Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

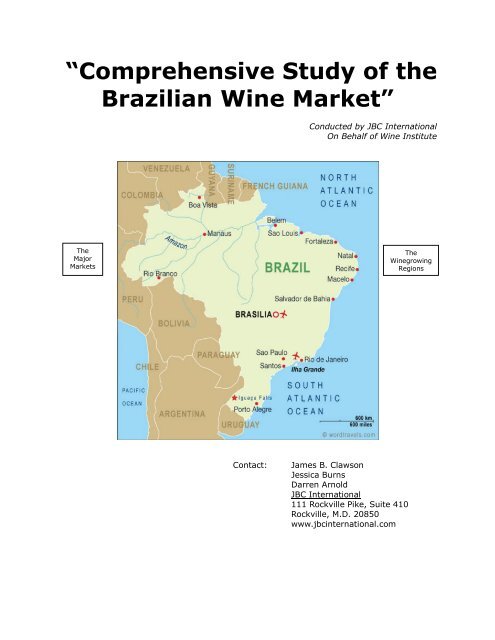

“Comprehensive Study of the<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong>”<br />

The<br />

Major<br />

<strong>Market</strong>s<br />

Conducted by <strong>JBC</strong> International<br />

On Behalf of <strong>Wine</strong> Institute<br />

Contact: James B. Clawson<br />

Jessica Burns<br />

Darren Arnold<br />

<strong>JBC</strong> International<br />

111 Rockville Pike, Suite 410<br />

Rockville, M.D. 20850<br />

www.jbcinternational.com<br />

The<br />

<strong>Wine</strong>growing<br />

Regions

1<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

Date: June <strong>2011</strong><br />

<strong>EMP</strong> Project <strong>Report</strong> #E09MXBR001<br />

<strong>Brazil</strong> – <strong>Wine</strong> “Comprehensive Study of <strong>Market</strong> Potential, Infrastructure, and Regulatory<br />

Policy for U.S. <strong>Wine</strong> Exports to <strong>Brazil</strong>”<br />

<strong>Report</strong> Highlights:<br />

<strong>Brazil</strong> provides both tremendous opportunities and challenges for U.S. wine exporters.<br />

Historically wine consumption per capita trails that of other beverage alcohol. The recent<br />

economic expansion has developed a strong middle class more interested in wine. An<br />

emergent domestic wine industry is introducing more <strong>Brazil</strong>ians to wine varieties through<br />

greater distribution and promotion. The neighboring wine producers, Chile and Argentina,<br />

are also enjoying sales increases demonstrating the appetite of the new wine consumer for<br />

New World wines. The distribution and retailing channels are in place in the main population<br />

centers although still often cumbersome and inefficient. The complex panoply of import<br />

regulations and high taxes are not unlike those of other emerging markets such as India,<br />

China and Russia. As <strong>Brazil</strong> continues to develop its international economy, now the 7 th<br />

largest in the world, it is investing in the infrastructure to improve its capacity to trade<br />

internationally. With the hosting of the 2014 FIFA World Cup and the 2016 Olympics, and<br />

following the Chinese example of hosting the 2008 Olympics, the <strong>Brazil</strong>ian government must<br />

insure that its capacity and infrastructure will meet the demands of those events. <strong>Brazil</strong>ian<br />

goods and services industries must be ready to accommodate over 1 million visitors for those<br />

two events. While many impediments to U.S. wine exports remain, the country with a<br />

population of over 200 million and half of those with disposable income presents a vast and<br />

largely untapped market for U.S. winemakers.

Table of Contents<br />

2<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Report</strong> Highlights ........................................................................................................ 1<br />

Table of Contents........................................................................................................ 2<br />

Executive Summary .................................................................................................... 3<br />

Project Background ..................................................................................................... 4<br />

State of the <strong>Brazil</strong>ian Economy ..................................................................................... 4<br />

Strategy for <strong>Market</strong> Entry ............................................................................................ 6<br />

Geography and Domestic <strong>Wine</strong> Production ..................................................................... 8<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> ............................................................................................... 12<br />

U.S. <strong>Wine</strong>s in <strong>Brazil</strong> .................................................................................................. 16<br />

Effect of <strong>Brazil</strong>ian Trade Policy on Imported <strong>Wine</strong> .......................................................... 17<br />

Consumption Analysis ............................................................................................... 18<br />

<strong>Brazil</strong> Trade <strong>Report</strong> ................................................................................................... 21<br />

Import Procedures .................................................................................................... 22<br />

<strong>Market</strong>ing Analysis .................................................................................................... 25<br />

<strong>Brazil</strong>ian <strong>Wine</strong> Importers ........................................................................................... 26<br />

Relevant Contacts ..................................................................................................... 32<br />

Acknowledgments .................................................................................................... 35<br />

Appendices .............................................................................................................. 36

Executive Summary<br />

3<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

As a member of the BRIC countries, <strong>Brazil</strong> is a target market for increasing U.S. wine<br />

exports. BRIC is a grouping acronym that refers to the countries of <strong>Brazil</strong>, Russia, India and<br />

China, which are all deemed to be at a similar stage of newly advanced economic<br />

development. The acronym has come into widespread use as a symbol of the shift in global<br />

economic power away from the developed G7 economies towards the developing world. The<br />

BRIC economies are promising engines of global economic growth and development. For the<br />

first time, helped along by the “Great Recession,” consumers from the BRIC emerging<br />

markets are outspending U.S. consumers. With real wages on the rise and middle classes<br />

forming, emerging market consumers now account for 34 percent of global consumption<br />

versus 27 percent for their U.S. counterparts. Families around the developing world now<br />

have disposable income. Instead of saving their newfound wealth, they are increasingly<br />

spending and putting money back into the local economy.<br />

A U.S.-based multinational such as Coca-Cola generates three-quarters of its sales overseas<br />

and already reflects the new reality. Revenues are booming for Coke in places like China and<br />

<strong>Brazil</strong>. For <strong>Brazil</strong>, Claudia Penteado of AdvertisingAge explains: “Much of <strong>Brazil</strong>’s explosive<br />

growth is being fueled by an emerging lower middle class that has grown to 95.4 million<br />

people. As they snap up cars, cell phones and new homes, this group is quickly becoming a<br />

prime target for marketers. The group, called the Class C, earns between $600 and $2,600 a<br />

month and, through upward mobility in a growing economy, has become <strong>Brazil</strong>’s largest<br />

consumer group in a population of 200 million people.”<br />

Recent data on BRIC countries’ consumer spending habits reveal interesting insights about<br />

consumer behavior and priorities in emerging markets. <strong>Brazil</strong>ians put a higher priority on<br />

living for the present by devoting a considerably larger share of income to discretionary<br />

spending. <strong>Brazil</strong>ians report saving a relatively modest 10 percent, the lowest level of the<br />

four BRIC countries.<br />

Per capita wine consumption lags considerably behind its neighbors Argentina and Chile.<br />

<strong>Wine</strong> has not been the alcoholic beverage of choice for <strong>Brazil</strong>ian consumers. Those<br />

preferences are beginning to change with the new found disposable income of the emerging<br />

middle class who are willing to try new products, including wine. The elements are in place<br />

for significant growth in wine consumption over the next ten years.<br />

The <strong>Brazil</strong>ian market has been difficult to penetrate for all consumer goods. Previous<br />

government policy has supported exports and restricted imports to maintain and increase its<br />

foreign exchange. With the new-found wealth and balance of payments surplus those<br />

policies are changing. While still difficult to navigate, the labyrinth of import regulations,<br />

congestion in customs clearance processes and multiple taxes have become more<br />

transparent. This report describes many of those challenges and provides advice to achieve<br />

compliance.<br />

Hosting of the 2014 FIFA World Cup and the 2016 Olympics will bring tens of thousands of<br />

foreign visitors to <strong>Brazil</strong>’s event venues. Such events engender a social environment<br />

conducive to on-premise wine consumption. As described in this study, the distribution and

4<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

consumption patterns of wine are also evolving for the benefit of sales. More retail outlets<br />

are growing their listings with a wider selection including New World such as those from the<br />

