engines.<br />

The demo flight effectively brings the<br />

airline industry closer to finding a commercially<br />

viable second-generation biofuel that could help<br />

reduce the impact of carbon dioxide emissions<br />

generated by aviation, while also reducing the<br />

industry’s reliance on traditional petroleum-based<br />

fuels. The test conducted on Jan. 30 involved<br />

a blend of 50 percent biofuel and 50 percent<br />

traditional Jet-A (kerosene) fuel in one of the four<br />

Pratt & Whitney JT9D engines of a JAL-owned<br />

Boeing 747-300 aircraft.<br />

The biofuel component was a mixture<br />

of three second-generation biofuel feedstocks:<br />

camelina (84 percent), jatropha (less than 16<br />

percent) and algae (less than 1 percent). JAL,<br />

Boeing, Pratt & Whitney, and Honeywell’s UOP<br />

have committed to the use of second-generation<br />

biofuel feedstocks that represent more efficient<br />

and sustainable energy than their first-generation<br />

predecessors.<br />

Second-generation biofuel feedstocks,<br />

such as camelina, jatropha and algae, do not<br />

compete with natural food or water resources and<br />

do not contribute to detrimental environmental<br />

activity such as deforestation.<br />

The fuel for the JAL demo flight was<br />

successfully converted from plant-based oil to<br />

biofuel by Honeywell’s UOP, using proprietary<br />

hydro-processing technology to complete the fuel<br />

conversion. To create the 50 percent blend, the<br />

biofuel was then blended with typical jet fuel.<br />

Subsequent laboratory testing by Boeing,<br />

UOP and several independent laboratories verified<br />

that the blended biofuel meets industry criteria<br />

for jet-fuel performance. Ground-based jet-engine<br />

performance testing by Pratt & Whitney of similar<br />

fuels further established that the biofuel blend<br />

either meets or exceeds the performance criteria<br />

in place for commercial aviation jet fuel today.<br />

At Tokyo’s Haneda Airport, JAL Group<br />

companies have also been working together with<br />

the Japan Civil Aviation Bureau and a group of<br />

other companies in testing biodiesel fuel that has<br />

been refined from waste tempura oil collected<br />

from restaurants.<br />

As part of the trials, JAL has tested the<br />

novel fuel in one of its tug vehicles, which is most<br />

commonly used to transport heavy loads around<br />

the airport and for baggage transportation. In<br />

using a 50/50 mixture of light oil and biodiesel fuel,<br />

no modification of the tug was necessary.<br />

Being a member of a global airline industry<br />

has also enabled JAL to play some unique roles in<br />

fostering environmental improvement. Because<br />

forests theoretically mitigate the effects of such<br />

challenges as global warming by absorbing CO 2<br />

emitted through the burning of fossil fuels, JAL<br />

has supported the Boreal Forest Fire Control<br />

Initiative and other similar projects.<br />

With the overall aim of preventing or at<br />

least effectively containing wildfires through early<br />

detection, information gathering and analysis,<br />

JAL’s pilots flying over vast open regions including<br />

Indonesia, Siberia and Alaska have been reporting<br />

any fire outbreaks they happen to spot, with more<br />

than 700 blazes reported in the past six years.<br />

Since 1993, JAL has also been participating<br />

in a global-warming observation project,<br />

monitoring greenhouse gases in the upper atmosphere<br />

using specially fitted air-sample-collection<br />

and -measuring equipment. The program now<br />

involves five JAL aircraft on international routes,<br />

measuring the CO2 concentration in the upper<br />

atmosphere.<br />

The data collected using JAL aircraft are<br />

helping scientists study and better understand the<br />

causes and effects of measurable increments in<br />

