General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

General Informatiion Concerning the QST and the GST/HST - Ryan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

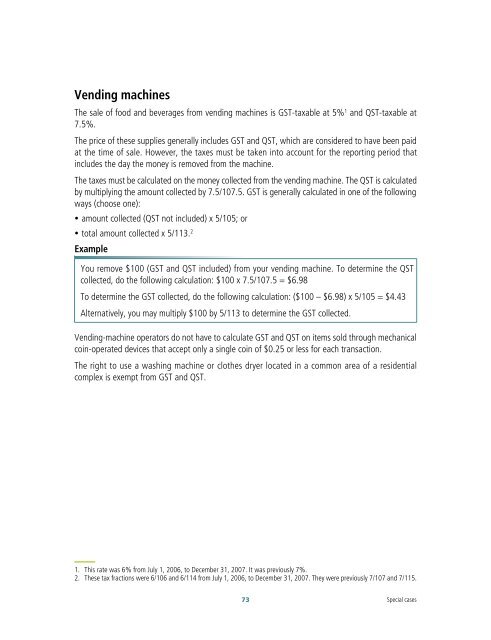

Vending machines<br />

The sale of food <strong>and</strong> beverages from vending machines is <strong>GST</strong>-taxable at 5% 1 <strong>and</strong> <strong>QST</strong>-taxable at<br />

7.5%.<br />

The price of <strong>the</strong>se supplies generally includes <strong>GST</strong> <strong>and</strong> <strong>QST</strong>, which are considered to have been paid<br />

at <strong>the</strong> time of sale. However, <strong>the</strong> taxes must be taken into account for <strong>the</strong> reporting period that<br />

includes <strong>the</strong> day <strong>the</strong> money is removed from <strong>the</strong> machine.<br />

The taxes must be calculated on <strong>the</strong> money collected from <strong>the</strong> vending machine. The <strong>QST</strong> is calculated<br />

by multiplying <strong>the</strong> amount collected by 7.5/107.5. <strong>GST</strong> is generally calculated in one of <strong>the</strong> following<br />

ways (choose one):<br />

y amount collected (<strong>QST</strong> not included) x 5/105; or<br />

y total amount collected x 5/113. 2<br />

Example<br />

You remove $100 (<strong>GST</strong> <strong>and</strong> <strong>QST</strong> included) from your vending machine. To determine <strong>the</strong> <strong>QST</strong><br />

collected, do <strong>the</strong> following calculation: $100 x 7.5/107.5 = $6.98<br />

To determine <strong>the</strong> <strong>GST</strong> collected, do <strong>the</strong> following calculation: ($100 – $6.98) x 5/105 = $4.43<br />

Alternatively, you may multiply $100 by 5/113 to determine <strong>the</strong> <strong>GST</strong> collected.<br />

Vending-machine operators do not have to calculate <strong>GST</strong> <strong>and</strong> <strong>QST</strong> on items sold through mechanical<br />

coin-operated devices that accept only a single coin of $0.25 or less for each transaction.<br />

The right to use a washing machine or clo<strong>the</strong>s dryer located in a common area of a residential<br />

complex is exempt from <strong>GST</strong> <strong>and</strong> <strong>QST</strong>.<br />

1. This rate was 6% from July 1, 2006, to December 31, 2007. It was previously 7%.<br />

2. These tax fractions were 6/106 <strong>and</strong> 6/114 from July 1, 2006, to December 31, 2007. They were previously 7/107 <strong>and</strong> 7/115.<br />

73<br />

Special cases