United States. Mass retailers like Wal-Mart and Carrefour are becoming significant<br />

opportunities for the sale of imported wine.<br />

<strong>Brazil</strong> is still a developing country. Lack of capacity, corruption and legacy policies must be<br />

carefully considered. President Obama’s recent visit and the priority the U.S. has devoted to<br />

its relationship with <strong>Brazil</strong> should assist in limiting the negative images and difficulties of the<br />

past. <strong>Brazil</strong> is a market that should be seriously considered for any winery looking to expand<br />

its export portfolio.<br />

Project Background<br />

In October 2009, <strong>JBC</strong> International—as <strong>Wine</strong> Institute’s International Trade Counsel<br />

undertook to execute a U.S. Department of Agriculture, Emerging <strong>Market</strong>s Project (USDA-<br />

<strong>EMP</strong>) titled #E09MXBR001, a “Comprehensive Survey of the <strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong>.” This<br />

project represents a collaborative effort between <strong>Wine</strong> Institute and USDA-<strong>EMP</strong> that was<br />

designed to address the interest voiced by many <strong>California</strong>n wineries to understand and<br />

identify strategies for expanding business opportunities into the BRIC countries, <strong>Brazil</strong>,<br />

Russia, India and China. <strong>JBC</strong> has completed previous studies of India and Russia.<br />

The prime objective and focus of this study has been to provide practical information needed<br />

to develop a strategy for market entry, one which exposes the risks, provides a guide to<br />

developing that strategy and outlines the potential rewards for U.S. wine exports to <strong>Brazil</strong>.<br />

This report serves as a critical educational resource for U.S. companies by:<br />

1. Providing detailed information concerning:<br />

- The economic environment for consumers to purchase wine;<br />

- The regulatory environment for wines in <strong>Brazil</strong>;<br />

- The existing trade barriers restricting wine imports from the United States;<br />

and,<br />

- The identification of the challenges and strategies for entering the market and<br />

selling wines in <strong>Brazil</strong>.<br />

2. Forecasting developments in <strong>Brazil</strong>’s wine market, supply chain and distribution<br />

network and trade activities; and,<br />

3. <strong>Report</strong>ing on where the market opportunities exist for imported wine by specific<br />

market, supply chain, importer and distributor throughout the country.<br />

The State of the <strong>Brazil</strong>ian Economy<br />

A combination of increased domestic and foreign demand for <strong>Brazil</strong>ian products led to<br />

considerable growth in the <strong>Brazil</strong>ian economy since the early 2000s. While the <strong>Brazil</strong>ian<br />

government has traditionally had problems with inflation, President Dilma Rousseff is<br />

committed to inflation targeting by the Central Bank. Under Rousseff, the government has<br />

focused on fiscal restraint, a floating exchange rate and adhered to a policy for sustainable<br />

growth through foreign trade. This has led to significant improvements in the stability of

5<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Brazil</strong>’s economy. <strong>Brazil</strong> has paid off all debt to the International Monetary Fund, which in<br />

2005 totaled $15.5 million. The Real has gained 40 percent against the US dollar since<br />

2009, amid huge economic growth and a rise in foreign investment.<br />

<strong>Brazil</strong> experienced two quarters of recession beginning in the latter half of the economic<br />

crisis and is considered one of the fastest economies to recover due to high investor and<br />

consumer confidence. Heavy involvement in international trade has made <strong>Brazil</strong> a leading<br />

economy in South America. Domestic consumption has been growing as wages and access<br />

to credit have improved. The <strong>Brazil</strong>ian labor force has seen an increase and in 2010 ranks<br />

six in the world with 103.6 million working citizens.<br />

“The 2010 growth rates demonstrate that the <strong>Brazil</strong>ian economy is growing at a significant<br />

and sustainable pace, which supports the country's plans for<br />

long-term investment projects,” finance minister Guido<br />

Population Indicators - <strong>Brazil</strong><br />

currently has the 5 th largest<br />

population in the world with<br />

203,429,773 citizens. The<br />

population between 15-64 years is<br />

66.8 percent, with a median age of<br />

28.9. Currently, <strong>Brazil</strong>’s drinking<br />

age is 18, which proves a sizable<br />

market for alcohol. There are more<br />

females than males: 98 percent<br />

male/female ratio. <strong>Brazil</strong>’s<br />

population is 74 percent Roman<br />

Catholic, and 86 percent of the<br />

population is located in urban<br />

areas. 1 A study conducted by the<br />

<strong>Brazil</strong>ian <strong>Wine</strong> Institute (IBRAVIN)<br />

shows demand for New World<br />

wines is growing with the consumer<br />

age group of 40 and above. Such<br />

persons are interested in<br />

purchasing higher quality wines<br />

they read about or are presented in<br />

the media.<br />

Mantega said. “We expect GDP to grow around 4.5 to 5.0<br />

percent in <strong>2011</strong>, a rate that would be sustainable and<br />

generate no inflationary pressures,” he added. Growth was<br />

led by industry which saw an expansion of 10.1 percent,<br />

agriculture growing 6.5 percent, and the services sector,<br />

which saw growth of 5.4 percent. <strong>Brazil</strong>'s GDP outstripped<br />

Mexico's. <strong>Brazil</strong>’s Gross National Income (GNI) per capita in<br />

2009 was $8,070 USD 1 .<br />

Industries<br />

<strong>Brazil</strong>’s largest industries are textiles, shoes, chemicals,<br />

cement, lumber, iron ore, steel, aircraft, motor vehicles and<br />

other machinery and equipment, in that order. The industrial<br />

production growth rate was 11.5 percent for 2010. <strong>Brazil</strong>’s<br />

main agricultural production includes: meat and by-products,<br />

coffee, soybeans, wheat, rice, corn, sugarcane, cocoa and<br />

citrus. <strong>Brazil</strong> is the 9 th largest oil producer in the world and the<br />

7 th largest consumer. Oil exports reached over 570,100<br />

bbl/day 2 in 2010.<br />

A quick economic recovery can be attributed to <strong>Brazil</strong>’s welldeveloped<br />

industry sectors. The breakdown of <strong>Brazil</strong>’s Gross<br />

Domestic Product by composition sector is as follows: agriculture: 6.1 percent; industry:<br />

26.4 percent; services: 67.5 percent. The <strong>Brazil</strong>ian Food Processors’ Association (ABIA)<br />

announced food and beverage industries of <strong>Brazil</strong> made up 85 percent and 15 percent of the<br />

$173 billion (USD) total net revenue in 2009, respectively. ABIA estimated a 5.3 percent<br />

volume increase in 2010 with 4.0 to 4.5 percent growth estimates per year over the next<br />

five years. This growth estimate is above the 3.3 percent average for the past ten years.<br />

The food processing industry consists of 38,500 companies including Nestle, Kraft, Unilever,<br />

etc.<br />

1 Doing Business <strong>2011</strong> in <strong>Brazil</strong>, The World Bank<br />

2 https://www.cia.gov/library/publications/the-world-factbook/geos/br.html

Infrastructure<br />

6<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

As host to the 2014 FIFA World Cup and the 2016 Summer Olympics, <strong>Brazil</strong> has seen its<br />

infrastructure under constant scrutiny in recent years. <strong>Brazil</strong> has 4,000 airports, the second<br />

most in the world behind only the United States. <strong>Brazil</strong> also has 28,857 km of railways (10 th<br />

in the world), 1,751,868 km of roads (4 th in the world) and 50,000 km of waterways (3rd in<br />

the world). While these statistics appear promising, much of the current infrastructure is<br />

underdeveloped or poorly maintained. For example, 82 percent of its roads are unpaved,<br />

many port facilities are outdated and many of the airports are too small or too crowded for<br />

business. All of these factors increase transportation costs. While the infrastructure in the<br />

less developed center of the country is insufficient because it is underdeveloped, the<br />

infrastructure in the more populated cities is inadequate because it is overcrowded.<br />

In 2007, the <strong>Brazil</strong>ian government took on an accelerated growth project, PAC, to increase<br />

the economic welfare of the country and to develop the infrastructure to address the current<br />

problems, in preparation for the upcoming games and the future increase in commerce and<br />

tourism. This has put infrastructure on the forefront of <strong>Brazil</strong>ian politics. The program will<br />

invest significant resources in seaports, airports, roads and railways. The program should<br />

drastically facilitate the movement of goods throughout the country in the upcoming years.<br />

The major ports and terminals of <strong>Brazil</strong> are Guaiba, Ilha Grande, Paranagua, Rio Grande,<br />

Santos, Sao Sebastiao, Salvador, and Tubarao. Santon, the main port of São Paulo, is the<br />

largest port in South America. The largest airport in <strong>Brazil</strong> is Guarulhos International in São<br />

