Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Import <strong>Market</strong> Shares by Country of Origin<br />

21<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

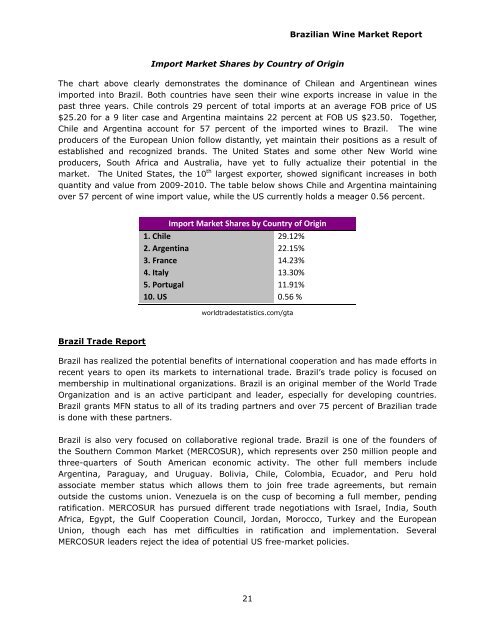

The chart above clearly demonstrates the dominance of Chilean and Argentinean wines<br />

imported into <strong>Brazil</strong>. Both countries have seen their wine exports increase in value in the<br />

past three years. Chile controls 29 percent of total imports at an average FOB price of US<br />

$25.20 for a 9 liter case and Argentina maintains 22 percent at FOB US $23.50. Together,<br />

Chile and Argentina account for 57 percent of the imported wines to <strong>Brazil</strong>. The wine<br />

producers of the European Union follow distantly, yet maintain their positions as a result of<br />

established and recognized brands. The United States and some other New World wine<br />

producers, South Africa and Australia, have yet to fully actualize their potential in the<br />

market. The United States, the 10 th largest exporter, showed significant increases in both<br />

quantity and value from 2009-2010. The table below shows Chile and Argentina maintaining<br />

over 57 percent of wine import value, while the US currently holds a meager 0.56 percent.<br />

<strong>Brazil</strong> Trade <strong>Report</strong><br />

Import <strong>Market</strong> Shares by Country of Origin<br />

1. Chile 29.12%<br />

2. Argentina 22.15%<br />

3. France 14.23%<br />

4. Italy 13.30%<br />

5. Portugal 11.91%<br />

10. US 0.56 %<br />

worldtradestatistics.com/gta<br />

<strong>Brazil</strong> has realized the potential benefits of international cooperation and has made efforts in<br />

recent years to open its markets to international trade. <strong>Brazil</strong>’s trade policy is focused on<br />

membership in multinational organizations. <strong>Brazil</strong> is an original member of the World Trade<br />

Organization and is an active participant and leader, especially for developing countries.<br />

<strong>Brazil</strong> grants MFN status to all of its trading partners and over 75 percent of <strong>Brazil</strong>ian trade<br />

is done with these partners.<br />

<strong>Brazil</strong> is also very focused on collaborative regional trade. <strong>Brazil</strong> is one of the founders of<br />

the Southern Common <strong>Market</strong> (MERCOSUR), which represents over 250 million people and<br />

three-quarters of South American economic activity. The other full members include<br />

Argentina, Paraguay, and Uruguay. Bolivia, Chile, Colombia, Ecuador, and Peru hold<br />

associate member status which allows them to join free trade agreements, but remain<br />

outside the customs union. Venezuela is on the cusp of becoming a full member, pending<br />

ratification. MERCOSUR has pursued different trade negotiations with Israel, India, South<br />

Africa, Egypt, the Gulf Cooperation Council, Jordan, Morocco, Turkey and the European<br />

Union, though each has met difficulties in ratification and implementation. Several<br />

MERCOSUR leaders reject the idea of potential US free-market policies.