global warming and overall climate change.<br />

And beyond JAL’s own regular air transportation<br />

activities, the carrier has been supporting<br />

the Japanese government’s energy-saving “Team<br />

Minus 6 Percent” initiative by reducing levels of<br />

office heating during the winter and office cooling<br />

during the summer, cutting CO2 emissions at<br />

JAL’s offices in Japan by more than 10 percent<br />

during the last five years.<br />

Also in support of the campaign, JAL has<br />

shown a Team Minus 6 Percent public-information<br />

video on its domestic flights, making a sincere<br />

appeal to members of the general public to consider<br />

ways they use energy in their everyday lives<br />

and encouraging them to economically use and<br />

conserve energy in every way possible.<br />

As company policy, JAL is also applying<br />

innovative flying and routing techniques including<br />

tailored arrival and user-preferred route to allow<br />

its aircraft to arrive at their destinations while<br />

using the least amount of fuel and producing the<br />

fewest CO2 emissions in the process.<br />

Additionally, JAL has instituted a voluntary<br />

customer carbon-offset program, enabling its<br />

passengers to purchase credits that are spent<br />

specifically on environmental procedures that<br />

effectively offset passengers’ individual measures<br />

of carbon generation during that particular<br />

trip.<br />

Furthermore, JAL’s commitment to finding<br />

and eventually introducing biofuel alternatives<br />

to conventional fossil fuels in its aircraft and<br />

ground vehicles represents a trailblazing effort<br />

for commercial aviation, essentially helping make<br />

commercial aviation the first global-transport sector<br />

to place verifiable sustainability practices in its<br />

fuel-supply chain.<br />

All of these and more measures are key<br />

elements of JAL’s equation to do its part in helping<br />

substantially improve the global environment.<br />

“As a symbol of our commitment to the<br />

environment, we operate an airplane with a green<br />

tail — and all employees are sharing in the effort<br />

to accelerate and carry out specific environmental<br />

activities,” Nishimatsu said.<br />

In the actions of its top executives and others<br />

throughout the organization, the JAL Group has<br />

exhibited a level of determination that may even be<br />

unique in worldwide corporate business circles to<br />

seriously combat the possible long-term detrimental<br />

effects of potentially harmful emissions and to<br />

leave a much more healthful environment as a<br />

genuine legacy to future generations. a<br />

Phil Johnson can be contacted at<br />

wearelistening@sabre.com.<br />

As part of its environmental sustainability strategy, JAl continues investing in new,<br />

more-efficient aircraft, such as the Boeing 787, which under normal conditions is estimated<br />

to burn 20 percent less fuel than current comparable aircraft.<br />

Photo courtesy of Boeing<br />

ascend 11<br />

profile

12 ascend<br />

In response to the many new challenges it’s faced during the past<br />

few years, Mexicana <strong>Airline</strong>s has made highly strategic changes to its<br />

commercial side of the business as well as experienced great success<br />

from its low-cost subsidiary.<br />

By Michael Mankowski and Michael Reyes | Ascend Contributors<br />

Forward<br />

LEAP<br />

Air New Zealand embraces innovation in both routing and<br />

flying techniques to generate significant fuel savings and<br />

reduced carbon dioxide emissions on a route from New Zealand<br />

to the United States.<br />

By Shawn Mechelke | Ascend Contributor

During its economically and environmentally significant flight last september, called AsPIre 1, Air New zealand saved approximately<br />

1,174 u.s. gallons of fuel and reduced co2 emissions by some 11,218 kilograms.<br />