Paulo.<br />

Strategy for <strong>Market</strong> Entry<br />

Research the <strong>Market</strong><br />

Using this report and relevant contacts (in both the U.S. and <strong>Brazil</strong>) as initial resources,<br />

prospective exporters can make informed decisions about export opportunities to <strong>Brazil</strong>.<br />

Members of the <strong>Wine</strong> Institute international program can contact that department for further<br />

information on the market and opportunities to participate in trade shows. Members of<br />

<strong>Wine</strong>America can contact their offices and the authors of this study to further investigate<br />

market opportunities. Likewise, members of the <strong>California</strong> Association of <strong>Wine</strong>grape Growers,<br />

<strong>Wine</strong>grape Growers of America, and the general public can contact <strong>JBC</strong> International and<br />

other entities listed in the “Relevant Contacts” section of this study.<br />

Find an Importer/Distributor<br />

The choice of which importer and distributor to work with in <strong>Brazil</strong> is a crucial decision for<br />

U.S. wineries and exporters, since these agents will function as product line representatives<br />

and facilitate many of the market intricacies, such as navigating the regulatory import<br />

requirements and distribution chains. Depending on the agent and the expectations of the<br />

winery, it can assist in marketing the product and ensuring its quality integrity. Many of the

7<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

importers in the “<strong>Brazil</strong>ian <strong>Wine</strong> Importers” section found at the end of this report are also<br />

distributors with either a wine boutique or a retail store location.<br />

Arrange <strong>Market</strong> Strategy and Fulfill Compliance Needs<br />

U.S. wineries that are successful in exports usually take one to two trips to the target<br />

country before making sales. The first visit is used to research and develop strategies for<br />

accessing the target markets, whether regional or sector-based (hotels, restaurants or<br />

retail). The same visit can be used to meet with importers in order to evaluate their<br />

operations before making a decision on whom to approach with a potential agreement. If<br />

necessary, the exporter will travel back a second time to finalize the arrangements with the<br />

selected importer/distributor and ensure that both they and the importer/distributor are<br />

ready to do business together. This step is oftentimes needed to ensure that all regulatory<br />

approval issues and import processes are addressed before orders can be solicited and<br />

subsequently fulfilled.<br />

Continue <strong>Market</strong> Promotion and Research<br />

The growing market opportunities in <strong>Brazil</strong> for U.S. wine exporters are primarily in the South<br />

and Southeast regions of Rio Grande do Sul and São Paulo; also major production regions.<br />

For wineries that are members of the <strong>Wine</strong> Institute International Program (based in San<br />

Francisco, CA), they can coordinate trade visits and market promotion with a group of<br />

participants. Additionally, representatives of USDA’s Foreign Agricultural Service (FAS) in<br />

<strong>Brazil</strong> share a common mission to promote trade with the United States. Representatives of<br />

USDA’s Office of Agricultural Affairs (OAA), headquartered at the U.S. Embassy in Brasília as<br />

well as those of USDA’s Agricultural Trade Office (ATO) at the U.S. Consulate General in São<br />

Paulo can offer free assistance with understanding the market and identifying future business<br />

opportunities. The FAS representatives can help U.S. wine exporters by supplying them with<br />

up-to-date market information, importer lists, and distributor data, as well as by endorsing<br />

U.S. Pavilions at trade shows and organizing various marketing events. The U.S. Alcohol and<br />

Tobacco Tax and Trade Bureau (TTB) has an International Trade Division and website<br />

(www.ttb.gov) that can similarly assist U.S. wineries and exporters with market information<br />

and regulatory compliance issues.<br />

Potential Risks<br />

There are several risks present when attempting to<br />

enter the <strong>Brazil</strong>ian marketplace. These include:<br />

a) Uncertainty of government regulations. Over<br />

the past two years, the <strong>Brazil</strong>ian Government<br />

has issued multiple regulations concerning wine<br />

producer registration, labeling and production<br />

processes. Most are implemented without<br />

advance notice and in the case of the<br />

production processes; no final rules have been<br />

published.<br />

b) Domestic and imported wine competition. <strong>Brazil</strong><br />

NOTE: AS OF THE PREPARATION OF THIS<br />

REPORT, REGULATIONS CONCERNING<br />

WINEMAKING PRACTICES WERE BEING<br />

REVISED. NO FINAL RULE ON SUCH<br />

PRACTICES HAS BEEN PUBLISHED BY THE<br />

BRAZILIAN GOVERNMENT. THIS REPORT<br />

WAS DELAYED FOR SIX MONTHS<br />

EXPECTING NEW RULES TO BE<br />

AVAILABLE. THE AUTHORS RECOMMEND<br />

PRIOR TO SHIPMENT OF WINE TO BRAZIL<br />

THAT THE EXPORTER VERIFY WHAT<br />

REGULATIONS ARE IN PLACE.

8<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

currently supplies much of the wine consumed within the country. The remainder is<br />

split between Chile and Argentina both enjoying trade tariff preferences and the<br />

European Union that subsidizes exports and production.<br />

c) Customs inconsistencies. As noted later in this report there are many border<br />

formalities necessary for the importation of goods. Those formalities are not<br />

consistently administered by the different ports of entry. It is recommended that an<br />

advanced ruling be requested from customs if the importer is not confident as to the<br />

classification, value and tax treatment of the wine.<br />

d) Other potential risks include current issues with contraband wine products that cross<br />

the border illegally, especially along the Southern border with Paraguay. These<br />

products reach the market at an unfair advantage; with costs lower than other<br />

importers can match.<br />

e) Potential new legislation to control alcohol abuse is also being considered.<br />

Geography and Domestic <strong>Wine</strong> Production<br />

Climate and Topography<br />

It is in the southern region of <strong>Brazil</strong>, with high temperatures during the day and cool low<br />

temperatures at night that is responsible for the quality and wide variety of grapes.<br />

Primarily, grape and wine production are centered in the Serra Gaucho Mountains located<br />

parallel 29° with average temperatures between 12°C in the winter months and 22°C during<br />

the summer. These mountains include the<br />

sub-region of Vale dos Vinhedos, <strong>Brazil</strong>’s first<br />

Geographical Indication. Production marches<br />

down from the mountains to the southern<br />

valleys. The southernmost state of Rio<br />

Grande do Sul produces over 55 percent of<br />

national grape production. Other well known<br />

wine producing regions of <strong>Brazil</strong> include the<br />

states of São Paulo, Paraná, Santa Catarina,<br />

Pernambuco and newly discovered Minas<br />

Gerais.<br />

<strong>Brazil</strong>ian <strong>Wine</strong>ry Miolo, photo by Lethaargic/Flickr<br />

Vale do São Francisco<br />

The tropical state of Vale do São Francisco<br />

resides at 9° south latitude and with its dry<br />

climate makes it the only wine producing region<br />

requiring irrigation. The alkaline soil along with<br />

the climate conditions produces low yield<br />

grapes with high sugar levels. Producers in this<br />

region can harvest grapes two times a year.

WINE GRAPE PRODUCTION AREAS<br />

Source: <strong>Brazil</strong>ian <strong>Wine</strong> Institute (IBRAVIN)<br />

9<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

The subtropical southern regions presents prime viticulture climate. <strong>Brazil</strong>’s high quality<br />

sparkling wines are a result of the appropriate soil and weather patterns. However, wide<br />

climatic variations in grape producing regions caused more than a 15 percent decrease in<br />

overall grape production volume between the years of 2007 and 2009 and another 3.74<br />

percent decrease in 2010.<br />

Northern Region Potential<br />

According to the <strong>Brazil</strong>ian Agriculture Research Center (<strong>EMP</strong>RAPA), there is high climatic<br />

potential for grape production in the northeast region of <strong>Brazil</strong>. Fine table grapes were<br />

introduced in the 20 th Century by the Italians and grown in the northeast Vale do São<br />

Francisco. Tonietto & Carbonneau 3 developed the Multicriteria Climatic Classification System<br />

(MCC System) on three regions of the northeast state of Minas Gerais over the course of two<br />

production cycles: October to March (spring-summer) and April to September (autumnwinter).<br />

The results showed all three regions to present unlimited grape-growing<br />

possibilities. The autumn-winter period presented two of the regions as moderately dry,<br />

warm and with temperate nights and the third region’s climatic condition as sub-humid,<br />

temperate and with cool nights. It would be no surprise to see a substantial growth in grape<br />

production in northern <strong>Brazil</strong>.<br />

3 TONIETTO, J.; CARBONNEAU, A. A multi-criteria climatic classification system for grapegrowing<br />

regions worldwide. Agricultural and Forest Meteorology, Amsterdam, v.124, p.81-<br />

97, 2004.

