Chapter -1 final last new font final - petrofed.winwinho...

Chapter -1 final last new font final - petrofed.winwinho...

Chapter -1 final last new font final - petrofed.winwinho...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

www.<strong>petrofed</strong>.org<br />

like ONGC, GAIL and OIL. The remaining losses investment sentiment and this could lead to a very<br />

on account of under-recoveries were borne by the negative situation for a growing economy like<br />

OMCs themselves 20.9 percent. India.<br />

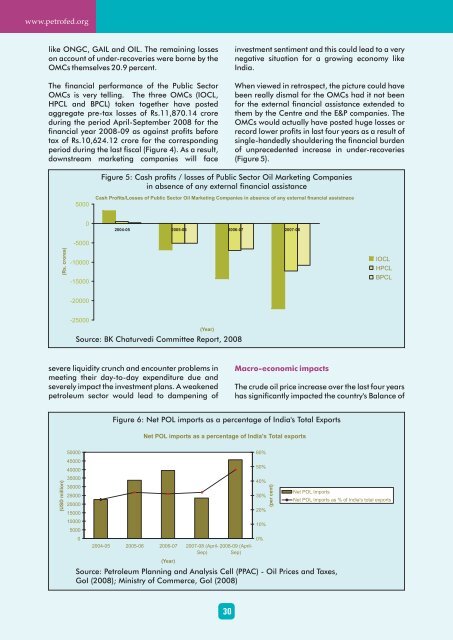

The financial performance of the Public Sector When viewed in retrospect, the picture could have<br />

OMCs is very telling. The three OMCs (IOCL, been really dismal for the OMCs had it not been<br />

HPCL and BPCL) taken together have posted for the external financial assistance extended to<br />

aggregate pre-tax losses of Rs.11,870.14 crore them by the Centre and the E&P companies. The<br />

during the period April-September 2008 for the OMCs would actually have posted huge losses or<br />

financial year 2008-09 as against profits before record lower profits in <strong>last</strong> four years as a result of<br />

tax of Rs.10,624.12 crore for the corresponding single-handedly shouldering the financial burden<br />

period during the <strong>last</strong> fiscal (Figure 4). As a result, of unprecedented increase in under-recoveries<br />

downstream marketing companies will face (Figure 5).<br />

(Rs. crores)<br />

severe liquidity crunch and encounter problems in<br />

meeting their day-to-day expenditure due and<br />

severely impact the investment plans. A weakened<br />

petroleum sector would lead to dampening of<br />

(USD million)<br />

-5000<br />

-10000<br />

-15000<br />

-20000<br />

-25000<br />

50000<br />

45000<br />

40000<br />

35000<br />

30000<br />

25000<br />

20000<br />

15000<br />

10000<br />

5000<br />

5000<br />

0<br />

Figure 5: Cash profits / losses of Public Sector Oil Marketing Companies<br />

in absence of any external financial assistance<br />

Cash Profits/Losses of Public Sector Oil Marketing Companies in absence of any external financial assistnace<br />

2004-05 2005-06 2006-07 2007-08<br />

(Year)<br />

Source: BK Chaturvedi Committee Report, 2008<br />

0<br />

30<br />

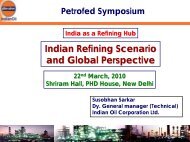

Macro-economic impacts<br />

IOCL<br />

HPCL<br />

BPCL<br />

The crude oil price increase over the <strong>last</strong> four years<br />

has significantly impacted the country's Balance of<br />

Figure 6: Net POL imports as a percentage of India's Total Exports<br />

Net POL imports as a percentage of India's Total exports<br />

2004-05 2005-06 2006-07 2007-08 (April- 2008-09 (April-<br />

Sep) Sep)<br />

(Year)<br />

Source: Petroleum Planning and Analysis Cell (PPAC) - Oil Prices and Taxes,<br />

GoI (2008); Ministry of Commerce, GoI (2008)<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

(per cent)<br />

Net POL Imports<br />

Net POL Imports as % of India's total exports