General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Special cases<br />

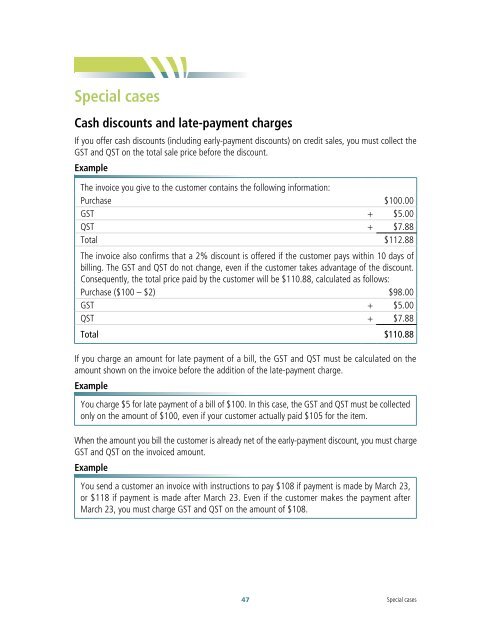

Cash discounts <strong>and</strong> late-payment charges<br />

If you offer cash discounts (including early-payment discounts) on credit sales, you must collect <strong>the</strong><br />

<strong>GST</strong> <strong>and</strong> <strong>QST</strong> on <strong>the</strong> total sale price before <strong>the</strong> discount.<br />

Example<br />

The invoice you give to <strong>the</strong> customer contains <strong>the</strong> following information:<br />

Purchase $100.00<br />

<strong>GST</strong> + $5.00<br />

<strong>QST</strong> + $7.88<br />

Total $112.88<br />

The invoice also confirms that a 2% discount is offered if <strong>the</strong> customer pays within 10 days of<br />

billing. The <strong>GST</strong> <strong>and</strong> <strong>QST</strong> do not change, even if <strong>the</strong> customer takes advantage of <strong>the</strong> discount.<br />

Consequently, <strong>the</strong> total price paid by <strong>the</strong> customer will be $110.88, calculated as follows:<br />

Purchase ($100 – $2) $98.00<br />

<strong>GST</strong> + $5.00<br />

<strong>QST</strong> + $7.88<br />

Total $110.88<br />

If you charge an amount for late payment of a bill, <strong>the</strong> <strong>GST</strong> <strong>and</strong> <strong>QST</strong> must be calculated on <strong>the</strong><br />

amount shown on <strong>the</strong> invoice before <strong>the</strong> addition of <strong>the</strong> late-payment charge.<br />

Example<br />

You charge $5 for late payment of a bill of $100. In this case, <strong>the</strong> <strong>GST</strong> <strong>and</strong> <strong>QST</strong> must be collected<br />

only on <strong>the</strong> amount of $100, even if your customer actually paid $105 for <strong>the</strong> item.<br />

When <strong>the</strong> amount you bill <strong>the</strong> customer is already net of <strong>the</strong> early-payment discount, you must charge<br />

<strong>GST</strong> <strong>and</strong> <strong>QST</strong> on <strong>the</strong> invoiced amount.<br />

Example<br />

You send a customer an invoice with instructions to pay $108 if payment is made by March 23,<br />

or $118 if payment is made after March 23. Even if <strong>the</strong> customer makes <strong>the</strong> payment after<br />

March 23, you must charge <strong>GST</strong> <strong>and</strong> <strong>QST</strong> on <strong>the</strong> amount of $108.<br />

47 Special cases