Chapter -1 final last new font final - petrofed.winwinho...

Chapter -1 final last new font final - petrofed.winwinho...

Chapter -1 final last new font final - petrofed.winwinho...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.<strong>petrofed</strong>.org<br />

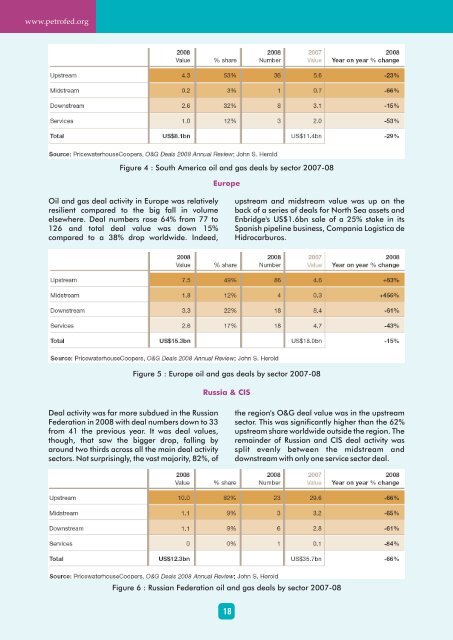

Figure 4 : South America oil and gas deals by sector 2007-08<br />

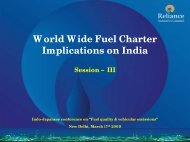

Europe<br />

Oil and gas deal activity in Europe was relatively upstream and midstream value was up on the<br />

resilient compared to the big fall in volume back of a series of deals for North Sea assets and<br />

elsewhere. Deal numbers rose 64% from 77 to Enbridge's US$1.6bn sale of a 25% stake in its<br />

126 and total deal value was down 15% Spanish pipeline business, Compania Logistica de<br />

compared to a 38% drop worldwide. Indeed, Hidrocarburos.<br />

Figure 5 : Europe oil and gas deals by sector 2007-08<br />

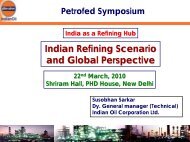

Russia & CIS<br />

Deal activity was far more subdued in the Russian the region's O&G deal value was in the upstream<br />

Federation in 2008 with deal numbers down to 33 sector. This was significantly higher than the 62%<br />

from 41 the previous year. It was deal values, upstream share worldwide outside the region. The<br />

though, that saw the bigger drop, falling by remainder of Russian and CIS deal activity was<br />

around two thirds across all the main deal activity split evenly between the midstream and<br />

sectors. Not surprisingly, the vast majority, 82%, of downstream with only one service sector deal.<br />

Figure 6 : Russian Federation oil and gas deals by sector 2007-08<br />

18