Government Production Policy<br />

10<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Brazil</strong> is fervently looking to wine production as a cash crop for their agriculture sector.<br />

According to the <strong>Brazil</strong>ian Institute of Geography and Statistics (IBGE) 2010 data, total<br />

vineyards planted in <strong>Brazil</strong> reached 83.718 hectares in 2010 up from 82.584 hectares in<br />

2009. In 1875 Bento Gonçalves, a town in Rio Grande do Sul, received Italian immigrants<br />

producing mostly American and hybrid grapes, more robust than vinfera varieties. The<br />

Italian arrival marked the beginning of expansion for <strong>Brazil</strong>’s <strong>Wine</strong> Industry. Today, Bento<br />

Gonçalves is considered the “<strong>Wine</strong> Capital of <strong>Brazil</strong>” primarily producing Cabernet Sauvignon,<br />

Cabernet Franc, Sauvignon Blanc and Merlot. In recent years, wine production in <strong>Brazil</strong> has<br />

generated greater wealth and employment, with the increase in grape growers and large<br />

wine processors. In the 1970’s, a multinational group of wine producers arrived in Rio<br />

Grande do Sul bringing with them modern wine-processing technology and planting new<br />

vinifera varieties although non-vinifera grapes still account for 80 percent of production.<br />

Isabella is the predominant non-vinifera grape and its juice production is an important<br />

export. In <strong>Brazil</strong>, table wine refers to non-vinifera and fine wine is the recently planted<br />

vinifera.<br />

Today <strong>Brazil</strong> is the 5 th largest wine producer in the Southern hemisphere with 320 million<br />

liters. Production in <strong>Brazil</strong> is highly concentrated in the southeast states. The state of Rio<br />

Grande do Sul alone accounts for 54 percent of all <strong>Brazil</strong>ian wine grapes produced. While<br />

there was an increase in vineyard planted areas in 2010, a combination of the global<br />

economic crisis and a poor harvest led to a 3.74 percent decrease in <strong>Brazil</strong>ian grape<br />

production when compared to 2009.<br />

Grapes production in <strong>Brazil</strong> (in tons)<br />

State/Year 2007 2008 2009 2010<br />

Pernambuco 170,326 162,977 158,515 168,225<br />

Bahia 120,654 101,787 90,508 78,283<br />

Minas Gerais 11,995 13,711 11,773 10,590<br />

São Paulo 193,023 184,930 177,934 177,538<br />

Paraná 99,180 101,500 102,080 101,900<br />

Santa Catarina 54,554 58,330 67,546 66,214<br />

Rio Grande do Sul 705,228 776,027 737,363 692,692<br />

<strong>Brazil</strong> 1,354,960 1,399,262 1,345,719 1,295,442<br />

Source: IBGE (<strong>Brazil</strong>ian Institute of Geography and Statistics)<br />

The table above illustrates the largest decrease in production took place in the Vale do São<br />

Francisco (Bahia state): 13.51 percent decrease from 2009, followed by Minias Gerais: 10.05<br />

percent decrease. The major wine producing region of Rio Grande do Sul realized a 6.06<br />

percent decrease in production.<br />

Presently in <strong>2011</strong>, climate issues are leading to an increase in grape production. Grape<br />

growers and wine producers have invested heavily in the industry, which has led to<br />

increased quality and efficiency in production. <strong>Brazil</strong>ian wine tends to be fresh and fruity<br />

with moderate to high alcohol content. The main grape varieties include Cabernet<br />

Sauvignon, Merlot, Moscato and Chardonnay (source: EMBRAPA). Because of its high quality

11<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

and growing popularity, there was a 10.73 percent growth in sales for sparkling wine in<br />

2010. Muscat sparkling wine saw a 16.71 percent increase in sales in the same year.<br />

Major <strong>Wine</strong>ries<br />

The major players and their production volumes are as follows:<br />

Domestic <strong>Wine</strong> Producers (2009)<br />

Million<br />

Liters<br />

Casa Di Conti Ltda 19.4<br />

Cooperativa Vinícola Aurora Ltda 17.6<br />

Vinhos Salton SA Indústria e Comércio 13.0<br />

Bacardi-Martini do Brasil Indústria e Comércio Ltda 10.3<br />

Vinícola Miolo Ltda 7.4<br />

All Others 256.7<br />

Total 324.3<br />

Source: Euromonitor<br />

The top five leading wine producers share 20 percent of the total wine production in <strong>Brazil</strong>.<br />

The top producer, Casa Di Conti Ltda, maintains a six percent share of the market.<br />

Domestic <strong>Wine</strong> Producers<br />

Casa Di Conti Ltda<br />

Estimated Production: 19.4 Million Liters<br />

Casa Di Conti has been in the market since 1947. It began making liquors, but has reached<br />

its level of success producing Vermouth. Its products have gained notoriety throughout Latin<br />

America. The company is located in the city of Cândido Mota, in the countryside of São Paulo,<br />

with an industrial area of 135.000 m². The company is dedicated to customer satisfaction<br />

and social responsibility. http://www.contini.com.br/1.0/ing/<br />

Cooperativa Vinícola Aurora Ltda<br />

Estimated Production 17.6 Million Liters<br />

On February 14, 1931, sixteen families of grape growers in the municipality of Bento<br />

Gonçalves, in the southern mountains, met to lay the cornerstone of what would become the<br />

biggest enterprise of its kind in <strong>Brazil</strong>: The AURORA COOPERATIVE WINE. Aurora has been<br />

producing grapes much the same way as the Italian immigrants who originally settled in the<br />

region in 1875. From 1998 to 2007, Aurora has won over 200 awards, all with the seal of the<br />

OIV. http://www.vinicolaaurora.com.br/default.asp<br />

Vinhos Salton SA Indústria e Comércio<br />

Estimated Production: 13 Million Liters<br />

The company was formally established in 1910, when brothers Paul, Angelo, John, Cesar,<br />

Luiz Antonio and Salton, incorporated the work of their father, Antonio Domenico Salton, an<br />

immigrant who vinified informally, like most Italians in the region. The brothers began to<br />

engage in the cultivation of grapes and the making of wines, sparkling wines and vermouth,<br />

with the name Paul Salton & Brothers, the Center for Bento. Nearly a century later, Salton is

12<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

recognized as one of the major wineries in the country and celebrates being familiar and 100<br />

percent <strong>Brazil</strong>ian. http://www.salton.com.br/novo/home.aspx<br />

Bacardi-Martini do Brasil Indústria e Comércio Ltda<br />

Estimated Production: 10.3 Liters<br />

Vinícola Miolo Ltda<br />

Estimated Production: 7.4 Million Liters<br />

The winery began producing bulk wine for sale in 1989 and started bottling with a family<br />

name in 1994. The company faced growing demand and was forced to develop a plan to<br />

sustain the growth. The Miolo <strong>Wine</strong> Group was established in 2006 to assemble a line of<br />

more than 70 products from national and international partnerships. The group’s goal was to<br />

formulate a line of products with a variety of qualities that can reach many different<br />

segments. The group today has eight projects: Vinícola Miolo (Vale dos Vinhedos, RS),<br />

Fortaleza do Seival Vineyards (Campanha Gaúcha, RS), RAR (Campos de Cima da Serra,<br />

RS), Lovara Vinhos finos (Serra Gaúcha, RS), Fazenda Ouro Verde (Vale do São Francisco,<br />

BA), Costa Pacifico (Chile), Osborne (Spain and Portugal) and Los Nevados (Argentina).<br />

http://www.miolo.com.br/en/company/miolo_wine_group/<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong><br />

Highlights<br />

With over 203 million citizens and a 2010 GDP of over $2 trillion,<br />

<strong>Brazil</strong> is truly a sizable market. Since 2003, <strong>Brazil</strong>’s economy has<br />

grown increasingly stable through a commitment to fiscal<br />

responsibility by building up foreign reserves, reducing its debt<br />

profile and adhering to an inflation target. <strong>Brazil</strong>’s debt was<br />

granted investment grade status but like many of the world’s<br />

economies, <strong>Brazil</strong> suffered during the recent economic crisis with<br />

a decline in global demand for <strong>Brazil</strong>ian goods. The economy grew by 7.5 percent, a rate<br />

unmatched since 1986. Since the currency started 2010 strong and ended it stronger, a<br />

