Annual Report 2009 in PDF - GKN

Annual Report 2009 in PDF - GKN

Annual Report 2009 in PDF - GKN

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

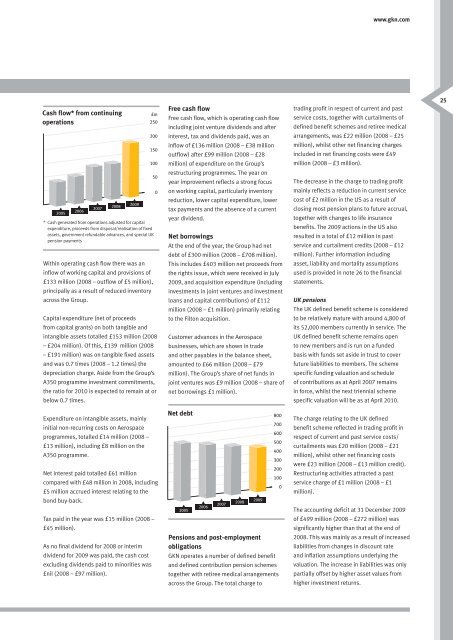

Cash flow* from cont<strong>in</strong>u<strong>in</strong>g<br />

operations<br />

2005<br />

2006<br />

2007<br />

2008<br />

<strong>2009</strong><br />

* Cash generated from operations adjusted for capital<br />

expenditure, proceeds from disposal/realisation of fixed<br />

assets, government refundable advances, and special UK<br />

pension payments<br />

With<strong>in</strong> operat<strong>in</strong>g cash flow there was an<br />

<strong>in</strong>flow of work<strong>in</strong>g capital and provisions of<br />

£133 million (2008 – outflow of £5 million),<br />

pr<strong>in</strong>cipally as a result of reduced <strong>in</strong>ventory<br />

across the Group.<br />

Capital expenditure (net of proceeds<br />

from capital grants) on both tangible and<br />

<strong>in</strong>tangible assets totalled £153 million (2008<br />

– £204 million). Of this, £139 million (2008<br />

– £191 million) was on tangible fixed assets<br />

and was 0.7 times (2008 – 1.2 times) the<br />

depreciation charge. Aside from the Group’s<br />

A350 programme <strong>in</strong>vestment commitments,<br />

the ratio for 2010 is expected to rema<strong>in</strong> at or<br />

below 0.7 times.<br />

Expenditure on <strong>in</strong>tangible assets, ma<strong>in</strong>ly<br />

<strong>in</strong>itial non-recurr<strong>in</strong>g costs on Aerospace<br />

programmes, totalled £14 million (2008 –<br />

£13 million), <strong>in</strong>clud<strong>in</strong>g £8 million on the<br />

A350 programme.<br />

Net <strong>in</strong>terest paid totalled £61 million<br />

compared with £48 million <strong>in</strong> 2008, <strong>in</strong>clud<strong>in</strong>g<br />

£5 million accrued <strong>in</strong>terest relat<strong>in</strong>g to the<br />

bond buy-back.<br />

Tax paid <strong>in</strong> the year was £15 million (2008 –<br />

£45 million).<br />

As no f<strong>in</strong>al dividend for 2008 or <strong>in</strong>terim<br />

dividend for <strong>2009</strong> was paid, the cash cost<br />

exclud<strong>in</strong>g dividends paid to m<strong>in</strong>orities was<br />

£nil (2008 – £97 million).<br />

£m<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Free cash flow<br />

Free cash flow, which is operat<strong>in</strong>g cash flow<br />

<strong>in</strong>clud<strong>in</strong>g jo<strong>in</strong>t venture dividends and after<br />

<strong>in</strong>terest, tax and dividends paid, was an<br />

<strong>in</strong>flow of £136 million (2008 – £38 million<br />

outflow) after £99 million (2008 – £28<br />

million) of expenditure on the Group’s<br />

restructur<strong>in</strong>g programmes. The year on<br />

year improvement reflects a strong focus<br />

on work<strong>in</strong>g capital, particularly <strong>in</strong>ventory<br />

reduction, lower capital expenditure, lower<br />

tax payments and the absence of a current<br />

year dividend.<br />

Net borrow<strong>in</strong>gs<br />

At the end of the year, the Group had net<br />

debt of £300 million (2008 – £708 million).<br />

This <strong>in</strong>cludes £403 million net proceeds from<br />

the rights issue, which were received <strong>in</strong> July<br />

<strong>2009</strong>, and acquisition expenditure (<strong>in</strong>clud<strong>in</strong>g<br />

