General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Glossary<br />

The key terms below are used in this booklet. Their definitions are based largely on those provided<br />

in <strong>the</strong> Excise Tax Act <strong>and</strong> <strong>the</strong> Act respecting <strong>the</strong> Québec sales tax.<br />

Charity<br />

A registered charity or a registered Canadian amateur athletic association within <strong>the</strong> meaning<br />

assigned by <strong>the</strong> Income Tax Act <strong>and</strong> <strong>the</strong> Taxation Act. For <strong>GST</strong> <strong>and</strong> <strong>QST</strong> purposes, if a charity is also a<br />

school authority, public college, university, hospital authority or local authority that is a municipality,<br />

it is not considered a charity but a public institution.<br />

Commercial activity<br />

Any activity carried on in order to make taxable sales. The making of exempt sales does not constitute<br />

a commercial activity.<br />

Consideration<br />

The value given in exchange on <strong>the</strong> sale of a good or service. It corresponds to an amount of<br />

money or to <strong>the</strong> fair market value of <strong>the</strong> good or service. In calculating <strong>the</strong> <strong>GST</strong>, <strong>the</strong> <strong>QST</strong> is not<br />

included in <strong>the</strong> consideration. However, <strong>the</strong> <strong>GST</strong> must be included in <strong>the</strong> consideration for purposes<br />

of calculating <strong>the</strong> <strong>QST</strong>.<br />

In this booklet, we also use <strong>the</strong> term “amount” since money is <strong>the</strong> most common form of<br />

consideration.<br />

Fair market value<br />

The highest price that can be obtained in an open market where <strong>the</strong> buyer <strong>and</strong> <strong>the</strong> seller are well<br />

informed, are dealing at arm’s length, <strong>and</strong> are not forced to buy or sell.<br />

Property<br />

Includes real property <strong>and</strong> personal property, whe<strong>the</strong>r tangible or intangible, but does not include<br />

money.<br />

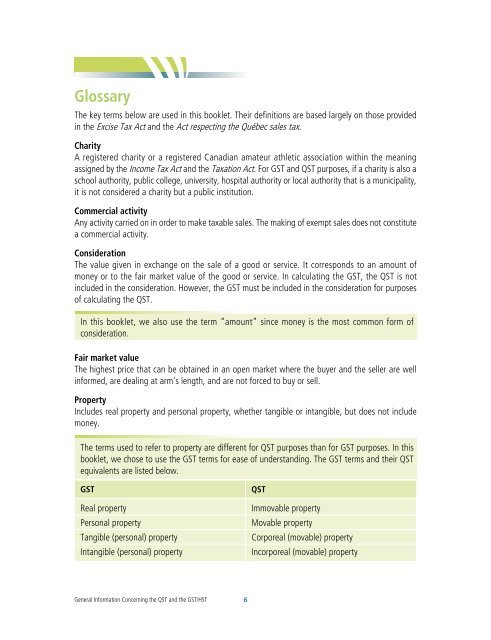

The terms used to refer to property are different for <strong>QST</strong> purposes than for <strong>GST</strong> purposes. In this<br />

booklet, we chose to use <strong>the</strong> <strong>GST</strong> terms for ease of underst<strong>and</strong>ing. The <strong>GST</strong> terms <strong>and</strong> <strong>the</strong>ir <strong>QST</strong><br />

equivalents are listed below.<br />

<strong>GST</strong> <strong>QST</strong><br />

Real property Immovable property<br />

Personal property Movable property<br />

Tangible (personal) property Corporeal (movable) property<br />

Intangible (personal) property Incorporeal (movable) property<br />

<strong>General</strong> Information <strong>Concerning</strong> <strong>the</strong> <strong>QST</strong> <strong>and</strong> <strong>the</strong> <strong>GST</strong>/<strong>HST</strong><br />

6