GDP of 3.675 trillion Reals converted at the year’s average exchange rate into US $2.089<br />

trillion. This meant that <strong>Brazil</strong> overtook Italy to rank as the world’s seventh-biggest<br />

economy. Income per head in <strong>Brazil</strong> has surpassed that in Mexico.<br />

The <strong>Brazil</strong>ian consumers have led the way to economic expansion, as the growing middle<br />

class stocks up on status symbols and domestic comforts once out of their reach. The export<br />

recovery has stimulated lower unemployment rates, higher monthly incomes and an overall<br />

rise in the middle class. All of these factors contribute to larger expendable incomes. As the<br />

home to the 2014 World Cup and the 2016 Summer Olympics, it is expected that increased<br />

interest and investment by the government to accommodate those international events will<br />

lead to further economic growth and greater consumer demand.<br />

Consumers are loyal to brands; including the low income population. More well-off<br />

consumers pay particular attention to quality, after-sales service and the company's social<br />

commitment (protection of the environment, sanitary standards, etc.) National pride is<br />

reflected in consumer habits, but <strong>Brazil</strong>ians remain attached to foreign products as exterior<br />

signs of wealth (technological equipment, American sports brands, etc.) Consumption

13<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

among the majority of the population is turned towards food and housing. The <strong>Brazil</strong>ian<br />

consumer is more demanding and selective. He is aware of quality, the price of goods and<br />

special offers. <strong>Brazil</strong> is a dual economy, in which the upper classes distinguish themselves by<br />

consumption close to that of the United States and Europe, while the poorer people have to<br />

be careful with prices and buy almost exclusively on the unofficial market. Access to credit<br />

is increasing, especially among the middle classes and in spite of some of the highest<br />

interest rates in the world. Everything is bought on credit: real estate, household appliances<br />

and brand name clothes. Many shops offer to spread payments over a period of time,<br />

sometimes without charging interest. 4<br />

While it is only natural that wine exporters would like to tap into the <strong>Brazil</strong>ian economy, there<br />

are a variety of barriers. The <strong>Brazil</strong>ian government currently has both tariff and non-tariff<br />

barriers that are not easily overcome. Furthermore, as a result of the advantages of free<br />

trade agreements, Chile and Argentina have been able to export at substantially lower costs,<br />

and as of 2010, together comprise over 57 percent of all wine imports. Consumers, however,<br />

are open to emerging trends, which may represent an opportunity for the U.S. to move up<br />

from its current status as the 10 th largest wine exporter to <strong>Brazil</strong>, importing $1,415,977 in<br />

2010 under Harmonized Code 2204- <strong>Wine</strong>s of Fresh Grapes 5 .<br />

Euro Monitor reports: that alcoholic drinks experienced strong growth in 2010 driven by the good<br />

performance of all sectors, in particular beer, which accounts for some 87% of overall volume sales.<br />

Beer benefited from increasing disposable incomes among lower-income brackets and steady<br />

unemployment rates combined with the consumer interest in the FIFA World Cup held in South Africa<br />

boosted sales in June and <strong>July</strong>, a period of the year when demand is typically lower compared to the<br />

summer season.<br />

Growing Investments in Premium Alcoholic Drinks<br />

With improvement in the purchasing power of most <strong>Brazil</strong>ians, growing demand for higher quality<br />

products was evident over the review period. As a result, alcoholic drinks manufacturers invested in<br />

expanding their portfolios with premium products such as Cervejarias Kaiser do Brasil which<br />

introduced Amstel Pulse (Netherlands), Birra Moretti (Italy), Edelweiss (Austria), Murphy’s Irish Stout<br />

and Murphy’s Irish Red (Ireland) in early 2010 and Cervejaria Petrópolis, which partnered with a<br />

German brewery to produce and distribute Weltenburger beer locally. In addition, growing sales of<br />

premium brands such as Absolut, Wyborowa and Stolichnaya were evident in vodka, and Ypióca Gold<br />

and artisanal products in cachaça.<br />

Ambev Continues To Grow In 2010<br />

AmBev (Cia Brasileira de Bebidas) is the outright leader in alcoholic drinks due to its leading position<br />

in beer. The company has a wide portfolio of beer in the standard and premium segments and it<br />

continued to experience growth in 2010 despite the acquisition of Cervejarias Kaiser do Brasil by<br />

Heineken and strong investments of Schincariol Participações e Representações and Cervejaria<br />

Petrópolis in expanding their portfolios with Devassa (Schincariol) and Petra and Weltenburger<br />

(Cervejaria Petrópolis).<br />

4 www.laposte-export-solutions.co.uk/uk<br />

5 http://www.gtis.com/gta/secure/gateway.cfm

Shift to Off-Trade Spurs Sales In Supermarkets/Hypermarkets<br />

14<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

The shift in consumption of alcoholic drinks from the on-trade to off-trade channels was very positive<br />

for supermarkets and hypermarkets which increased shelf space given over to alcoholic drinks,<br />

particularly beer. Additionally, investment by manufacturers in diversifying packaging sizes of beers<br />

such as 1-litre glass bottles, 473ml/269ml/210ml metal beverage cans and 5-litre kegs to cater to<br />

consumers’ different needs also contributed to spur sales in grocery retailers.<br />

Optimistic Outlook for Alcoholic Drinks<br />

Alcoholic drinks is expected to show significant growth over the forecast period as disposable incomes<br />

will continue to improve among socioeconomic groups 6 C, D and E and unemployment rates will<br />

remain steady. Beer will continue to sustain growth of alcoholic drinks in the near future but it is<br />

estimated that wine, driven by still light grape wine and sparkling wine, and spirits such as whiskies<br />

and vodka will experience strong growth from 2010 to 2015 as <strong>Brazil</strong>ian consumers expand their<br />

consumption habits in alcoholic drinks. 7<br />

Economical Segments 2008<br />

Source: http://www.propertybrazil.com/news/the-emerging-middle-class-in-brazil-25<br />

6<br />

The <strong>Brazil</strong>ian economical classes are segmented according to monthly household income levels as follows:<br />

Class A&B: + 4807 R$<br />

Class C : 1116 - 4807 R$<br />

Class D: 804 - 1115 R$<br />

Class E: Under 804 R$<br />

As can be seen, class A & B make up the upper income classes; class C is the "official" middle class; class D<br />

constitutes the lower middle class and class E is the lowest income segment.<br />

7 Source: Euro Monitor

Alcohol in <strong>Brazil</strong>ian Culture<br />

15<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

Since the early 2000s, wine consumption and tasting have become much trendier among<br />

<strong>Brazil</strong>ians. This has made consumers more knowledgeable and has led to increased<br />

consumption, especially New World wines of South America. In 2001, the <strong>Brazil</strong>ian <strong>Wine</strong><br />

Institute (IBRAVIN) conducted research to evaluate consumers’ wine preferences. At that<br />

time, it was determined that there were three categories of wine consumers: light users (1/2<br />

bottle per month); medium users (1-3 bottles per month); and heavy users (more than 3<br />

bottles per month), representing 36 percent, 54 percent and 10 percent of buyers,<br />

respectively. Medium users tend to be 40 years of age and in the middle class, with an even<br />

distribution of men and women; more than half have university degrees. It was determined<br />

that income and education don’t affect consumption patterns while sex and age do. Men<br />

tend to be heavier drinkers, while females tend to be lighter drinkers. Consumption also<br />

tends to increase with age. Light drinkers tend to drink on holidays or in the winter.<br />

<strong>Brazil</strong>ians tend to consume mostly still wines and sparkling wines. Among still wines, red<br />

wine is the most popular. While vermouth and dessert wines have been popular in the past,<br />

consumption has been slowing and is expected to continue to decline as such types are not<br />

nearly as popular among young consumers. As a result, there are limited marketing<br />

campaigns to promote these products. <strong>Wine</strong> education is starting to see growth amoung<br />

<strong>Brazil</strong>ians and more consumers are familiarizing themselves with wine quality and type.<br />

