Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Brazil Wine Market Report JBC EMP July 2011 - California Wine ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

25<br />

<strong>Brazil</strong>ian <strong>Wine</strong> <strong>Market</strong> <strong>Report</strong><br />

• Period of validity (if applicable)<br />

• Gluten declaration: “Contém Glúten" (Contains Gluten) or “Não contém Glúten” (Does<br />

not contain Gluten)<br />

• Warning statement must be declared in bold letters on labels for beverages with<br />

alcohol content above 13 percent alcohol by volume: “Evite o consumo excessivo de<br />

álcool” (Avoid excessive consumption of alcohol).<br />

The exporter should forward a sample of the package to the importer in order to confirm<br />

label compliance. 12<br />

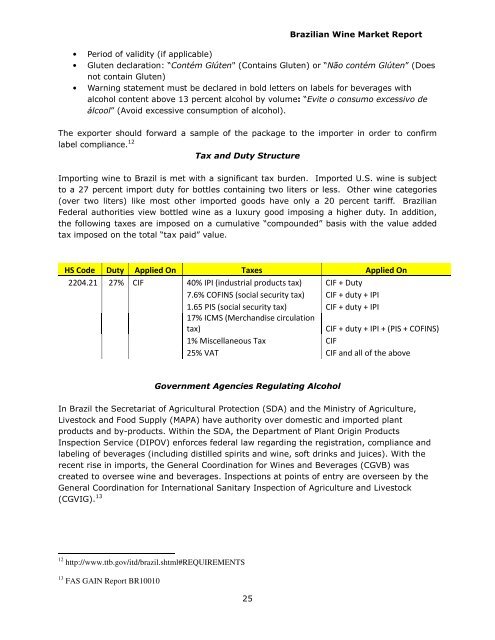

Tax and Duty Structure<br />

Importing wine to <strong>Brazil</strong> is met with a significant tax burden. Imported U.S. wine is subject<br />

to a 27 percent import duty for bottles containing two liters or less. Other wine categories<br />

(over two liters) like most other imported goods have only a 20 percent tariff. <strong>Brazil</strong>ian<br />

Federal authorities view bottled wine as a luxury good imposing a higher duty. In addition,<br />

the following taxes are imposed on a cumulative “compounded” basis with the value added<br />

tax imposed on the total “tax paid” value.<br />

HS Code Duty Applied On Taxes Applied On<br />

2204.21 27% CIF 40% IPI (industrial products tax) CIF + Duty<br />

7.6% COFINS (social security tax) CIF + duty + IPI<br />

1.65 PIS (social security tax) CIF + duty + IPI<br />

17% ICMS (Merchandise circulation<br />

tax) CIF + duty + IPI + (PIS + COFINS)<br />

1% Miscellaneous Tax CIF<br />

25% VAT CIF and all of the above<br />

Government Agencies Regulating Alcohol<br />

In <strong>Brazil</strong> the Secretariat of Agricultural Protection (SDA) and the Ministry of Agriculture,<br />

Livestock and Food Supply (MAPA) have authority over domestic and imported plant<br />

products and by-products. Within the SDA, the Department of Plant Origin Products<br />

Inspection Service (DIPOV) enforces federal law regarding the registration, compliance and<br />

labeling of beverages (including distilled spirits and wine, soft drinks and juices). With the<br />

recent rise in imports, the General Coordination for <strong>Wine</strong>s and Beverages (CGVB) was<br />

created to oversee wine and beverages. Inspections at points of entry are overseen by the<br />

General Coordination for International Sanitary Inspection of Agriculture and Livestock<br />

(CGVIG). 13<br />

12 http://www.ttb.gov/itd/brazil.shtml#REQUIREMENTS<br />

13 FAS GAIN <strong>Report</strong> BR10010