The Birth of Insurance Contracts - The Ataturk Institute for Modern ...

The Birth of Insurance Contracts - The Ataturk Institute for Modern ...

The Birth of Insurance Contracts - The Ataturk Institute for Modern ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

in the meantime. Premium insurance established a coverage payment <strong>for</strong> loss due to shipwreck,<br />

piracy, or confiscation <strong>of</strong> the merchandise abroad in return <strong>for</strong> a premium payable in advance or,<br />

more generally, after the insured cargo was safely arrived to destination. Shipments, however,<br />

were rarely insured <strong>for</strong> more than half <strong>of</strong> their value or even less.<br />

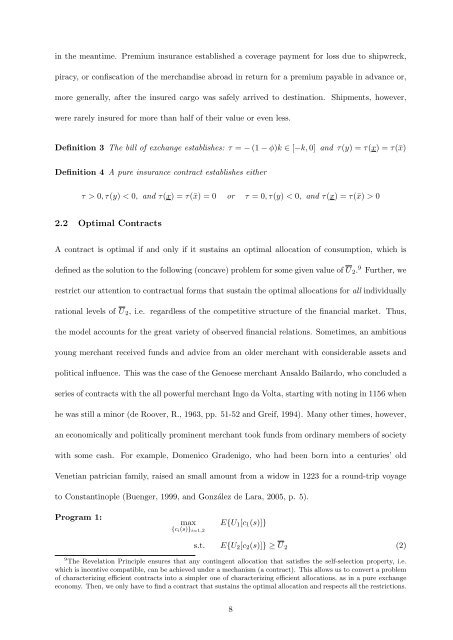

Definition 3 <strong>The</strong> bill <strong>of</strong> exchange establishes: τ = − (1 − φ)k ∈ [−k, 0] and τ(y) = τ(x) = τ(¯x)<br />

Definition 4 A pure insurance contract establishes either<br />

τ > 0, τ(y) < 0, and τ(x) = τ(¯x) = 0 or τ = 0, τ(y) < 0, and τ(x) = τ(¯x) > 0<br />

2.2 Optimal <strong>Contracts</strong><br />

A contract is optimal if and only if it sustains an optimal allocation <strong>of</strong> consumption, which is<br />

defined as the solution to the following (concave) problem <strong>for</strong> some given value <strong>of</strong> U 2. 9 Further, we<br />

restrict our attention to contractual <strong>for</strong>ms that sustain the optimal allocations <strong>for</strong> all individually<br />

rational levels <strong>of</strong> U 2, i.e. regardless <strong>of</strong> the competitive structure <strong>of</strong> the financial market. Thus,<br />

the model accounts <strong>for</strong> the great variety <strong>of</strong> observed financial relations. Sometimes, an ambitious<br />

young merchant received funds and advice from an older merchant with considerable assets and<br />

political influence. This was the case <strong>of</strong> the Genoese merchant Ansaldo Bailardo, who concluded a<br />

series <strong>of</strong> contracts with the all powerful merchant Ingo da Volta, starting with noting in 1156 when<br />

he was still a minor (de Roover, R., 1963, pp. 51-52 and Greif, 1994). Many other times, however,<br />

an economically and politically prominent merchant took funds from ordinary members <strong>of</strong> society<br />

with some cash. For example, Domenico Gradenigo, who had been born into a centuries’ old<br />

Venetian patrician family, raised an small amount from a widow in 1223 <strong>for</strong> a round-trip voyage<br />

to Constantinople (Buenger, 1999, and González de Lara, 2005, p. 5).<br />

Program 1:<br />

max<br />

{ci(s)}i=1,2<br />

E{U1[c1(s)]}<br />

s.t. E{U2[c2(s)]} ≥ U 2 (2)<br />

9 <strong>The</strong> Revelation Principle ensures that any contingent allocation that satisfies the self-selection property, i.e.<br />

which is incentive compatible, can be achieved under a mechanism (a contract). This allows us to convert a problem<br />

<strong>of</strong> characterizing efficient contracts into a simpler one <strong>of</strong> characterizing efficient allocations, as in a pure exchange<br />

economy. <strong>The</strong>n, we only have to find a contract that sustains the optimal allocation and respects all the restrictions.<br />

8