<strong>Wine</strong> economists expect a growth in reserve wine sales in <strong>2011</strong>. In fine wines, the most<br />

common varietals are Cabernet Sauvignon, Merlot and Pinot Noir for still red wine, with<br />

esteem rising for Malbec and Shiraz. Chardonnay, Moscato and Sauvignon Blanc are the<br />

most popular varietals for still white wine and other sparkling wine.<br />

In <strong>Brazil</strong>, 750ml glass bottles are the most common form of packaging, accounting for 95<br />

percent of wines. Some manufacturers have invested in alternative packaging such as PET<br />

bottles and bag-in-a-box to reduce costs and promote sales to the younger generation.<br />

However, these pack types represent no more than 2 percent of volume sales. Salton<br />

released a 187ml glass bottle to stimulate sales amongst club and bar patrons. However,<br />

wine purchasing tends to take place mostly in supermarkets and specialty stores.<br />

In June 2008, the federal government enacted a law that established new rules for drink<br />

driving and sales of alcoholic drinks in highways located in rural areas. Law 11705/08, also<br />

named “Lei Seca” (Dry Law), prohibited sales of alcoholic drinks in restaurants, bars and<br />

any other establishment located in highways outside urban areas. This Law also changed<br />

the tolerance of drink driving from 0.6 mg/litre to 0.1 mg/litre. Drivers who are caught<br />

under the influence of more than 0.1 mg/litre will be subject to a fine of R$955, detention of<br />

their vehicle and withdrawal of their driving license for one year. For those who are caught<br />

with alcohol levels of over 0.6 mg/litre, the driver will also be taken into custody from six<br />

months to three years, with bail fixed between R$300 and R$1,200.

Domestic <strong>Market</strong>ing<br />

16<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

In 2008, IBRAVIN (<strong>Brazil</strong>ian Institute of <strong>Wine</strong>) and key players of the wine industry<br />

invested in an advertising campaign to promote national brands of still light grape wines<br />

and highlight the high quality of <strong>Brazil</strong>ian wines. There are also efforts to increase exports of<br />

still light grape wines and sparkling wines through a project called “<strong>Wine</strong>s of <strong>Brazil</strong>”, a<br />

partnership between wine manufacturers and APEX (<strong>Brazil</strong>ian Agency of Promotion of<br />

Exports and Investments). Sparkling wines still account for the majority of exports reaching<br />

665 tonnes in 2007.<br />

Declining sales of table wines and competition with Chilean and Argentinean still light grape<br />

wines will lead domestic manufacturers to increase investment in a wide product portfolio of<br />

fine wines with brands positioned as low-, mid- and high-end as part of the strategy to<br />

remain competitive and cater to the different demands of high-income consumers and mid-<br />

/low-income consumers. For wealthier consumers, the grape varietal type and origin of the<br />

wine are important attributes, while price followed by origin are the most important criteria<br />

for lower-income brackets.<br />

The competition between imported and national wines will persist until the <strong>Brazil</strong>ian<br />

government, trade associations and key domestic manufacturers adopt an agreement about<br />

the import tax charged to Chilean and Argentinean governments or subsidies provided by<br />

the <strong>Brazil</strong>ian government to protect domestic companies. Meanwhile, the wine industry will<br />

have to maintain investments in economy products and/or marketing campaigns to increase<br />

the visibility of their products.<br />

Investment in smaller packaging for sparkling wines and still light grape wines such as Salton<br />

might be a good strategy to stimulate young consumers to trial different alcoholic beverages,<br />

especially in the on-trade since the sector faces resistance from consumers between the ages<br />

of 18 and 25 that frequently prefer beverages such as beer, vodka and RTDs.<br />

U.S. <strong>Wine</strong>s in <strong>Brazil</strong><br />

Current U.S. Exports<br />

In 2010, U.S. wine sales to <strong>Brazil</strong> totaled $1,415,977 8 ; however, this represented a<br />

miniscule percentage of the wine import market. Over the last three years, <strong>Brazil</strong> has<br />

imported approximately 6.5 million cases (12 bottles of 750ml each) of wine per year, which<br />

represents US$ 196 million FOB of annual imports. The U.S. share of those imports is less<br />

than one percent. Although <strong>Brazil</strong>’s population is approximately 203 million, wine<br />

consumption per capita for 2010 was 1.8 liters. This small figure presents definite<br />

possibilities for market expansion. The United States Department of Agriculture, Foreign<br />

Agricultural Service (FAS) prepared a list of best import prospects based on <strong>Brazil</strong>ian<br />

consumption patterns. According to the FAS market trend evaluation, wine ranks second on<br />

the list of potential increase.<br />

8 http://www.gtis.com/gta/secure/gateway.cfm

Product Imports<br />

in 2009<br />

Dairy Products US$ 366<br />

mi<br />

<strong>Wine</strong> US$ 176<br />

mi<br />

Processed Fruit<br />

and<br />

Vegetables<br />

Fish/Seafood<br />

products<br />

Food<br />

Preparation<br />

products (HS<br />

Codes 21.03<br />

and 21.04)<br />

US$ 500<br />

mi<br />

US$ 501<br />

mi<br />

US$ 20<br />

mi<br />

Import Tariff<br />

Rate<br />

Depends on the HS<br />

Code. Ranges from<br />

14% to 28%<br />

Key Constraints to<br />

<strong>Market</strong> Development<br />

U.S. has to overcome tariffs<br />

and high transportation<br />

costs compared to tariffs<br />

applied to Mercosul member<br />

countries.<br />

20% U.S. has to overcome tariffs<br />

and high transportation<br />

costs compared to tariffs<br />

applied to wines from<br />

Mercosul member countries<br />

and Chilean wines.<br />

Investments in marketing<br />

are also needed.<br />

Depends on the HS<br />

Code. Ranges from<br />

10% to 18%<br />

Depends on the HS<br />

Code. Ranges from<br />

10% to 16%<br />

Depends on the HS<br />

Code. Ranges from<br />

16% to 18%<br />

Argentina is the largest<br />

exporter with a share of<br />

31% of total sales. U.S. has<br />

to overcome tariffs and<br />

transportation costs.<br />

U.S. has to overcome tariffs<br />

and U.S. transportation<br />

costs. Investments in<br />

marketing are<br />

also needed.<br />

U.S. is the top supplier of<br />

food preparation products<br />

with a share<br />

of 34% of total imported<br />

value.<br />

17<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Market</strong> Attractiveness<br />

for<br />

USA<br />

From January-October,<br />

2010 imports increased<br />

20% compared to the<br />

same period in 2009.<br />

In 2009, wine imports<br />

increased 108%. <strong>Brazil</strong>ian<br />

consumers are open and<br />

receptive to wines from<br />

new origins and varieties.<br />

From January-October,<br />

2010 imports increased<br />

40% compared to the<br />

same period in 2009.<br />

From January-October,<br />

2010 imports increased<br />

40% compared to the<br />

same period in 2009.<br />

From January-October,<br />

2010 imports increased 4%<br />

compared to the same<br />

period in 2009.<br />

A turn in <strong>Brazil</strong>ian consumption patterns shows an increase in wine educated drinkers<br />

interested in purchasing New World wines. More affluent consumers are expanding the<br />

market possibilities for United States winemakers.<br />

Ability of US Brands to Penetrate the <strong>Market</strong><br />

<strong>Brazil</strong>ian wine imports have grown to a great extent in the past decade. South American and<br />

EU wine suppliers have well-established positions and customs duty preferences, making it<br />

difficult for other countries to penetrate the market. The current situation for wines of the<br />

United States could be considered difficult but not insurmountable. <strong>Brazil</strong>ian wine importers<br />

stated that the current exchange rate and the rise in income of <strong>Brazil</strong>ian citizens increase the<br />

attraction to purchase U.S. wines. The exceedingly high rate of imported Chilean wines only<br />

proves consumer interest in New World wines, a positive indicator for the United States.<br />

According to the Secretary for External Commerce from the Ministry for Development,<br />

Industry and Commerce (SECEX/MDIC), the growth of U.S. wine exports to <strong>Brazil</strong> was larger<br />

than the average growth of imported wines in containers of less than two liters. This means<br />

that over the course of five years, between 2005 and 2009, U.S. wine exports increased 187<br />

percent against an average growth of 108 percent of all imported wines in the same period.<br />

The United States ranked 2 nd only to France for the largest market growth. Thankfully,<br />

<strong>Brazil</strong>ian consumers are open to emerging trends, leading to significant growth opportunities<br />

for imports of New World wines. This openness should provide excellent opportunities for<br />

U.S. wines in the near future.

