General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

B<br />

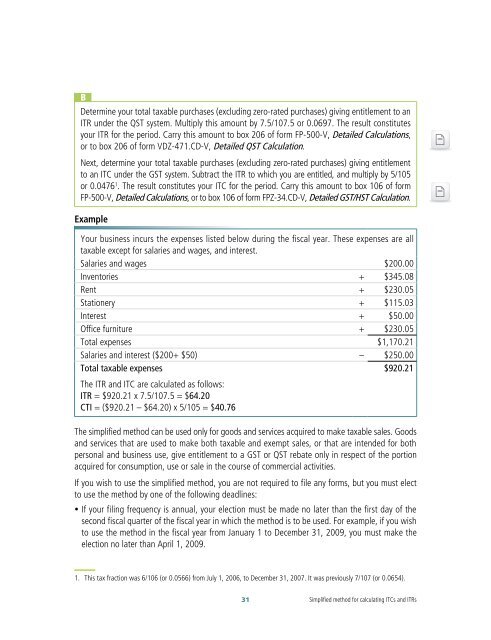

Determine your total taxable purchases (excluding zero-rated purchases) giving entitlement to an<br />

ITR under <strong>the</strong> <strong>QST</strong> system. Multiply this amount by 7.5/107.5 or 0.0697. The result constitutes<br />

your ITR for <strong>the</strong> period. Carry this amount to box 206 of form FP-500-V, Detailed Calculations,<br />

or to box 206 of form VDZ-471.CD-V, Detailed <strong>QST</strong> Calculation.<br />

Next, determine your total taxable purchases (excluding zero-rated purchases) giving entitlement<br />

to an ITC under <strong>the</strong> <strong>GST</strong> system. Subtract <strong>the</strong> ITR to which you are entitled, <strong>and</strong> multiply by 5/105<br />

or 0.0476 1 . The result constitutes your ITC for <strong>the</strong> period. Carry this amount to box 106 of form<br />

FP-500-V, Detailed Calculations, or to box 106 of form FPZ-34.CD-V, Detailed <strong>GST</strong>/<strong>HST</strong> Calculation.<br />

Example<br />

Your business incurs <strong>the</strong> expenses listed below during <strong>the</strong> fiscal year. These expenses are all<br />

taxable except for salaries <strong>and</strong> wages, <strong>and</strong> interest.<br />

Salaries <strong>and</strong> wages $200.00<br />

Inventories + $345.08<br />

Rent + $230.05<br />

Stationery + $115.03<br />

Interest + $50.00<br />

Office furniture + $230.05<br />

Total expenses $1,170.21<br />

Salaries <strong>and</strong> interest ($200+ $50) – $250.00<br />

Total taxable expenses $920.21<br />

The ITR <strong>and</strong> ITC are calculated as follows:<br />

ITR = $920.21 x 7.5/107.5 = $64.20<br />

CTI = ($920.21 – $64.20) x 5/105 = $40.76<br />

The simplified method can be used only for goods <strong>and</strong> services acquired to make taxable sales. Goods<br />

<strong>and</strong> services that are used to make both taxable <strong>and</strong> exempt sales, or that are intended for both<br />

personal <strong>and</strong> business use, give entitlement to a <strong>GST</strong> or <strong>QST</strong> rebate only in respect of <strong>the</strong> portion<br />

acquired for consumption, use or sale in <strong>the</strong> course of commercial activities.<br />

If you wish to use <strong>the</strong> simplified method, you are not required to file any forms, but you must elect<br />

to use <strong>the</strong> method by one of <strong>the</strong> following deadlines:<br />

y If your filing frequency is annual, your election must be made no later than <strong>the</strong> first day of <strong>the</strong><br />

second fiscal quarter of <strong>the</strong> fiscal year in which <strong>the</strong> method is to be used. For example, if you wish<br />

to use <strong>the</strong> method in <strong>the</strong> fiscal year from January 1 to December 31, 2009, you must make <strong>the</strong><br />

election no later than April 1, 2009.<br />

1. This tax fraction was 6/106 (or 0.0566) from July 1, 2006, to December 31, 2007. It was previously 7/107 (or 0.0654).<br />

31<br />

Simplified method for calculating ITCs <strong>and</strong> ITRs