Two basic necessities in the global air<br />

transport industry — saving fuel and<br />

reducing potentially environmentally<br />

harmful CO2 emissions — are linked directly to<br />

greater efficiency.<br />

And greater efficiency is precisely the<br />

goal that Air New Zealand has effectively targeted<br />

in its innovative application of advanced<br />

routing and flying procedures on its trans-<br />

Pacific route between New Zealand’s global<br />

economic hub in Auckland and the California<br />

coast at Air New Zealand’s North American<br />

destination in San Francisco.<br />

Considering the entire process, Air New<br />

Zealand has helped enable the aviation industry<br />

to make a leap forward in defining both a<br />

more environmentally friendly and economic<br />

means of operating aircraft over long transoceanic<br />

distances.<br />

On Sept. 12, Air New Zealand completed<br />

what is now recognized as an economically<br />

and environmentally significant flight of a<br />

Boeing 777-200ER aircraft from Auckland to<br />

San Francisco.<br />

Before and during this historically noteworthy<br />

flight called ASPIRE 1, Air New Zealand<br />

applied broad capabilities in the areas of<br />

advanced flight planning techniques, datalink<br />

communications and air traffic control advancements<br />

to reap highly impressive results in trip<br />

fuel savings totaling approximately 1,174 U.S.<br />

gallons as well as approximately 11,218 kilograms<br />

in reduced CO 2 emissions.<br />

Combined concerns revolving around<br />

global climate change, ongoing measurable<br />

ozone depletion and the overuse of natural<br />

resources (as represented by petroleum products)<br />

have intensified the sense of urgency<br />

felt by Air New Zealand executives to position<br />

themselves on the leading edge in identifying<br />

new operational methods for the carrier’s<br />

scheduled flights — especially flights across<br />

the vast distances of the Pacific Ocean.<br />

In coordination with innovative oceanic<br />

air traffic procedures, Air New Zealand has<br />

implemented advanced flight planning techniques<br />

to set a new standard in trans-Pacific<br />

travel.<br />

Air New Zealand determined that approximately<br />

42 percent of the total fuel savings on<br />

the Auckland-San Francisco flight is attributable<br />

to calculations and decisions derived from data<br />

supplied by Air New Zealand’s flight planning<br />

system, <strong>Sabre</strong> ® Dispatch Manager.<br />

The remainder of the credit for Air<br />

New Zealand’s significant achievement goes<br />

primarily to the most advanced air-navigation<br />

services provided by several government<br />

agencies, including Airways New Zealand,<br />

Airservices Australia and the U.S. Federal<br />

Aviation Administration.<br />

In incrementally analyzing Air New<br />

Zealand’s remarkable accomplishment, it’s<br />

important to examine the flight’s sequential<br />

process — from preflight stage through takeoff<br />

and climb, cruise, descent, and finally the<br />

flight’s landing at San Francisco International<br />

Airport.<br />

Air New Zealand uses Dispatch Manager<br />

to create optimized flight plans, which are then<br />

sent via datalink communications to an Air New<br />

Zealand aircraft cockpit’s flight management<br />

computer. This includes the flight plan itself,<br />

plus enroute wind and temperature data.<br />

The carrier is able to analyze historical<br />

fuel-burn data for each of its individual aircraft<br />

(compared to what was flight planned) and<br />

adjust its fuel-burn calculations accordingly for<br />

each aircraft, including calculation of a performance-deterioration<br />

allowance.<br />

To analyze this factor in proper context,<br />

the airline takes into account that as aircraft<br />

age, their fuel-burn performance is altered.<br />

Air New Zealand monitors the fuel-burn performance<br />

of each of its aircraft on a daily<br />

basis and makes weekly adjustments in its<br />

aircraft fuel-burn data. It also considers these<br />

measures a collective maintenance practice,<br />

which are followed to produce highly accurate<br />

flight plans based at least partly on the specific<br />

expected fuel-burn performance of each individual<br />

aircraft.<br />

As another key factor that results in<br />

highly accurate flight plans, Dispatch Manager<br />

receives an updated set of worldwide wind<br />

and temperature forecasts every six hours. Air<br />

New Zealand flight dispatch officers are then<br />

able to use these latest wind and temperature<br />

forecasts in the preflight planning stage to create<br />

the initial flight plan for any given flight’s<br />

departure.<br />

Further augmenting the flight-plan accuracy<br />

(as based on the most recent six-hourly<br />

wind and temperature data), Air New Zealand<br />

maintains various items of direct-operating-<br />

ascend<br />

Photo courtesy of Boeing<br />

13<br />