The Effect of <strong>Brazil</strong>ian Trade Policy on Imported <strong>Wine</strong><br />

18<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Brazil</strong> is a party to a plurilateral free trade agreement called MERCOSUR. This agreement<br />

represents the Southern Cone Common <strong>Market</strong>. Countries involved in the agreement<br />

include Argentina, <strong>Brazil</strong>, Paraguay and Uruguay with Chile as an associate member.<br />

MERCOSUR created a customs union between member countries that provided for the<br />

elimination of certain trade barriers at the end of 1995. A common external tariff has been<br />

implemented upon all products coming in from outside the region. The mutual tariffs set for<br />

wine by the parties’ trade agencies were imposed at 20 percent.<br />

Argentinean producers profit in sales to <strong>Brazil</strong> since their wines are exempt from import<br />

tariffs under the MERCOSUR trade agreement. Because of this, Argentinean producers<br />

began intensely marketing their neighbor country. Even Chilean wines have enjoyed a<br />

decrease in import tax through a bilateral trade agreement with <strong>Brazil</strong> that will reach tax<br />

exemption in <strong>2011</strong>. In 2006, the <strong>Brazil</strong>ian government agreed to reduce import taxes from<br />

27 percent to zero percent in exchange for the Chilean agreement to purchase buses from<br />

<strong>Brazil</strong> for the widening tourism movement. These tax benefits have increased the<br />

popularity of Argentinean and Chilean wines while harming domestic sales and other<br />

imported wines at the same time.<br />

Consumption Analysis<br />

Value and Volume Estimates<br />

For 2009, <strong>Brazil</strong>ian wine consumption was 310.5 million liters, at a value of US $2,970<br />

million. Consumption for <strong>2011</strong> is estimated at 314 million liters, and consumption for 2014 is<br />

estimated at 332.9 million liters. On a per capita basis, <strong>Brazil</strong>ians consume 1.8 liters of wine<br />

per annum, a small figure compared to the neighboring country of Argentina at 23 liters per<br />

annum. Economists recognize a steady 10 percent increase in consumption in both 2009<br />

and 2010 and predict there will be a similar increase in <strong>2011</strong> and 2012.<br />

<strong>Brazil</strong>ian <strong>Wine</strong> Consumption<br />

Table A<br />

<strong>Brazil</strong>ian <strong>Wine</strong> Consumption- Historical and Projected<br />

By Volume (million liters)<br />

Year Total Imported Domestic<br />

2004 341.00 64.40 276.60<br />

2005 395.30 39.50 355.80<br />

2006 375.10 49.90 325.20<br />

2007 363.50 59.60 303.90<br />

2008 344.90 56.60 288.30<br />

2009 324.30 57.80 266.50<br />

2010 310.50 73.70 236.80

<strong>2011</strong> 314.00<br />

2012 319.20<br />

2013 327.00<br />

2014 332.90<br />

Source: Euromonitor- Passport<br />

Table B<br />

19<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

<strong>Brazil</strong>ian Fine <strong>Wine</strong> <strong>Market</strong><br />

YEAR/PRODUCT 2006 2007 2008 2009 2010<br />

NATIONAL 25,085 23,130 23,120 23,019 24,670<br />

IMPORTED 46,371 57,629 54,410 55,927 75,051<br />

TOTAL GRAPEVINES 71,456 80,759 77,530 78,946 99,721<br />

IMP. PARTICIP./TOTAL (%) 64.89 71.36 70.18 70.84 75.26<br />

Source: UVIBRA (<strong>Brazil</strong>ian Grape and <strong>Wine</strong> Producers Association); IBRAVIN (<strong>Brazil</strong>ian <strong>Wine</strong> Institute) and MDIC<br />

(Minstry of Development, Industry and Foreign Trade)<br />

Created by: Loiva Maria Ribeiro de Mello – Embrapa Uva e Vinho (Grape and <strong>Wine</strong>)<br />

It is important for third country producers to note imported fine wines (Table B) accounted<br />

for 75.26 percent of the total 100 million liters of fine wines sold in <strong>Brazil</strong>’s 2010 market.<br />

However, both Table A and Table B show <strong>Brazil</strong>ian wine consumption trends to be somewhat<br />

unpredictable. Consumption totals of imported and domestically produced wines tend to<br />

fluctuate from year to year. A variety of factors affect consumption totals. Emerging<br />

demands for imported wines are often hindered by new barriers to trade, and with much of<br />

the market demand for wine met by domestic production (which is highly concentrated in<br />

one region, Rio Grande do Sul), a poor crop can drastically affect the market. National fine<br />

wine has thus-far been unable to meet demand. The economic crisis clearly affected the<br />

<strong>Brazil</strong>ian wine industry, but analysts predict that consumption totals will continue to grow in<br />

the future, consistent with the rise of the middle class.<br />

<strong>Wine</strong> Consumption According to Price Structure<br />

Still <strong>Wine</strong> Consumption by Price Range (USD) in Million Liters<br />

2004 2005 2006 2007 2008 2009<br />

$0-$5.60 94.0 104.5 93.5 82.9 74.0 65.4<br />

$5.60-$13.43 110.4 135.3 130.3 128.5 122.2 115.9<br />

$13.43-$22.39 10.6 13.9 13.6 15.8 15.9 15.1<br />

$22.39+ 11.7 14.7 14.5 14.8 14.5 13.8<br />

Source: Euromonitor- Passport<br />

It is apparent from the table above that <strong>Brazil</strong>ian consumers strongly prefer moderately<br />

priced and less expensive wines. For 2009, over 86 percent of still wines consumed cost less

20<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

than $13.43. This is consistent with the idea that the rising middle class is consuming alcohol<br />

and the idea that most of the wine consumed is produced either domestically or in other<br />

South American Countries, keeping tariffs and transportation costs low.<br />

<strong>Wine</strong> Consumption for 2009 By <strong>Wine</strong> Type (Still <strong>Wine</strong>s)<br />

Still Light Grape <strong>Wine</strong> Consumption 2009 (by type)<br />

By Volume (million liters)<br />

Color Total<br />

Red 217.3<br />

White 45.9<br />

Rose 4.5<br />

Total 267.7<br />

Source: Euromonitor- Passport<br />

<strong>Brazil</strong>ians clearly have a strong preference for red wine. Of the red wines, Cabernet<br />

Sauvignon enjoys the dominant share with 71.6 million liters. Malbec and Merlot are also<br />

very popular grape varieties, with 22.5 and 24.3 million liters respectively. Of the white<br />

wines, Chardonnay is most popular with 21.5 million liters.<br />

Partner<br />

Country<br />

<strong>Wine</strong> Consumption Data for Imports<br />

<strong>Brazil</strong> Import Statistics<br />

Commodity: 2204, <strong>Wine</strong> Of Fresh Grapes, Incl Fortified; Grape Must O/T Heading 20.09<br />

Unit<br />

Calendar Year: 2008 - 2010<br />

2008 2009 2010<br />

USD Quantity USD Quantity USD Quantity<br />

World L 185,836,478 56,593,564 196,049,568 57,848,119 251,549,238 73,767,146<br />

Chile L 50,982,411 18,177,493 61,563,326 21,961,881 73,239,549 25,957,208<br />

Argentina L 40,476,584 15,297,016 41,255,809 14,752,051 55,715,290 18,046,478<br />

France L 27,048,955 3,051,254 28,840,407 2,973,740 35,805,532 3,577,296<br />

Italy L 28,853,317 10,704,938 26,076,286 9,055,564 33,452,731 12,960,301<br />

Portugal L 24,100,160 6,233,933 23,980,957 5,972,013 29,947,461 8,057,888<br />

Spain<br />

South<br />

L 7,215,868 1,239,690 7,627,607 1,411,411 10,618,202 1,989,727<br />

Africa L 1,182,329 315,459 1,973,912 498,107 3,637,693 939,835<br />

Uruguay L 2,097,911 880,192 1,963,590 748,045<br />

3,225,363 1,254,517<br />

Australia<br />

United<br />

L 1,252,014 196,777 1,000,788 213,247 1,876,543 345,808<br />

States L 577,322 77,536 728,777 92,535 1,415,977 220,637<br />

Source: worldtradestatistics.com/gta

Import <strong>Market</strong> Shares by Country of Origin<br />

21<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

The chart above clearly demonstrates the dominance of Chilean and Argentinean wines<br />

imported into <strong>Brazil</strong>. Both countries have seen their wine exports increase in value in the<br />

past three years. Chile controls 29 percent of total imports at an average FOB price of US<br />

