End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>and</strong> the country is now the fifth largest importer <strong>of</strong> boneless beef worldwide. Growth from 150,800 MT <strong>of</strong> boneless<br />

beef imports in 2005 to 253,358 MT in 2007 represents a 68<br />

percent increase in two years. It appears that despite consumer<br />

preferences for fresh beef, concerns about transboundary diseases,<br />

particularly FMD, are driving a shift from live cattle to beef<br />

imports. Indeed, following an FMD outbreak in January 2006,<br />

imports not only <strong>of</strong> live animals but also <strong>of</strong> carcasses were banned,<br />

<strong>and</strong> only boneless imports were allowed. This is in accordance with<br />

OIE recommendations, which state that for countries where FMD<br />

is present, the exportation <strong>of</strong> boneless beef, chilled or frozen, is<br />

safe (as long as the meat originates from deboned carcasses from<br />

which the major lymph nodes have been removed). 61 Boneless beef<br />

is imported either chilled or frozen, with frozen meats supplied<br />

mainly by Argentina <strong>and</strong> Brazil <strong>and</strong> catering primarily to lowerincome<br />

groups within Egypt.<br />

The 2007 price paid for boneless beef was $1,931 per MT, one <strong>of</strong> the lowest prices amongst the top importers. This is<br />

likely due to large volumes <strong>of</strong> the cheaper frozen (rather than chilled) beef, as Egyptian importers report a monthly<br />

market for approximately 50,000 MT <strong>of</strong> frozen meat.<br />

Egypt is also the world’s fourth largest importer <strong>of</strong> beef <strong>of</strong>fal, with 82,005 MT imported in 2007. Prices paid per MT<br />

($858) are low relative to other importers. The US, a relative newcomer to the Middle East market, is a major supplier<br />

<strong>of</strong> beef <strong>of</strong>fal to Egypt. 62<br />

Buffalo meat is widely consumed in Egypt <strong>and</strong>, as an alternative bovine meat, may displace some <strong>of</strong> the potential<br />

market for beef. Egypt imports large quantities <strong>of</strong> frozen buffalo meat from India.<br />

MARKET OVERVIEW: SHOATS AND SHOAT MEAT<br />

Egyptian live sheep <strong>and</strong> sheep meat imports are low (an annual average <strong>of</strong> 5,012 head <strong>and</strong> 1,656 MT respectively from<br />

2005 to 2007). Egypt does not import any goat meat.<br />

TRENDS<br />

The Egyptian authorities are reportedly planning to construct abattoirs near the ports <strong>of</strong> entry in order to slaughter<br />

live animals upon arrival. If this project is completed, this may shift some <strong>of</strong> the import market back to live animals<br />

<strong>and</strong> away from meat.<br />

ETHIOPIAN MARKET SHARE<br />

From July 2005 to April 2006, Ethiopia exported 864 MT <strong>of</strong> meat (valued at $1.49 million) to Egypt. This represents<br />

12 percent <strong>of</strong> Ethiopia’s meat exports, but less than 1 percent <strong>of</strong> Egypt’s meat imports. In early 2006, an FMD<br />

outbreak in Egypt was attributed by Egyptian authorities to Ethiopia, as the disease strains found in Egypt were<br />

reportedly Kenyan types exported through Ethiopia. The resulting limitation on imports to only boneless beef has<br />

limited Ethiopia’s ability to participate in the market, since the country lacks the appropriate beef dressing facilities for<br />

deboning <strong>and</strong> vacuum packaging. In a recent positive development, Egypt has reportedly agreed to re-open its market<br />

to <strong>Ethiopian</strong> cattle.<br />

61 Rich et al 2008: p. 19<br />

62 http://www.usmef.org/TradeLibrary/MiddleEast.asp<br />

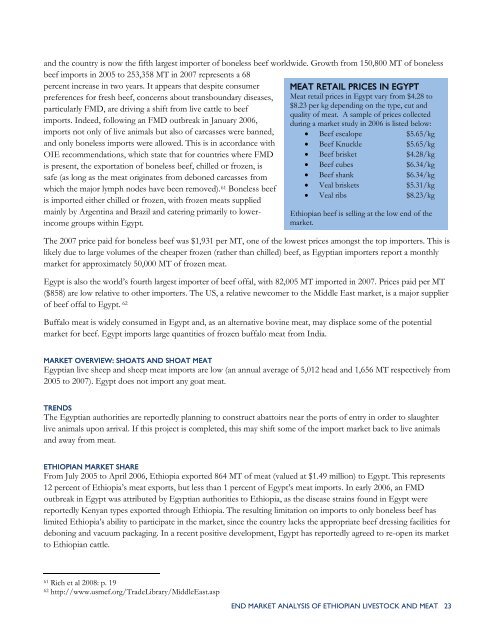

MEAT RETAIL PRICES IN EGYPT<br />

Meat retail prices in Egypt vary from $4.28 to<br />

$8.23 per kg depending on the type, cut <strong>and</strong><br />

quality <strong>of</strong> meat. A sample <strong>of</strong> prices collected<br />

during a market study in 2006 is listed below:<br />

• Beef escalope $5.65/kg<br />

• Beef Knuckle $5.65/kg<br />

• Beef brisket $4.28/kg<br />

• Beef cubes $6.34/kg<br />

• Beef shank $6.34/kg<br />

• Veal briskets $5.31/kg<br />

• Veal ribs $8.23/kg<br />

<strong>Ethiopian</strong> beef is selling at the low end <strong>of</strong> the<br />

market.<br />

END MARKET ANALYSIS OF ETHIOPIAN LIVESTOCK AND MEAT 23