profile

profile<br />

14<br />

cost information in the flight planning system,<br />

including fuel costs.<br />

To determine the optimum route and<br />

altitude for a particular flight, the Air New<br />

Zealand flight planning engine uses the latest<br />

wind and temperature information, plus highly<br />

reliable direct-operating-cost data. The carrier<br />

then calculates the cost of flight time crossreferenced<br />

against the cost of fuel and eventually<br />

arrives at a cost index that will result in the<br />

minimum total cost for the flight.<br />

The cost-index data correspond to the<br />

performance data in the aircraft’s flight management<br />

computer and provide guidance to<br />

the flight crew as to the performance profiles<br />

to use in the climb, cruise and descent flight<br />

phases.<br />

As a result, variable cost-index calculations<br />

can be computed preflight as well as<br />

while the aircraft is en route — every six<br />

hours, when wind and temperature updates<br />

are received. The flight-plan route, winds,<br />

temperatures and cost-index setting are sent<br />

to the aircraft’s flight management computer<br />

via datalink communications.<br />

In addition to its Dispatch Manager<br />

flight-planning capability, Air New Zealand uses<br />

aircraft situation display technology via the<br />

<strong>Sabre</strong> ® Flight Explorer ® System to graphically<br />

view and track a flight’s progress in real time<br />

while the aircraft is en route from takeoff to<br />

landing.<br />

The aircraft situation display, in addition<br />

to the flight-planning system, can also be used<br />

to guide Air New Zealand flight dispatchers<br />

in determining optimum routes by using the<br />

system’s weather-overlay capabilities plus satellite<br />

imagery to compare and take into consideration<br />

graphical forecast weather conditions<br />

along the route, including potential turbulence<br />

and icing as well as areas of thunderstorm<br />

activity in relation to the planned route.<br />

In addition to the optimization provided<br />

by the flight planning system, an Air New<br />

Zealand flight dispatcher can assess the overall<br />

route and determine if it needs to be adjusted<br />

at certain points due to locally adverse weather<br />

conditions.<br />

All of the factors are in place, then, to<br />

allow flight planners to take into consideration<br />

not only a vast array of weather variations that<br />

can affect a flight, but to allow the planners to<br />

construct a route with both fuel savings and<br />

minimal CO2 emissions in mind. And in the<br />

preflight stage, Air New Zealand uses Dispatch<br />

Manager to determine the most economical<br />

flight route — looking to identify a route requiring<br />

the least amount of fuel and generating the<br />

lowest CO2 emissions.<br />

As a key element in this process, Air<br />

New Zealand defines for the flight a userpreferred<br />

route, or UPR. UPRs have been<br />

operational in the South Pacific oceanic airspace<br />

for a number of years, enabling carriers<br />

to plan optimized routes based on better flight<br />

ascend<br />

efficiency in taking advantage of the benefits<br />

of prevailing wind patterns rather than simply<br />

being required to fly fixed city/pair routes.<br />

Fixed routes — whether in the form<br />

of permanently defined tracks or flex-tracks<br />

(flex-tracks, effectively, are fixed tracks defined<br />

daily) — are not essential in the Auckland<br />

oceanic flight information region (managed by<br />

the government agency Airways New Zealand<br />

using its oceanic control system, or OCS) and<br />

the Oakland flight information region (managed<br />

by the FAA using its Ocean21 system).<br />

HiGHlight<br />

In coordination with<br />

innovative oceanic<br />

air traffic procedures,<br />

Air New Zealand<br />

has implemented<br />

advanced flight<br />

planning techniques<br />

to set a new standard<br />

in trans-Pacific travel.<br />

In the pre-departure phase for Air New<br />

Zealand’s flight from Auckland to San Francisco<br />

— using the calculated cost index and the latest<br />

enroute upper-air wind and temperature forecast<br />

— the carrier used Dispatch Manager to<br />

calculate the track between Auckland and San<br />

Francisco that would most effectively minimize<br />

fuel usage and emissions.<br />

This route is the UPR, implementation<br />

of which requires air traffic control systems<br />

that are able to support aircraft operating outside<br />

of predefined airways. With Air New<br />

Zealand’s OCS and the FAA’s Ocean21 — as<br />

well as their real-time conflict-probe capabilities,<br />

which instantly probe for conflicting factors with<br />

regard to any revision of flight profile — there<br />

is no requirement for traffic to maintain fixed<br />

routes in order for air traffic controllers to be<br />

able to identify conflicts.<br />

Once calculated, the user-preferred route<br />