$25.20 for a 9 liter case and Argentina maintains 22 percent at FOB US $23.50. Together,<br />

Chile and Argentina account for 57 percent of the imported wines to <strong>Brazil</strong>. The wine<br />

producers of the European Union follow distantly, yet maintain their positions as a result of<br />

established and recognized brands. The United States and some other New World wine<br />

producers, South Africa and Australia, have yet to fully actualize their potential in the<br />

market. The United States, the 10 th largest exporter, showed significant increases in both<br />

quantity and value from 2009-2010. The table below shows Chile and Argentina maintaining<br />

over 57 percent of wine import value, while the US currently holds a meager 0.56 percent.<br />

<strong>Brazil</strong> Trade <strong>Report</strong><br />

Import <strong>Market</strong> Shares by Country of Origin<br />

1. Chile 29.12%<br />

2. Argentina 22.15%<br />

3. France 14.23%<br />

4. Italy 13.30%<br />

5. Portugal 11.91%<br />

10. US 0.56 %<br />

worldtradestatistics.com/gta<br />

<strong>Brazil</strong> has realized the potential benefits of international cooperation and has made efforts in<br />

recent years to open its markets to international trade. <strong>Brazil</strong>’s trade policy is focused on<br />

membership in multinational organizations. <strong>Brazil</strong> is an original member of the World Trade<br />

Organization and is an active participant and leader, especially for developing countries.<br />

<strong>Brazil</strong> grants MFN status to all of its trading partners and over 75 percent of <strong>Brazil</strong>ian trade<br />

is done with these partners.<br />

<strong>Brazil</strong> is also very focused on collaborative regional trade. <strong>Brazil</strong> is one of the founders of<br />

the Southern Common <strong>Market</strong> (MERCOSUR), which represents over 250 million people and<br />

three-quarters of South American economic activity. The other full members include<br />

Argentina, Paraguay, and Uruguay. Bolivia, Chile, Colombia, Ecuador, and Peru hold<br />

associate member status which allows them to join free trade agreements, but remain<br />

outside the customs union. Venezuela is on the cusp of becoming a full member, pending<br />

ratification. MERCOSUR has pursued different trade negotiations with Israel, India, South<br />

Africa, Egypt, the Gulf Cooperation Council, Jordan, Morocco, Turkey and the European<br />

Union, though each has met difficulties in ratification and implementation. Several<br />

MERCOSUR leaders reject the idea of potential US free-market policies.

22<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

Other trade organizations of which <strong>Brazil</strong> is a member include the Global System of Trade<br />

Preferences among Developing Countries (GSTP), Multilateral Investment Guarantee Agency<br />

(MIGA), and Organization for Economic Cooperation and Development (OECD).<br />

<strong>Brazil</strong>’s trade policy drastically affects its wine imports and the potential for US wines. In<br />

2006, <strong>Brazil</strong> and Chile signed an agreement to gradually eliminate import taxes reaching<br />

zero percent by 2010. In exchange, Chile agreed to purchase <strong>Brazil</strong>ian buses. As members<br />

of MERCOSUR, Argentina and <strong>Brazil</strong> share zero percent import taxes. This explains the high<br />

concentration of these wines in <strong>Brazil</strong> from previous sections of this report.<br />

Trade Balance<br />

Grape, Grape juice, wine and by-products exports and imports balance: amounts in<br />

USD 1,000.00 (FOB) – <strong>Brazil</strong> 2008/2010<br />

Product 2008 2009 2010<br />

Quantity USD Quantity USD Quantity USD<br />

Exports<br />

Fresh grapes (t) 82,242 171,456 54,560 110,574 60,805 136,649<br />

Grape juice (t) 6,623 15,174 5,860 12,621 3,098 8,048<br />

Table wine (1,000 L) 10,346 7,118 25,514 8,941 10,067 5,297<br />

Sparkling wine (1,000<br />

L) 355 548 190 347 320 1,335<br />

Total<br />

194,296<br />

132,483<br />

151,329<br />

Imports<br />

Fresh grapes (t) 12,565 14,849 18,655 21,697 24,794 36,075<br />

Raisins (t) 20,146 34,973 22,656 32,648 25,919 50,664<br />

Table wine (1,000 L) 54,410 165,692 55,927 176,396 70,737 223,080<br />

Sparkling wine (1,000<br />

L) 3,502 20,144 3,200 19,473 4,314 27,961<br />

Grape juice (t) 185 227 43 52 - -<br />

Total<br />

BALANCE<br />

235,885<br />

-41,589<br />

Source: MDIC (Ministry of Development, Industry and Foreign Trade)<br />

Created by: Loiva Maria Ribeiro de Mello - Embrapa Uva e Vinho (Grape and <strong>Wine</strong>)<br />

250,266<br />

-117,783<br />

337,780<br />

-186,451<br />

Imported wine sales are higher than domestic sales by a large margin, proving <strong>Brazil</strong> to be a<br />

targetable consumer market. In 2010, imported wine totaled $251.5 million. There was a<br />

26.48 percent increase in wine imports quantity with an average price of USD 3.15 per liter.<br />

The table above shows <strong>Brazil</strong> to hold a USD 186.451 million deficit due to an increase in<br />

imports in all items and a reduction in exports.

Import Procedures 9<br />

Customs Clearance<br />

23<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

In order to export wine to <strong>Brazil</strong>, U.S. exporters must have the following documents:<br />

• Pro forma invoice (including product information, form of payment, method of<br />

transportation, etc.)<br />

• Commercial invoice (this is required to clear the products through Customs. The<br />

commercial invoice should include U.S. exporter and <strong>Brazil</strong>ian importer information,<br />

quantities, brands, net and gross weights of the package, country of origin,<br />

destination country, payment conditions, etc.)<br />

• Air Waybill or Bill of Lading<br />

• Certificate of Origin and Analysis<br />

It is essential for the U.S. exporter to establish a good working relationship with a <strong>Brazil</strong>ian<br />

importer. The importer accepts a pro forma invoice by the exporter then applies for an<br />

import license (LI) before any shipments can enter <strong>Brazil</strong>. The license is obtained through<br />

the SISCOMEX electronic system and must be approved by MAPA before any shipment is<br />

made. Once the import license is obtained, the importer must register the Import<br />

Declaration at SISCOMEX. The Import Declaration contains importer information, data on<br />

the cargo and bonded storage, etc. The importer will then notify the exporter and provide<br />

“embarkation instructions” for wine shipment. When the wine arrives in <strong>Brazil</strong>, the importer<br />

must have goods physically reviewed by a MAPA official, pay duties and taxes and have all<br />

required information for the customs inspection before the release of the product.<br />

The following table lists the procedures necessary and the number of days spent on each for<br />

importing standardized cargo of goods into <strong>Brazil</strong>. <strong>Wine</strong> requires some additional<br />

documentation.<br />

Import Procedures (2010)<br />

Nature of Import Procedures Duration (days) Cost (USD)<br />

Documents preparation 8 330<br />

Customs clearance and technical control 4 250<br />

Ports and terminal handling 3 300<br />

Inland transportation and handling 2 850<br />

Totals 17 1730<br />

World Bank. Doing Business in <strong>Brazil</strong> <strong>2011</strong>. Washington, DC. www.doingbusiness.org<br />

Standard Import Documents 10<br />

9 For a more detailed description of import procedures see http://www.usdabrazil.org.br/home/pdf/rw_wine.pdf<br />

10 (World Bank. Doing Business in <strong>Brazil</strong> <strong>2011</strong>. Washington, DC. www.doingbusiness.org) (US Agricultural Trade<br />

Office (ATO) of USDA/Foreign Agricultural Service in Sao Paulo, <strong>Brazil</strong> <strong>Wine</strong> <strong>Market</strong> Access Project).<br />

www.usdabrazil.org.br)

24<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

The following is a list of exporter documents necessary to import a standardized cargo of<br />

goods into <strong>Brazil</strong>, taken from both the World Bank’s report Doing Business in <strong>Brazil</strong> <strong>2011</strong> and<br />

USDA’s Sao Paulo Agricultural Trade Office <strong>Wine</strong> <strong>Market</strong> Access Project:<br />

• Copy of Bill of lading<br />

• Certificate of analysis and certificate of Origin<br />