End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

End Market Analysis of Ethiopian Livestock and ... - USAID Microlinks

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3. EXCHANGE RATES<br />

The price competitiveness <strong>of</strong> <strong>Ethiopian</strong> meat is determined in part by currency exchange rates, <strong>and</strong> the current rate <strong>of</strong><br />

13.235 birr = $1 (March 10, 2010), down from 8.65 birr = $1 just a few years ago, is favorable to exports.<br />

B. TRANSPORT LOGISTICS<br />

Transport logistics—whether air freight for chilled carcasses/cuts or shipping freight for frozen meat—are a key<br />

factor determining the competitiveness <strong>of</strong> a country’s exports. Ethiopia has the advantage <strong>of</strong> geographical proximity<br />

to the Gulf States, but several logistical factors constrain its competitive advantage.<br />

1. LAND<br />

Refrigerated trucks <strong>and</strong> containers are a key link in meat export<br />

logistics, both for chilled meat <strong>and</strong> frozen meat. For frozen meat<br />

exports, the cold chain must be maintained over long distances<br />

(approximately 850 km by road from Modjo to Djibouti Port <strong>and</strong><br />

870 km from Debre Zeit to Djibouti Port) even before the cargo is<br />

loaded onto shipping vessels for the 3- to 8-day journey to Egypt<br />

or the Gulf. Refrigerated containers appear to be a critical missing<br />

link for this channel, <strong>and</strong> it may be useful to explore backhaul<br />

opportunities for frozen foods imported to Ethiopia via Djibouti.<br />

Even without transport to Djibouti, the lack <strong>of</strong> properly equipped<br />

refrigerated trucks for the transportation <strong>of</strong> chilled carcasses<br />

constrains meat exporters’ ability to sign <strong>and</strong> honor large contracts.<br />

The failure <strong>of</strong> meat exporters to meet the dem<strong>and</strong>s <strong>of</strong> the<br />

important Eid al-Fitr export market in November 2009 (see text<br />

box at right7) was a case in point, illustrating some <strong>of</strong> the reasons<br />

why Ethiopia has found it difficult to penetrate the meat export<br />

market in the Gulf.<br />

2. AIR<br />

Chilled carcasses <strong>and</strong> meat cuts fetch a premium in the export market, but the logistics required to export chilled meat<br />

are dem<strong>and</strong>ing <strong>and</strong> expensive. <strong>Ethiopian</strong> Airlines has dedicated freighter aircraft (757 F, 747 F or MD-11 F) available<br />

on a charter or a scheduled basis to the following destinations relevant for meat exports: 8<br />

• Cairo: charter flights only<br />

• Dubai: (5 days/week), for a weight break <strong>of</strong> +1000 = $0.70/kg<br />

• Jeddah: (2 days/week), for a weight break <strong>of</strong> +1000 = $0.70/kg<br />

• Kinshasa: (2 days/week) for a weight break <strong>of</strong> +45 = $2.10/kg<br />

+100 = $1.50/kg<br />

+200 = $1.00/kg<br />

+300 = $0.90/kg<br />

+500 = $0.80/kg<br />

7 Addis Fortune 2009. Logistics Company Fouls Up Eid Deliveries. December 14, 2009.<br />

(http://allafrica.com/stories/200912150824.html)<br />

8 E-mail quote from <strong>Ethiopian</strong> Airlines Cargo Department sales representative, March 8, 2010<br />

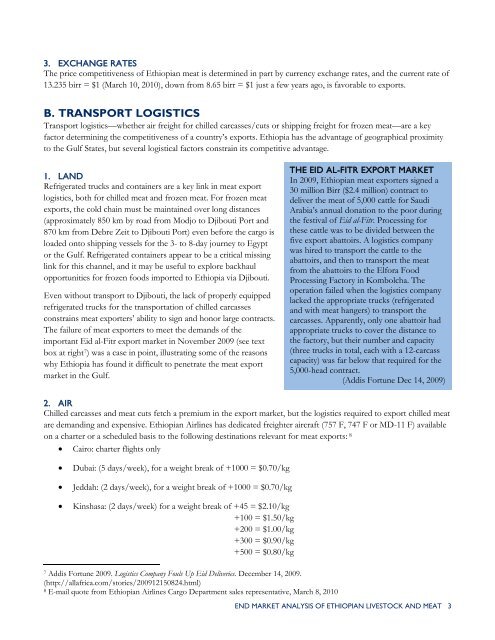

THE EID AL-FITR EXPORT MARKET<br />

In 2009, <strong>Ethiopian</strong> meat exporters signed a<br />

30 million Birr ($2.4 million) contract to<br />

deliver the meat <strong>of</strong> 5,000 cattle for Saudi<br />

Arabia’s annual donation to the poor during<br />

the festival <strong>of</strong> Eid al-Fitr. Processing for<br />

these cattle was to be divided between the<br />

five export abattoirs. A logistics company<br />

was hired to transport the cattle to the<br />

abattoirs, <strong>and</strong> then to transport the meat<br />

from the abattoirs to the Elfora Food<br />

Processing Factory in Kombolcha. The<br />

operation failed when the logistics company<br />

lacked the appropriate trucks (refrigerated<br />

<strong>and</strong> with meat hangers) to transport the<br />

carcasses. Apparently, only one abattoir had<br />

appropriate trucks to cover the distance to<br />

the factory, but their number <strong>and</strong> capacity<br />

(three trucks in total, each with a 12-carcass<br />

capacity) was far below that required for the<br />

5,000-head contract.<br />

(Addis Fortune Dec 14, 2009)<br />

END MARKET ANALYSIS OF ETHIOPIAN LIVESTOCK AND MEAT 3