is digitally uplinked to the aircraft, inclusive of<br />

the wind and temperature data for loading into<br />

the aircraft flight management computer. The<br />

fuel saved on this flight through the implementation<br />

of UPR amounted to approximately 420<br />

U.S. gallons and UPR was also accountable for<br />

approximately 4,015 kilograms of reduced CO 2<br />

emissions (emission reductions and fuel savings<br />

across the entire flight).<br />

Other factors in the initial stages of the<br />

flight also figured into the greater fuel equation.<br />

In an aircraft’s climb after takeoff, for example,<br />

there are numerous disparate factors that must<br />

be balanced to arrive at an optimum operating<br />

procedure.<br />

When considering climb power, the use of<br />

a derate climb power, or a power setting that is up<br />

to 20 percent below the aircraft’s maximum climb<br />

power, serves to significantly improve engine life<br />

potential and thereby lower maintenance costs,<br />

but the use of derate climb power also effectively<br />

increases the overall amount of fuel consumed<br />

during this flight phase.<br />

Even under the effects of fairly recent higher<br />

fuel prices, however, the savings to a carrier in<br />

terms of engine maintenance costs would still<br />

exceed by more than double the cost of fuel that<br />

could be saved in this flight phase. Thereby, derate<br />

climb power has remained Air New Zealand’s<br />

preferred option.<br />

Climb speeds on Air New Zealand aircraft,<br />

incidentally, are set automatically through the<br />

mechanism of a cost-index factor that is entered<br />

into the aircraft’s flight management computer.<br />

And some of the things that figured in later<br />

during the Auckland-San Francisco flight took on<br />

even greater significance. Once at cruising altitude,<br />

for instance, the flight gained an advantage<br />

through the six-hourly update of the upper air wind<br />

and temperature forecasts received through the<br />

flight planning system. A process called dynamic<br />

airborne reroute procedure, or DARP, is applied in<br />

effectively re-planning the flight en route.<br />

On the Air New Zealand flight from<br />

Auckland to San Francisco, the DARP process<br />

was completed twice, thereby saving approximately<br />

70 U.S. gallons of fuel.<br />

Air New Zealand’s use of DARP commences<br />

with an aircraft-datalink request for a<br />

DARP to the Air New Zealand flight dispatch office<br />

in Auckland. Immediately, the latest wind and<br />

temperature forecast becomes available, and the<br />

Air New Zealand flight dispatcher uses Dispatch<br />

Manager to recalculate the optimum track from<br />

a predetermined point just ahead of the current<br />

aircraft airborne position.<br />

Once calculated, the revised route is<br />

uplinked to the aircraft for flight crew consideration.<br />

The crew then downlinks a request for the<br />

revised route to New Zealand’s oceanic control<br />

center and, once approved, accepts the revised<br />

route into the active side of the flight management<br />

computer.<br />

Another advanced air traffic procedure that<br />

now benefits Air New Zealand operations in the<br />

Pacific oceanic region is 30/30 separation.<br />

Beginning in 2005, the Airways New<br />

Zealand and Airservices Australia agencies<br />

reduced the required separation between aircraft<br />

in their oceanic airspace to 30 nautical miles<br />

longitude and 30 nautical miles latitude — the first<br />

such reduced separation in international airspace

to be implemented globally. Within a year, the FAA<br />

followed suit with regard to its Pacific airspace.<br />

Air New Zealand has invested in aircraft<br />

systems that enable the carrier to obtain approval<br />

for both RNP10 (which results in 50-nautical-mile<br />

lateral and longitudinal separation) and RNP4<br />

(which allows the use of a 30-nautical-mile standard<br />

in oceanic regions).<br />

This separation standard is now routinely<br />

applied on flights between Auckland and San<br />

Francisco, and 30/30 separation effectively pro-<br />

vides the Airways New Zealand agency significantly<br />

increased airspace capacity as well as<br />

increased route flexibility, thereby enabling an<br />

overall reduction in fuel burn and CO2 emissions<br />

from each and every aircraft operating in the<br />

region.<br />

Air traffic control’s ability to allow closer<br />

separation between aircraft therefore also reduces<br />

the number of times during which aircraft are held<br />

below the optimum altitude, and on this Air New<br />

Zealand flight resulted in savings of approximately<br />

According to Air New zealand, approximately 61 percent of the total fuel savings<br />

on its AsPIre 1 flight last september were attributed to the carrier’s state-of-the-art<br />

flight planning system, Dispatch Manager, part of <strong>Sabre</strong> ® AirCentre Enterprise Operations.<br />

