- Page 2 and 3:

TABLE OF CONTENTS DISCLOSURE OF ACC

- Page 4 and 5:

Explanation Fundamental Accounting

- Page 6 and 7:

21. Examples of matters in respect

- Page 8 and 9:

Definitions 3. The following terms

- Page 10 and 11:

(b) storage costs, unless those cos

- Page 12 and 13:

27. Information about the carrying

- Page 14 and 15:

performance by different enterprise

- Page 16 and 17:

15. The separate disclosure of cash

- Page 18 and 19:

22. Cash flows arising from the fol

- Page 20 and 21:

34. Cash flows arising from taxes o

- Page 22 and 23:

The appendix is illustrative only a

- Page 24 and 25:

Interest expense (400) Interest inc

- Page 26 and 27:

Interest expense 400 Operating prof

- Page 28 and 29:

31,850 Less : Sundry debtors at the

- Page 30 and 31:

Short-term funds (650) Deposits hel

- Page 32 and 33:

not contingencies as defined in par

- Page 34 and 35:

8.6 Events occurring after the bala

- Page 36 and 37:

Accounting Standard (AS) 5 Net Prof

- Page 38 and 39:

financial statements in understandi

- Page 40 and 41:

gratuity scheme by an employer in p

- Page 42 and 43:

(ii) expected useful life of the de

- Page 44 and 45:

19. A change in the method of depre

- Page 46 and 47:

Accounting Standard 7 (REVISED) Con

- Page 48 and 49:

8. A group of contracts, whether wi

- Page 50 and 51:

a. costs that relate directly to th

- Page 52 and 53:

estimated reliably when all the fol

- Page 54 and 55:

of which recovery is probable; and

- Page 56 and 57:

defects have been rectified. Progre

- Page 58 and 59:

incurred for work performed upto th

- Page 60 and 61:

calculated as follows: (amount in R

- Page 62 and 63:

4.3 Proportionate completion method

- Page 64 and 65:

the time of raising of any claim it

- Page 66 and 67:

should be based on the sales value

- Page 68 and 69:

Accounting Standard (AS) 10 Account

- Page 70 and 71:

9.3 Administration and other genera

- Page 72 and 73:

14.4 On disposal of a previously re

- Page 74 and 75:

either to the asset given up or to

- Page 76 and 77:

Accounting Standard (AS) 11 (Revise

- Page 78 and 79:

Reporting currency is the currency

- Page 80 and 81:

Classification of Foreign Operation

- Page 82 and 83:

. income and expense items of the n

- Page 84 and 85:

historical cost for those items in

- Page 86 and 87:

Appendix Note: This Appendix is not

- Page 88 and 89:

Accounting Treatment of Government

- Page 90 and 91:

8.1 Grants related to specific fixe

- Page 92 and 93:

(The Accounting Standard comprises

- Page 94 and 95:

Accounting Standard (AS) 13 Account

- Page 96 and 97:

fair value provides a prudent metho

- Page 98 and 99:

31. Investments classified as curre

- Page 100 and 101:

(v) No adjustment is intended to be

- Page 102 and 103:

Treatment of Reserves on Amalgamati

- Page 104 and 105:

(a) consideration for the amalgamat

- Page 106 and 107:

41. Where the scheme of amalgamatio

- Page 158 and 159: Accounting Standard (AS) 16 Borrowi

- Page 160 and 161: orrowings made specifically for the

- Page 162 and 163: Accounting Standard (AS) 17 Segment

- Page 164 and 165: statement of profit and loss. Segme

- Page 166 and 167: segments for internal financial rep

- Page 168 and 169: 24. Business and geographical segme

- Page 170 and 171: calculation done in applying a part

- Page 172 and 173: Secondary Segment Information 47. P

- Page 174 and 175: segment, both primary and secondary

- Page 176 and 177: REVENUE External sales Intersegment

- Page 178 and 179: 101 90 Assets and additions to tang

- Page 180 and 181: and intangible fixed assets by loca

- Page 182 and 183: 4. In the context of this Statement

- Page 184 and 185: (c) the director is nominated by th

- Page 186 and 187: (iii) a description of the nature o

- Page 188 and 189: 1. upon the occurrence of some remo

- Page 190 and 191: 5. The classification of leases ado

- Page 194 and 195: f. a general description of the les

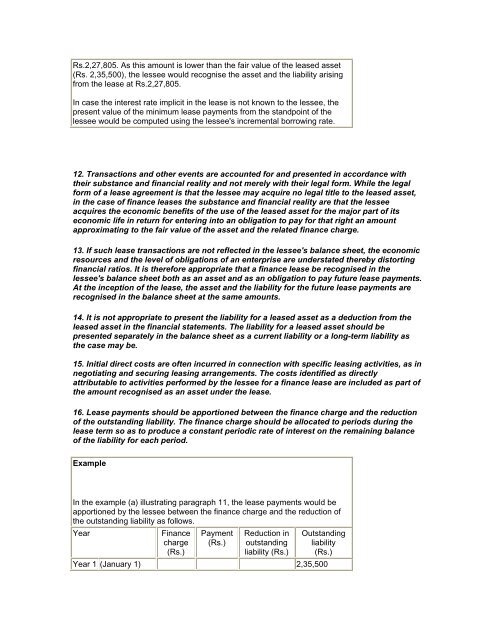

- Page 196 and 197: commencement of the lease term is t

- Page 198 and 199: 48. If a sale and leaseback transac

- Page 200 and 201: AS 20 Earnings Per Share (In this A

- Page 202 and 203: c. options including employee stock

- Page 204 and 205: merger is the aggregate of the weig

- Page 206 and 207: 29. For the purpose of calculating

- Page 208 and 209: 41. Potential equity shares are ant

- Page 210 and 211: Note: These appendices are illustra

- Page 212 and 213: EPS for the year 20X0 as originally

- Page 214 and 215: Convertible Preference Shares Incre

- Page 216 and 217: (a) the ownership, directly or indi

- Page 218 and 219: the consolidated financial statemen

- Page 220 and 221: subsidiary and does not become an a

- Page 222 and 223: Accounting Standard (AS) 22 ACCOUNT

- Page 224 and 225: accounting purposes, straight line

- Page 226 and 227: (a) has a legally enforceable right

- Page 228 and 229: 6. If for any reason the recognitio

- Page 230 and 231: Deferred tax A/c Dr. 20,000 To Prof

- Page 232 and 233: Accounting Standard (AS) 23 Account

- Page 234 and 235: (b) the associate operates under se

- Page 236 and 237: Disclosure 22. In addition to the d

- Page 238 and 239: . that represents a separate major

- Page 240 and 241: infrequently. All infrequently occu

- Page 242 and 243:

g. the amount of pre-tax profit or

- Page 244 and 245:

35. Appendix 2 illustrates applicat

- Page 246 and 247:

The following is Note 5 to Delta Co

- Page 248 and 249:

III. Financial Statements for 20X3

- Page 250 and 251:

2 A separate Accounting Standard on

- Page 252 and 253:

6. A complete set of financial stat

- Page 254 and 255:

g. segment revenue, segment capital

- Page 256 and 257:

29. To illustrate: a. the principle

- Page 258 and 259:

Accounting Standard to assist in cl

- Page 260 and 261:

1. Basic Earnings Per Share 2.Dilut

- Page 262 and 263:

provisions for employees (b) Other

- Page 264 and 265:

(condensed or complete) for the fol

- Page 266 and 267:

1st Quarter 2nd Quarter 3rd Quarter

- Page 268 and 269:

Accounting for the Effects of Chang

- Page 270 and 271:

a. intangible assets that are cover

- Page 272 and 273:

ecoverable amount.4 Carrying amount

- Page 274 and 275:

supportable assumptions that repres

- Page 276 and 277:

Therefore, in addition to complying

- Page 278 and 279:

titles, customer lists and items si

- Page 280 and 281:

Past Expenses not to be Recognised

- Page 282 and 283:

The enterprise amortises the right

- Page 284 and 285:

assets, how it determines the recov

- Page 286 and 287:

e. copyrights, and patents and othe

- Page 288 and 289:

Appendix A This Appendix, which is

- Page 290 and 291:

aforesaid and expensed in an earlie

- Page 292 and 293:

without physical substance held for

- Page 294 and 295:

Application and Infrastructure Deve

- Page 296 and 297:

On 1-4-2003, the remaining period o

- Page 298 and 299:

Accounting Standard 27 Financial Re

- Page 300 and 301:

The arrangement identifies those de

- Page 302 and 303:

the assets; c. its share of any lia

- Page 304 and 305:

separately as part of the inventory

- Page 306 and 307:

44 In case of transactions between

- Page 308 and 309:

Accounting Standard (AS) 28 Impairm

- Page 310 and 311:

4. The following terms are used in

- Page 312 and 313:

e. evidence is available of obsoles

- Page 314 and 315:

15. It is not always necessary to d

- Page 316 and 317:

ate can be justified. This growth r

- Page 318 and 319:

38. A restructuring is a programme

- Page 320 and 321:

. the enterprise’s incremental bo

- Page 322 and 323:

generate cash inflows from continui

- Page 324 and 325:

determined excluding cash flows tha

- Page 326 and 327:

esult from synergy between the iden

- Page 328 and 329:

88. In allocating an impairment los

- Page 330 and 331:

paragraphs 106 to 107 and for goodw

- Page 332 and 333:

102. Any increase in the carrying a

- Page 334 and 335:

a. if the enterprise sells the disc

- Page 336 and 337:

ased on the enterprise’s primary

- Page 338 and 339:

EXAMPLE 3- EXAMPLE 4- EXAMPLE 5- EX

- Page 340 and 341:

determining value in use of both X

- Page 342 and 343:

Total 10,000 7,000 3,000 A24. T use

- Page 344 and 345:

of the asset for tax purposes is Rs

- Page 346 and 347:

Gross carrying amount 1,000 2,000 3

- Page 348 and 349:

in forecasting cash flows. This res

- Page 350 and 351:

Schedule 1. Calculation of the plan

- Page 352 and 353:

Schedule 5. Summary of the carrying

- Page 354 and 355:

End of 20X4 A B C Goodwill Z Carryi

- Page 356 and 357:

in Rs. lakhs) Year Future cash flow

- Page 358 and 359:

Accounting Standard (AS) 29 Provisi

- Page 360 and 361:

The objective of this Statement is

- Page 362 and 363:

settle the obligation; or ii. a rel

- Page 364 and 365:

17. Financial statements deal with

- Page 366 and 367:

may result in the recognition of in

- Page 368 and 369:

warranties). The other party may ei

- Page 370 and 371:

expenditures are recognised on the

- Page 372 and 373:

It does not form part of the Accoun

- Page 374 and 375:

paragraphs 14 and 21). Example 3: O

- Page 376 and 377:

2005, the enterprise's lawyers advi

- Page 378:

an onerous contract as a contract i