Annual Report 2005/06 - voestalpine

Annual Report 2005/06 - voestalpine

Annual Report 2005/06 - voestalpine

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management <strong>Report</strong><br />

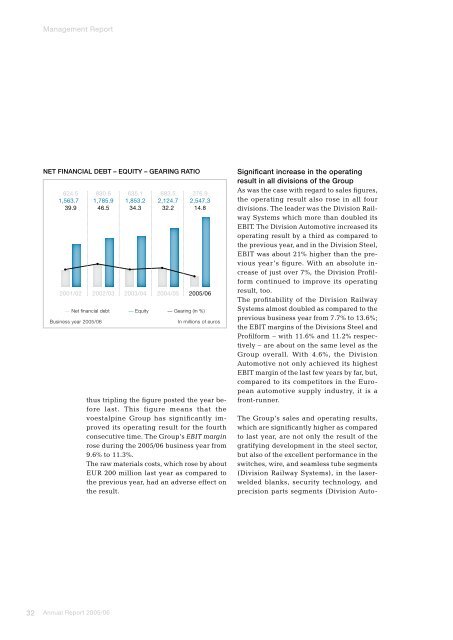

neT FinanCial DeBT – eqUiTy – gearing raTio<br />

624.5 830.6 635.1 683.5 376.9<br />

1,563.7 1,785.9 1,853.2 2,124.7 2,547.3<br />

39.9 46.5 34.3 32.2 14.8<br />

2001/02 2002/03 2003/04 2004/05 <strong>2005</strong>/<strong>06</strong><br />

— Net financial debt — Equity — Gearing (in %)<br />

Business year <strong>2005</strong>/<strong>06</strong> In millions of euros<br />

32 <strong>Annual</strong> <strong>Report</strong> <strong>2005</strong>/<strong>06</strong><br />

thus tripling the figure posted the year before<br />

last. This figure means that the<br />

<strong>voestalpine</strong> Group has significantly improved<br />

its operating result for the fourth<br />

consecutive time. The Group’s EBIT margin<br />

rose during the <strong>2005</strong>/<strong>06</strong> business year from<br />

9.6% to 11.3%.<br />

The raw materials costs, which rose by about<br />

EUR 200 million last year as compared to<br />

the previous year, had an adverse effect on<br />

the result.<br />

significant increase in the operating<br />

result in all divisions of the group<br />

As was the case with regard to sales figures,<br />

the operating result also rose in all four<br />

divisions. The leader was the Division Railway<br />

Systems which more than doubled its<br />

EBIT. The Division Automotive increased its<br />

operating result by a third as compared to<br />

the previous year, and in the Division Steel,<br />

EBIT was about 21% higher than the previous<br />

year ’s figure. With an absolute increase<br />

of just over 7%, the Division Profilform<br />

continued to improve its operating<br />

result, too.<br />

The profitability of the Division Railway<br />

Systems almost doubled as compared to the<br />

previous business year from 7.7% to 13.6%;<br />

the EBIT margins of the Divisions Steel and<br />

Profilform – with 11.6% and 11.2% respectively<br />

– are about on the same level as the<br />

Group overall. With 4.6%, the Division<br />

Automotive not only achieved its highest<br />

EBIT margin of the last few years by far, but,<br />

compared to its competitors in the European<br />

automotive supply industry, it is a<br />

front-runner.<br />

The Group’s sales and operating results,<br />

which are significantly higher as compared<br />

to last year, are not only the result of the<br />

gratifying development in the steel sector,<br />

but also of the excellent performance in the<br />

switches, wire, and seamless tube segments<br />

(Division Railway Systems), in the laserwelded<br />

blanks, security technology, and<br />

precision parts segments (Division Auto