135 U.S. gallons of fuel and 1,290 kilograms in<br />

reduced CO2 emissions.<br />

The crew of the Air New Zealand flight<br />

was also able to make use of new descent and<br />

arrival procedures into San Francisco International<br />

Airport that saved approximately 200 U.S. gallons<br />

of fuel and 1,912 kilograms in reduced CO2<br />

emissions.<br />

Through what is known as a tailored arrival,<br />

the descent and approach into San Francisco was<br />

optimized for efficiency.<br />

Tailored arrival into San Francisco is a<br />

sophisticated application of a type of emissionsoptimized<br />

arrival known as a continuous descent<br />

arrival. CDA allows an aircraft to fly a continuousdescent<br />

path to land at an airport, instead of the<br />

traditional step-downs or intermediate-level flight<br />

operations.<br />

Using CDA, the pilot initiates descent from<br />

a high altitude in a near-idle (or low-power) engine<br />

condition until reaching a stabilization point prior to<br />

touchdown on the runway. CDA results not only<br />

in fuel savings and decreased emissions, but also<br />

significantly reduces noise beyond the airport.<br />

The tailored arrival then takes the principles<br />

of the CDA a step further by identifying the most<br />

beneficial flight path available by integrating all<br />

known aircraft performance, air traffic, airspace,<br />

meteorological, obstacle-clearance and environmental<br />

constraints expected to be encountered<br />

during the arrival phase.<br />

So in a broad analysis, the combination of<br />

Air New Zealand’s desire to pursue a “green”<br />

approach in the air — combined with state-ofthe-art<br />

technologies as well as innovative air traffic<br />

control systems from government agencies,<br />

Airways New Zealand, Airservices Australia and<br />

the FAA — made this particular Air New Zealand<br />

flight something of a high-profile case study, worthy<br />

of both detailed analysis and emulation.<br />

And the entire aviation industry appears<br />

to have taken notice. In a remarkable globally<br />

significant accomplishment, Air New Zealand has<br />

effectively demonstrated how to operate aircraft<br />

over long oceanic distances while creating a<br />

considerably smaller environmental footprint and<br />

saving substantial amounts of fuel.<br />

Today, there are more than 150 flights per<br />

week connecting New Zealand and Australia to<br />

the United States and Canada. Based on these<br />

flights alone, the potential total annual savings are<br />

in excess of 10 million U.S. gallons of fuel and<br />

reduced CO 2 emissions of more than 100,000<br />

tons … simply by following the principles that<br />

have been established and proven effective by Air<br />

New Zealand during a memorable flight from<br />

Auckland to San Francisco. a<br />

Shawn Mechelke is an operations<br />

product management director for <strong>Sabre</strong><br />

<strong>Airline</strong> <strong>Solutions</strong>®. He can be contacted<br />

at shawn.mechelke@sabre.com.<br />

ascend<br />

15<br />

profile

A<br />

Clear<br />

Vision<br />

A Conversation With …<br />

Sean Durfy, WestJet Chief Executive Officer

WestJet <strong>Airline</strong>s<br />

Photos courtesy of WestJet<br />

WestJet <strong>Airline</strong>s, Ltd., has come a long<br />

way since the days of three aircraft<br />

flying to five destinations in western<br />

Canada. Its growing fleet of Boeing Next-<br />

Generation aircraft now serve cities across<br />

Canada and the United States, including three<br />

Hawaiian destinations. It is quickly becoming<br />

the airline of choice for vacation travel with its<br />

Caribbean and Mexican destinations.<br />

Despite a global economy that is currently<br />

dictating a significant downturn in the<br />

airline industry, WestJet remains optimistic<br />

about its expansion plans.<br />

Yes, it’s been impacted. In February,<br />

the carrier posted a 45 percent slide in fourthquarter<br />

earnings to C$40.8 million (US$31.5<br />

million) as harsh winter weather and waning<br />

demand for air travel continued to bog down<br />

its earnings. But Sean Durfy, WestJet chief<br />

executive officer, is bullish on his airline’s<br />

expansion plans, which forecasts 5 percent<br />

growth this year and includes adding eight<br />

more leased planes to its 77-plane fleet.<br />

“We’re still growing this airline,” Durfy<br />

said in a February interview with Canada’s<br />

Financial Post. “We’re still adding new routes,<br />

and we’ll continue to grow the WestJet<br />

Vacations product. We’re taking nine aircraft<br />

this year, and we have no flexibility on that.”<br />

During that interview, Durfy said there<br />

are several initiatives in the works that will<br />

help fill WestJet’s planes, most of which rely<br />

on the successful implementation of its new<br />

reservations system, built by <strong>Sabre</strong> <strong>Airline</strong>s<br />

