General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

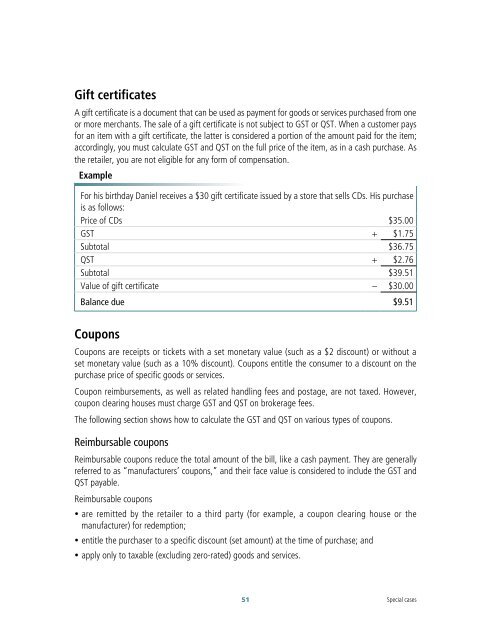

Gift certificates<br />

A gift certificate is a document that can be used as payment for goods or services purchased from one<br />

or more merchants. The sale of a gift certificate is not subject to <strong>GST</strong> or <strong>QST</strong>. When a customer pays<br />

for an item with a gift certificate, <strong>the</strong> latter is considered a portion of <strong>the</strong> amount paid for <strong>the</strong> item;<br />

accordingly, you must calculate <strong>GST</strong> <strong>and</strong> <strong>QST</strong> on <strong>the</strong> full price of <strong>the</strong> item, as in a cash purchase. As<br />

<strong>the</strong> retailer, you are not eligible for any form of compensation.<br />

Example<br />

For his birthday Daniel receives a $30 gift certificate issued by a store that sells CDs. His purchase<br />

is as follows:<br />

Price of CDs $35.00<br />

<strong>GST</strong> + $1.75<br />

Subtotal $36.75<br />

<strong>QST</strong> + $2.76<br />

Subtotal $39.51<br />

Value of gift certificate – $30.00<br />

Balance due $9.51<br />

Coupons<br />

Coupons are receipts or tickets with a set monetary value (such as a $2 discount) or without a<br />

set monetary value (such as a 10% discount). Coupons entitle <strong>the</strong> consumer to a discount on <strong>the</strong><br />

purchase price of specific goods or services.<br />

Coupon reimbursements, as well as related h<strong>and</strong>ling fees <strong>and</strong> postage, are not taxed. However,<br />

coupon clearing houses must charge <strong>GST</strong> <strong>and</strong> <strong>QST</strong> on brokerage fees.<br />

The following section shows how to calculate <strong>the</strong> <strong>GST</strong> <strong>and</strong> <strong>QST</strong> on various types of coupons.<br />

Reimbursable coupons<br />

Reimbursable coupons reduce <strong>the</strong> total amount of <strong>the</strong> bill, like a cash payment. They are generally<br />

referred to as “manufacturers’ coupons,” <strong>and</strong> <strong>the</strong>ir face value is considered to include <strong>the</strong> <strong>GST</strong> <strong>and</strong><br />

<strong>QST</strong> payable.<br />

Reimbursable coupons<br />

y are remitted by <strong>the</strong> retailer to a third party (for example, a coupon clearing house or <strong>the</strong><br />

manufacturer) for redemption;<br />

y entitle <strong>the</strong> purchaser to a specific discount (set amount) at <strong>the</strong> time of purchase; <strong>and</strong><br />

y apply only to taxable (excluding zero-rated) goods <strong>and</strong> services.<br />

51<br />

Special cases