General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

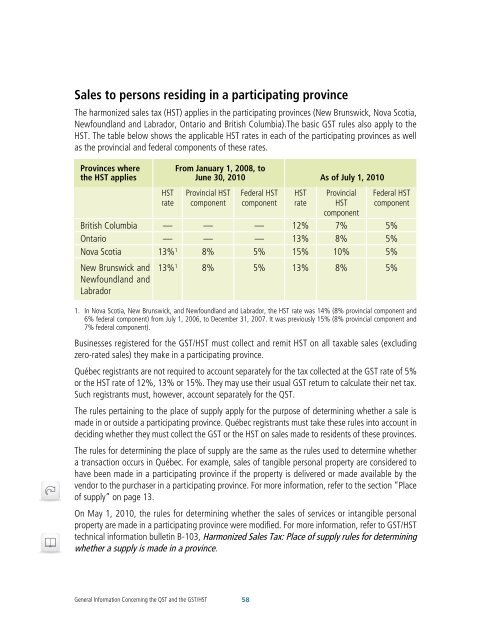

Sales to persons residing in a participating province<br />

The harmonized sales tax (<strong>HST</strong>) applies in <strong>the</strong> participating provinces (New Brunswick, Nova Scotia,<br />

Newfoundl<strong>and</strong> <strong>and</strong> Labrador, Ontario <strong>and</strong> British Columbia).The basic <strong>GST</strong> rules also apply to <strong>the</strong><br />

<strong>HST</strong>. The table below shows <strong>the</strong> applicable <strong>HST</strong> rates in each of <strong>the</strong> participating provinces as well<br />

as <strong>the</strong> provincial <strong>and</strong> federal components of <strong>the</strong>se rates.<br />

Provinces where<br />

<strong>the</strong> <strong>HST</strong> applies<br />

<strong>HST</strong><br />

rate<br />

<strong>General</strong> Information <strong>Concerning</strong> <strong>the</strong> <strong>QST</strong> <strong>and</strong> <strong>the</strong> <strong>GST</strong>/<strong>HST</strong> 58<br />

From January 1, 2008, to<br />

June 30, 2010 As of July 1, 2010<br />

Provincial <strong>HST</strong><br />

component<br />

Federal <strong>HST</strong><br />

component<br />

<strong>HST</strong><br />

rate<br />

Provincial<br />

<strong>HST</strong><br />

component<br />

Federal <strong>HST</strong><br />

component<br />

British Columbia — — — 12% 7% 5%<br />

Ontario — — — 13% 8% 5%<br />

Nova Scotia 13% 1 8% 5% 15% 10% 5%<br />

New Brunswick <strong>and</strong><br />

Newfoundl<strong>and</strong> <strong>and</strong><br />

Labrador<br />

13% 1 8% 5% 13% 8% 5%<br />

1. In Nova Scotia, New Brunswick, <strong>and</strong> Newfoundl<strong>and</strong> <strong>and</strong> Labrador, <strong>the</strong> <strong>HST</strong> rate was 14% (8% provincial component <strong>and</strong><br />

6% federal component) from July 1, 2006, to December 31, 2007. It was previously 15% (8% provincial component <strong>and</strong><br />

7% federal component).<br />

Businesses registered for <strong>the</strong> <strong>GST</strong>/<strong>HST</strong> must collect <strong>and</strong> remit <strong>HST</strong> on all taxable sales (excluding<br />

zero-rated sales) <strong>the</strong>y make in a participating province.<br />

Québec registrants are not required to account separately for <strong>the</strong> tax collected at <strong>the</strong> <strong>GST</strong> rate of 5%<br />

or <strong>the</strong> <strong>HST</strong> rate of 12%, 13% or 15%. They may use <strong>the</strong>ir usual <strong>GST</strong> return to calculate <strong>the</strong>ir net tax.<br />

Such registrants must, however, account separately for <strong>the</strong> <strong>QST</strong>.<br />

The rules pertaining to <strong>the</strong> place of supply apply for <strong>the</strong> purpose of determining whe<strong>the</strong>r a sale is<br />

made in or outside a participating province. Québec registrants must take <strong>the</strong>se rules into account in<br />

deciding whe<strong>the</strong>r <strong>the</strong>y must collect <strong>the</strong> <strong>GST</strong> or <strong>the</strong> <strong>HST</strong> on sales made to residents of <strong>the</strong>se provinces.<br />

The rules for determining <strong>the</strong> place of supply are <strong>the</strong> same as <strong>the</strong> rules used to determine whe<strong>the</strong>r<br />

a transaction occurs in Québec. For example, sales of tangible personal property are considered to<br />

have been made in a participating province if <strong>the</strong> property is delivered or made available by <strong>the</strong><br />

vendor to <strong>the</strong> purchaser in a participating province. For more information, refer to <strong>the</strong> section “Place<br />

of supply” on page 13.<br />

On May 1, 2010, <strong>the</strong> rules for determining whe<strong>the</strong>r <strong>the</strong> sales of services or intangible personal<br />

property are made in a participating province were modified. For more information, refer to <strong>GST</strong>/<strong>HST</strong><br />

technical information bulletin B-103, Harmonized Sales Tax: Place of supply rules for determining<br />

whe<strong>the</strong>r a supply is made in a province.