<strong>Solutions</strong> ®<br />

, by the end of the year.<br />

While that process will likely push the<br />

launch of WestJet’s new loyalty program into<br />

the third quarter, it will enable the airline to<br />

increasingly move to an “à la carte” model,<br />

where passengers pay for the services they<br />

desire, such as advance seat selection and<br />

flexible fares.<br />

It will also enable the airline to implement<br />

its recently announced codeshare<br />

agreements with Southwest <strong>Airline</strong>s and Air<br />

France-KLM by the end of the year and during<br />

the first quarter of 2010, respectively.<br />

Talks continue with Cathay Pacific<br />

Airways and several other carriers over the<br />

potential for further codeshare agreements.<br />

“I think we will sign up at least one<br />

more this year for 2010,” Durfy said.<br />

What is the key to the carrier’s success?<br />

People, first. At WestJet, a team<br />

responsible for corporate culture organizes<br />

ascend 17

profile<br />

18<br />

WestJet <strong>Airline</strong>s employees, through their friendly, professional interaction with customers,<br />

display firsthand the airline’s emphasis on its award-winning corporate culture and how<br />

important its employees are to the company’s overall success.<br />

250 annual events including talks with pilots<br />

and flight crews to discuss culture and news,<br />

parties, and town hall meetings.<br />

Durfy communicates regularly with<br />

employees to keep them updated. In addition,<br />

all employees undergo an orientation program<br />

in which they learn about the importance of<br />

corporate culture. The company also conducts<br />

an internal biannual survey called WHY<br />

(We Hear You) that measures culture and<br />

safety is just one of five key elements that define WestJet <strong>Airline</strong>s’ culture, along with<br />

accountability, fun, friendliness and ownership.<br />

ascend<br />

employee engagement and encourages feedback<br />

so leaders can make improvements.<br />

Durfy ties his success to technology<br />

as well. In an ad by Microsoft, an announcer<br />

asks, “So Durf, how do you keep the vision<br />

alive?” His reply?<br />

“When we had 200 people, everyone<br />

said, ‘Ah, you’ll never keep your culture.’<br />

Then we went to 1,000 people; they said,<br />

‘Ah, bet you won’t keep it when you go to<br />

2,000.’ Then we went to 2,000, and they<br />

said, ‘Ah, when you get to 5,000, it’s going<br />

to be a different game.’ Of course, we’re at<br />

7,500 people, and our culture has never been<br />

as strong.<br />

“With 7,500 folks across Canada and the<br />

United States, you can’t look at everybody’s<br />

eyes anymore. We now look at technology as<br />

a strategic driver of the company. If you don’t<br />

have that, you’re screwed, brother.”<br />

Durfy has been with WestJet since<br />

2004, when he joined the airline as executive<br />

vice president of sales and marketing. He<br />

was appointed president in September 2005<br />

and assumed the role of CEO in September<br />

2007.<br />

In a recent interview with Lynne Clark<br />

from Ascend magazine, Durfy shared more<br />

thoughts about keeping the vision alive.<br />

Question: on your Web site,<br />

you call WestJet a different kind of airline.<br />

What sets WestJet apart from other lowcost<br />

carriers?<br />

Answer: First and foremost, it’s<br />

our people and their commitment to deliver<br />

a world-class guest experience that sets<br />

us apart from other airlines and, indeed,<br />

other companies. Our people are our greatest<br />

asset. In addition, we have a strong business<br />

model and low cost structure, which allow<br />

us to offer our guests great fares and travel<br />

packages.<br />

Q: WestJet has been named one<br />

of canada’s “most admired corporate cultures”<br />

four times. Describe your corporate<br />

culture and how it has contributed to the<br />

company’s phenomenal success.<br />

A: Our culture is value based and<br />

driven by our entire workforce in a grassroots<br />

way by every WestJetter and demonstrated<br />

equally by our leadership teams. Centered<br />

around caring, our culture includes elements<br />

of accountability, safety, fun, friendliness and<br />

ownership. Pride in ownership and being part<br />

of this great success story encourages our<br />

people to make great decisions and contribute<br />

even further to our performance.<br />

Q: What would a first-time WestJet<br />

passenger notice most about his or her<br />

flight experience?<br />

A: The first thing they’ll notice is the<br />

fun and friendly attitude of our WestJetters.

