Annual Report 2005/06 - voestalpine

Annual Report 2005/06 - voestalpine

Annual Report 2005/06 - voestalpine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

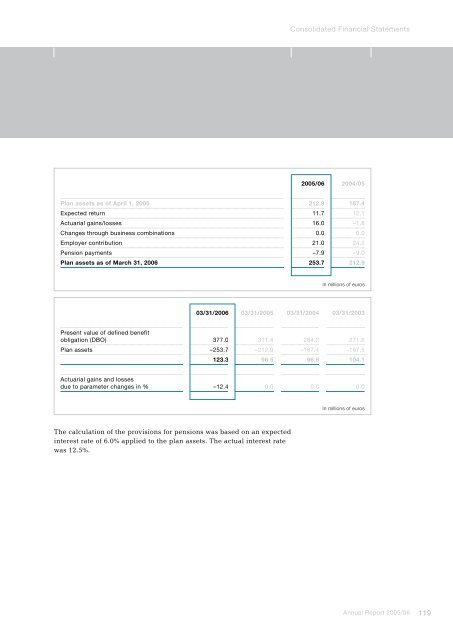

The calculation of the provisions for pensions was based on an expected<br />

interest rate of 6.0% applied to the plan assets. The actual interest rate<br />

was 12.5%.<br />

Consolidated Financial Statements<br />

<strong>2005</strong>/<strong>06</strong> 2004/05<br />

Plan assets as of April 1, <strong>2005</strong> 212.9 187.4<br />

Expected return 11.7 12.1<br />

Actuarial gains/losses 16.0 –1.8<br />

Changes through business combinations 0.0 0.0<br />

Employer contribution 21.0 24.2<br />

Pension payments –7.9 –9.0<br />

Plan assets as of March 31, 20<strong>06</strong> 253.7 212.9<br />

In millions of euros<br />

03/31/20<strong>06</strong> 03/31/<strong>2005</strong> 03/31/2004 03/31/2003<br />

Present value of defined benefit<br />

obligation (DBO) 377.0 311.4 284.2 271.6<br />

Plan assets –253.7 –212.9 –187.4 –167.5<br />

123.3 98.5 96.8 104.1<br />

Actuarial gains and losses<br />

due to parameter changes in % –12.4 0.0 0.0 0.0<br />

In millions of euros<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2005</strong>/<strong>06</strong><br />

11