Annual Report 2009 in PDF - GKN

Annual Report 2009 in PDF - GKN

Annual Report 2009 in PDF - GKN

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24<br />

<strong>GKN</strong> plc <strong>Annual</strong> <strong>Report</strong> <strong>2009</strong><br />

Review of Performance<br />

Taxation<br />

The tax charge on management profits of<br />

subsidiaries of £65 million (2008 – £154<br />

million) was £11 million (2008 – £1 million<br />

charge), represent<strong>in</strong>g a 16.9% tax rate (2008<br />

– 0.6%).<br />

Compared with the weighted average tax rate<br />

for the Group of 31%, the <strong>2009</strong> tax rate has<br />

benefited from a comb<strong>in</strong>ation of the release<br />

of provisions for uncerta<strong>in</strong> tax positions,<br />

the recognition of previously unrecognised<br />

deferred tax assets and certa<strong>in</strong> tax refunds.<br />

Certa<strong>in</strong> other items have tended to <strong>in</strong>crease<br />

the tax rate, <strong>in</strong>clud<strong>in</strong>g the treatment for tax<br />

of exchange variations, the reversal of a prior<br />

year tax credit <strong>in</strong> respect of discont<strong>in</strong>ued<br />

operations and the non-recognition of deferred<br />

tax assets aris<strong>in</strong>g <strong>in</strong> the year. The reported net<br />

tax rate was 16.9% (2008 – 0.6%).<br />

<strong>GKN</strong>’s tax strategy cont<strong>in</strong>ues to be aimed at<br />

creat<strong>in</strong>g a susta<strong>in</strong>able ‘cash tax’ charge that<br />

balances m<strong>in</strong>imis<strong>in</strong>g tax payments with the<br />

need to comply with the tax laws of each<br />

country <strong>in</strong> which we operate. The cash tax<br />

charge excludes deferred taxes, movements<br />

<strong>in</strong> provisions for uncerta<strong>in</strong> tax positions and<br />

tax relat<strong>in</strong>g to those non-trad<strong>in</strong>g elements<br />

of operat<strong>in</strong>g profit identified separately <strong>in</strong><br />

the <strong>in</strong>come statement. In <strong>2009</strong> the cash<br />

tax charge was 29% (2008 – 17%) which<br />

exceeds the ‘20% or below’ cash tax rate<br />

expected. This <strong>in</strong>crease is primarily a result of<br />

the unusual profit profile across our trad<strong>in</strong>g<br />

markets, exaggerated by the low level of<br />

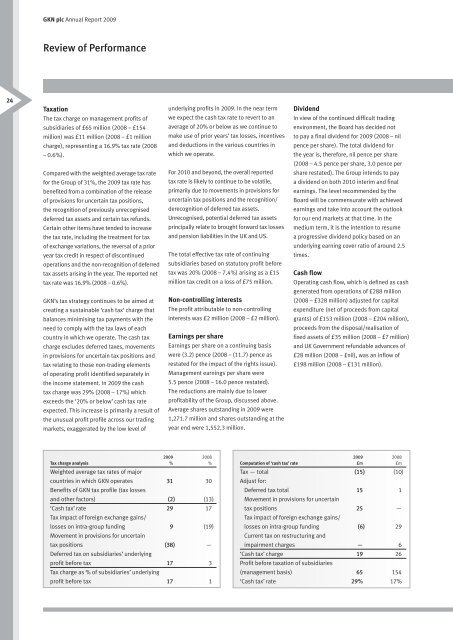

<strong>2009</strong> 2008<br />

Tax charge analysis % %<br />

Weighted average tax rates of major<br />

countries <strong>in</strong> which <strong>GKN</strong> operates<br />

Benefits of <strong>GKN</strong> tax profile (tax losses<br />

31 30<br />

and other factors) (2) (13)<br />

‘Cash tax’ rate<br />

Tax impact of foreign exchange ga<strong>in</strong>s/<br />

29 17<br />

losses on <strong>in</strong>tra-group fund<strong>in</strong>g<br />

Movement <strong>in</strong> provisions for uncerta<strong>in</strong><br />

9 (19)<br />

tax positions<br />

Deferred tax on subsidiaries’ underly<strong>in</strong>g<br />

(38) —<br />

profit before tax<br />

Tax charge as % of subsidiaries’ underly<strong>in</strong>g<br />

17 3<br />

profit before tax 17 1<br />

underly<strong>in</strong>g profits <strong>in</strong> <strong>2009</strong>. In the near term<br />

