Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Import Procedures 9<br />

Customs Clearance<br />

23<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

In order to export wine to <strong>Brazil</strong>, U.S. exporters must have the following documents:<br />

• Pro forma invoice (including product information, form of payment, method of<br />

transportation, etc.)<br />

• Commercial invoice (this is required to clear the products through Customs. The<br />

commercial invoice should include U.S. exporter and <strong>Brazil</strong>ian importer information,<br />

quantities, brands, net and gross weights of the package, country of origin,<br />

destination country, payment conditions, etc.)<br />

• Air Waybill or Bill of Lading<br />

• Certificate of Origin and Analysis<br />

It is essential for the U.S. exporter to establish a good working relationship with a <strong>Brazil</strong>ian<br />

importer. The importer accepts a pro forma invoice by the exporter then applies for an<br />

import license (LI) before any shipments can enter <strong>Brazil</strong>. The license is obtained through<br />

the SISCOMEX electronic system and must be approved by MAPA before any shipment is<br />

made. Once the import license is obtained, the importer must register the Import<br />

Declaration at SISCOMEX. The Import Declaration contains importer information, data on<br />

the cargo and bonded storage, etc. The importer will then notify the exporter and provide<br />

“embarkation instructions” for wine shipment. When the wine arrives in <strong>Brazil</strong>, the importer<br />

must have goods physically reviewed by a MAPA official, pay duties and taxes and have all<br />

required information for the customs inspection before the release of the product.<br />

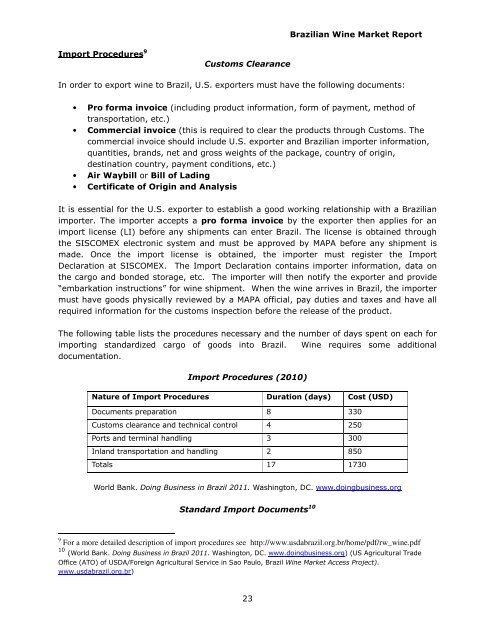

The following table lists the procedures necessary and the number of days spent on each for<br />

importing standardized cargo of goods into <strong>Brazil</strong>. <strong>Wine</strong> requires some additional<br />

documentation.<br />

Import Procedures (2010)<br />

Nature of Import Procedures Duration (days) Cost (USD)<br />

Documents preparation 8 330<br />

Customs clearance and technical control 4 250<br />

Ports and terminal handling 3 300<br />

Inland transportation and handling 2 850<br />

Totals 17 1730<br />

World Bank. Doing Business in <strong>Brazil</strong> <strong>2011</strong>. Washington, DC. www.doingbusiness.org<br />

Standard Import Documents 10<br />

9 For a more detailed description of import procedures see http://www.usdabrazil.org.br/home/pdf/rw_wine.pdf<br />

10 (World Bank. Doing Business in <strong>Brazil</strong> <strong>2011</strong>. Washington, DC. www.doingbusiness.org) (US Agricultural Trade<br />

Office (ATO) of USDA/Foreign Agricultural Service in Sao Paulo, <strong>Brazil</strong> <strong>Wine</strong> <strong>Market</strong> Access Project).<br />

www.usdabrazil.org.br)