download - BG Group

download - BG Group

download - BG Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32 Americas and Global LNG<br />

Brazil continued<br />

COMGÁS<br />

Summary of Comgás 2008 results:<br />

• 6% increase in the total volume of<br />

gas sales to 5.3 bcm;<br />

• 10% increase in residential customers;<br />

• 4% increase in commercial customers; and<br />

• 449 kilometres of network expansion.<br />

<strong>BG</strong> <strong>Group</strong> has a 60.1% majority interest in<br />

Comgás, Brazil’s largest gas distribution<br />

company. Comgás is listed on the São Paulo<br />

stock exchange.<br />

At end 2008, Comgás had 5 704 kilometres<br />

of pipelines covering 67 municipalities<br />

and supplied gas to 1 004 industrial,<br />

8 885 commercial and 620 191 residential<br />

customers in the state of São Paulo.<br />

Additionally, Comgás supplied 401 NGV<br />

filling stations, 20 customers in co-generation<br />

and two in the thermo-generation market.<br />

Comgás has increased its average daily<br />

volume from 3.0 mmcmd in 1999 to<br />

14.6 mmcmd in 2008.<br />

In 2008, Comgás’ operating profit was<br />

£115 million (2007 £211 million) and volumes<br />

increased by 6%. A strong underlying<br />

performance was obscured by a significant<br />

increase in the cost of gas. Regulatory<br />

mechanisms allow the higher cost of gas<br />

incurred by Comgás to be passed through<br />

to customers in future periods. At the end<br />

of 2008, the balance of gas costs to be<br />

recovered in 2009 and 2010 was £161 million.<br />

Excluding the impact of the timing effect<br />

of increased cost of gas at Comgás, the<br />

operating profit increased by 15% in 2008,<br />

reflecting volume growth and better margin<br />

performance at Comgás.<br />

The Comgás concession is a 30-year franchise,<br />

with a potential for a further 20 years.<br />

The concession area contains 7.7 million<br />

households and is in the industrial heartland<br />

of Brazil, accounting for about 25% of Brazil’s<br />

GDP. The current business focus continues<br />

to be the connection of higher-margin<br />

commercial and residential customers.<br />

The concession contract requires a tariff<br />

review every five years. Since privatisation<br />

in 1999, Comgás has invested more than<br />

BRL 2.9 billion. In May 2009, the regulator,<br />

ARSESP, published the details of the final<br />

outcome of Comgás’ tariff review covering<br />

the period 2009-2014. The tariff review<br />

resulted in some reductions in Comgás’<br />

margins, mainly reflecting the pass through<br />

of reduced cost of gas seen in the last six<br />

months and some reduction of the<br />

www.bg-group.com<br />

maximum allowed margin. As a result of<br />

the reduction, competitiveness of natural<br />

gas is expected to improve.<br />

Comgás purchases gas at prices indexed to<br />

a basket of oil-related fuels. Brazilian gas<br />

supplies from Petrobras of 3.5 mmcmd are<br />

contracted until December 2012. Bolivian gas<br />

supplies from Petrobras began in July 1999<br />

under a 20-year contract, with volume<br />

increasing from 4.0 mmcmd in 1999 to<br />

8.7 mmcmd in 2007, and they are contracted<br />

until July 2019. Comgás has two further<br />

gas supply contracts with Petrobras: a firm<br />

energy contract (1.0 mmcmd until December<br />

2012) and an interruptible contract (up to<br />

1.5 mmcmd until December 2010).<br />

In May 2008, a new supply agreement<br />

for 0.65 mmcmd was agreed between<br />

<strong>BG</strong> <strong>Group</strong>’s gas marketing arm, <strong>BG</strong> Comercio,<br />

and Comgás to replace an earlier agreement<br />

that needed to be restructured as a result of<br />

changes to the Bolivian regulatory regime.<br />

In 2009, industrial and commercial demand<br />

reduced due to the fall in economic activity<br />

and high rainfall benefiting competing<br />

hydro electric generation. The residential<br />

segment continues to add connections.<br />

Growth in the industrial and commercial<br />

segments is expected to resume as the<br />

economic outlook improves.<br />

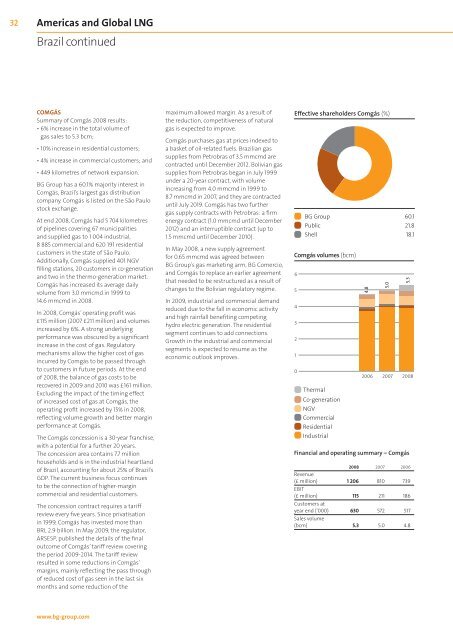

Effective shareholders Comgás (%)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

<strong>BG</strong> <strong>Group</strong> 60.1<br />

Public 21.8<br />

Shell 18.1<br />

Comgás volumes (bcm)<br />

Thermal<br />

Co-generation<br />

NGV<br />

Commercial<br />

Residential<br />

Industrial<br />

4.8<br />

2006<br />

5.0<br />

2007<br />

5.3<br />

2008<br />

Financial and operating summary – Comgás<br />

2008 2007 2006<br />

Revenue<br />

(£ million)<br />

EBIT<br />

1 206 810 739<br />

(£ million)<br />

Customers at<br />

115 211 186<br />

year end (‘000)<br />

Sales volume<br />

630 572 517<br />

(bcm) 5.3 5.0 4.8