we expect the cash tax rate to revert to an<br />

average of 20% or below as we cont<strong>in</strong>ue to<br />

make use of prior years’ tax losses, <strong>in</strong>centives<br />

and deductions <strong>in</strong> the various countries <strong>in</strong><br />

which we operate.<br />

For 2010 and beyond, the overall reported<br />

tax rate is likely to cont<strong>in</strong>ue to be volatile,<br />

primarily due to movements <strong>in</strong> provisions for<br />

uncerta<strong>in</strong> tax positions and the recognition/<br />

derecognition of deferred tax assets.<br />

Unrecognised, potential deferred tax assets<br />

pr<strong>in</strong>cipally relate to brought forward tax losses<br />

and pension liabilities <strong>in</strong> the UK and US.<br />

The total effective tax rate of cont<strong>in</strong>u<strong>in</strong>g<br />

subsidiaries based on statutory profit before<br />

tax was 20% (2008 – 7.4%) aris<strong>in</strong>g as a £15<br />

million tax credit on a loss of £75 million.<br />

Non-controll<strong>in</strong>g <strong>in</strong>terests<br />

The profit attributable to non-controll<strong>in</strong>g<br />

<strong>in</strong>terests was £2 million (2008 – £2 million).<br />

Earn<strong>in</strong>gs per share<br />

Earn<strong>in</strong>gs per share on a cont<strong>in</strong>u<strong>in</strong>g basis<br />

were (3.2) pence (2008 – (11.7) pence as<br />

restated for the impact of the rights issue).<br />

Management earn<strong>in</strong>gs per share were<br />

5.5 pence (2008 – 16.0 pence restated).<br />

The reductions are ma<strong>in</strong>ly due to lower<br />

profitability of the Group, discussed above.<br />

Average shares outstand<strong>in</strong>g <strong>in</strong> <strong>2009</strong> were<br />

1,271.7 million and shares outstand<strong>in</strong>g at the<br />

year end were 1,552.3 million.<br />

<strong>2009</strong> 2008<br />

Computation of ‘cash tax’ rate £m £m<br />

Tax — total (15) (10)<br />

Adjust for:<br />

Deferred tax total 15 1<br />

Movement <strong>in</strong> provisions for uncerta<strong>in</strong><br />

tax positions 25 —<br />

Tax impact of foreign exchange ga<strong>in</strong>s/<br />

losses on <strong>in</strong>tra-group fund<strong>in</strong>g (6) 29<br />

Current tax on restructur<strong>in</strong>g and<br />

impairment charges — 6<br />

‘Cash tax’ charge 19 26<br />

Profit before taxation of subsidiaries<br />

Dividend<br />

In view of the cont<strong>in</strong>ued difficult trad<strong>in</strong>g<br />

environment, the Board has decided not<br />

to pay a f<strong>in</strong>al dividend for <strong>2009</strong> (2008 – nil<br />

pence per share). The total dividend for<br />

the year is, therefore, nil pence per share<br />

(2008 – 4.5 pence per share, 3.0 pence per<br />

share restated). The Group <strong>in</strong>tends to pay<br />

a dividend on both 2010 <strong>in</strong>terim and f<strong>in</strong>al<br />

earn<strong>in</strong>gs. The level recommended by the<br />

Board will be commensurate with achieved<br />

earn<strong>in</strong>gs and take <strong>in</strong>to account the outlook<br />

for our end markets at that time. In the<br />

medium term, it is the <strong>in</strong>tention to resume<br />

a progressive dividend policy based on an<br />

underly<strong>in</strong>g earn<strong>in</strong>g cover ratio of around 2.5<br />

times.<br />

Cash flow<br />

Operat<strong>in</strong>g cash flow, which is def<strong>in</strong>ed as cash<br />

generated from operations of £288 million<br />

(2008 – £328 million) adjusted for capital<br />

expenditure (net of proceeds from capital<br />

grants) of £153 million (2008 – £204 million),<br />

proceeds from the disposal/realisation of<br />

fixed assets of £35 million (2008 – £7 million)<br />

and UK Government refundable advances of<br />

£28 million (2008 – £nil), was an <strong>in</strong>flow of<br />

£198 million (2008 – £131 million).<br />

(management basis) 65 154<br />

‘Cash tax’ rate 29% 17%