like traditional low-cost carriers, WestJet <strong>Airline</strong>s operates a single aircraft type, with a fleet<br />

of 77 Boeing Next-generation 737 planes and plans to grow its fleet by 5 percent this year.<br />

We get more compliments about our people<br />

than anything else. From the time our guests<br />

book their tickets to check-in, the boarding<br />

lounge and, of course, the flight itself, it’s all<br />

about delivering a world-class guest experience.<br />

People also like our new and efficient<br />

Boeing Next-Generation 737s, our on-time<br />

performance and, in general, how easy and<br />

worry-free it is to fly with us.<br />

Q: Describe a memorable, fun or offthe-wall<br />

event WestJet hosted for employees<br />

and/or shareholders.<br />

A: It would be hard to describe just<br />

one. In fact, we have over 200 parties and<br />

events for WestJetters and their families<br />

every year. Probably one of the most satisfying<br />

events is our twice-annual profit share parties,<br />

when WestJetters have an opportunity<br />

to come together to celebrate and share in<br />

our success, and leaders enjoy the opportunity<br />

to personally reward team members for<br />

their part in our success.<br />

Q: Your founders based their<br />

business model on southwest <strong>Airline</strong>s.<br />

Describe the similarities and differences of<br />

the two carriers.<br />

A: There are many similarities as well<br />

as some differences. For example, we are<br />

similar in that we use only one type of aircraft,<br />

we are dedicated to providing high value at a<br />

low cost, we’re fun and friendly, and we focus<br />

on creating an amazing guest experience.<br />

However, our workforce is much smaller and<br />

it is non union.<br />

Q: You have a new codeshare agreement<br />

with southwest <strong>Airline</strong>s. How chal-<br />

lenging will it be to integrate your operations?<br />

Will it be difficult to differentiate<br />

your brands?<br />

A: From day one, we have always<br />

enjoyed a tremendous relationship with<br />

our friends at Southwest. For example, our<br />

respective operations teams have exchanged<br />

best practices and business process information,<br />

which has been a significant benefit<br />

not only from a technical perspective, but<br />

also in terms of getting to know each other<br />

and experiencing the cultural “fit” firsthand.<br />

From a brand perspective, we share many<br />

of the same values with Southwest and look<br />

forward to the day when our guests will be<br />

able to enjoy the full benefits of this new<br />

arrangement.<br />

Q: What do you consider when<br />

evaluating new partners?<br />

A: Our first priority is a cultural<br />

fit. How does the potential partner view<br />

the importance of creating a world-class<br />

guest experience? What are their organizational<br />

values, and how do they treat<br />

their people? Of course, we also evaluate<br />

critical elements such as technology,<br />

business processes, etc. At the end of<br />

the day, any partnership must be mutually<br />

beneficial and be capable of moving both<br />

companies forward in their respective<br />

business strategies.<br />

Q: How do you balance the need<br />

to grow with the need to nurture the<br />

corporate culture that has made you so<br />

successful?<br />

A: This is an excellent question. As<br />

an organization grows, its culture changes<br />

subtly with each new hire. At WestJet, we<br />

believe we can maintain our strong corporate<br />

culture while growing our business,<br />

and that our culture will grow and evolve<br />

along with our business. There is a strong<br />

relationship between the two, and we’re<br />

resolved to never lose that focus.<br />

Q: obviously, WestJet has been<br />

successful because it continues to provide<br />

safe, friendly and affordable air<br />

travel. What role has technology played<br />

in that commitment?<br />

More than 80 percent of WestJet employees are owners of the airline, which contributes to<br />

their strong desire and motivation to help build and grow the business. In addition, WestJet<br />

leaders view all employees as partners, and it’s this team concept that supports the thriving<br />

carrier.<br />

ascend 19<br />

profile

profile<br />

20<br />

With its fleet of Boeing Next-generation 737-600, 737-700 and 737-800 aircraft, WestJet <strong>Airline</strong>s operates the most modern fleet in North<br />

America of any large commercial airline. the aircraft are equipped with more legroom, leather seats and live seatback television.<br />

A: Technology innovations and partnerships<br />

have played a significant role in<br />

our success as much of our core business<br />

is dependant on technological applications.<br />

For example, we developed an<br />

RNP (required navigational performance)<br />

application, which affords us significant<br />

fuel savings and increased safety when<br />