<strong>in</strong>vestments <strong>in</strong> jo<strong>in</strong>t ventures and <strong>in</strong>vestment<br />

loans and capital contributions) of £112<br />

million (2008 – £1 million) primarily relat<strong>in</strong>g<br />

to the Filton acquisition.<br />

Customer advances <strong>in</strong> the Aerospace<br />

bus<strong>in</strong>esses, which are shown <strong>in</strong> trade<br />

and other payables <strong>in</strong> the balance sheet,<br />

amounted to £66 million (2008 – £79<br />

million). The Group’s share of net funds <strong>in</strong><br />

jo<strong>in</strong>t ventures was £9 million (2008 – share of<br />

net borrow<strong>in</strong>gs £1 million).<br />

Net debt<br />

2005<br />

2006<br />

2007<br />

2008<br />

<strong>2009</strong><br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Pensions and post-employment<br />

obligations<br />

<strong>GKN</strong> operates a number of def<strong>in</strong>ed benefit<br />

and def<strong>in</strong>ed contribution pension schemes<br />

together with retiree medical arrangements<br />

across the Group. The total charge to<br />

www.gkn.com<br />

trad<strong>in</strong>g profit <strong>in</strong> respect of current and past<br />

service costs, together with curtailments of<br />

def<strong>in</strong>ed benefit schemes and retiree medical<br />

arrangements, was £22 million (2008 – £25<br />

million), whilst other net f<strong>in</strong>anc<strong>in</strong>g charges<br />

<strong>in</strong>cluded <strong>in</strong> net f<strong>in</strong>anc<strong>in</strong>g costs were £49<br />

million (2008 – £3 million).<br />

The decrease <strong>in</strong> the charge to trad<strong>in</strong>g profit<br />

ma<strong>in</strong>ly reflects a reduction <strong>in</strong> current service<br />

cost of £2 million <strong>in</strong> the US as a result of<br />

clos<strong>in</strong>g most pension plans to future accrual,<br />

together with changes to life <strong>in</strong>surance<br />

benefits. The <strong>2009</strong> actions <strong>in</strong> the US also<br />

resulted <strong>in</strong> a total of £12 million <strong>in</strong> past<br />

service and curtailment credits (2008 – £12<br />

million). Further <strong>in</strong>formation <strong>in</strong>clud<strong>in</strong>g<br />

asset, liability and mortality assumptions<br />

used is provided <strong>in</strong> note 26 to the f<strong>in</strong>ancial<br />

statements.<br />

UK pensions<br />

The UK def<strong>in</strong>ed benefit scheme is considered<br />

to be relatively mature with around 4,800 of<br />

its 52,000 members currently <strong>in</strong> service. The<br />

UK def<strong>in</strong>ed benefit scheme rema<strong>in</strong>s open<br />

to new members and is run on a funded<br />

basis with funds set aside <strong>in</strong> trust to cover<br />

future liabilities to members. The scheme<br />

specific fund<strong>in</strong>g valuation and schedule<br />

of contributions as at April 2007 rema<strong>in</strong>s<br />

<strong>in</strong> force, whilst the next triennial scheme<br />

specific valuation will be as at April 2010.<br />

The charge relat<strong>in</strong>g to the UK def<strong>in</strong>ed<br />

benefit scheme reflected <strong>in</strong> trad<strong>in</strong>g profit <strong>in</strong><br />

respect of current and past service costs/<br />

curtailments was £20 million (2008 – £21<br />

million), whilst other net f<strong>in</strong>anc<strong>in</strong>g costs<br />

were £23 million (2008 – £13 million credit).<br />

Restructur<strong>in</strong>g activities attracted a past<br />

service charge of £1 million (2008 – £1<br />

million).<br />

The account<strong>in</strong>g deficit at 31 December <strong>2009</strong><br />

of £499 million (2008 – £272 million) was<br />

significantly higher than that at the end of<br />

2008. This was ma<strong>in</strong>ly as a result of <strong>in</strong>creased<br />

liabilities from changes <strong>in</strong> discount rate<br />

and <strong>in</strong>flation assumptions underly<strong>in</strong>g the<br />

valuation. The <strong>in</strong>crease <strong>in</strong> liabilities was only<br />

partially offset by higher asset values from<br />

higher <strong>in</strong>vestment returns.<br />

25