The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

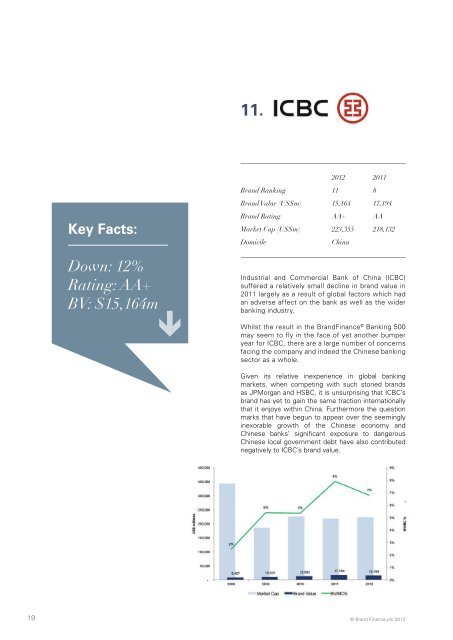

key Facts:<br />

Down: 12%<br />

Rating: AA+<br />

BV: $15,164m<br />

11.<br />

2012 2011<br />

<strong>Brand</strong> Ranking 11 8<br />

<strong>Brand</strong> Value (US$m) 15,164 17,194<br />

<strong>Brand</strong> Rating AA+ AA<br />

Market Cap (US$m) 223,355 218,132<br />

Domicile China<br />

Industrial and Commercial Bank of China (ICBC)<br />

suffered a relatively small decline in brand value in<br />

2011 largely as a result of global factors which had<br />

an adverse affect <strong>on</strong> <strong>the</strong> bank as well as <strong>the</strong> wider<br />

banking industry.<br />

Whilst <strong>the</strong> result in <strong>the</strong> <strong>Brand</strong><strong>Finance</strong> ® Banking 500<br />

may seem to fly in <strong>the</strong> face of yet ano<strong>the</strong>r bumper<br />

year for ICBC, <strong>the</strong>re are a large number of c<strong>on</strong>cerns<br />

facing <strong>the</strong> company and indeed <strong>the</strong> Chinese banking<br />

sector as a whole.<br />

Given its relative inexperience in global banking<br />

markets, when competing with such storied brands<br />

as JPMorgan and HSBC, it is unsurprising that ICBC’s<br />

brand has yet to gain <strong>the</strong> same tracti<strong>on</strong> internati<strong>on</strong>ally<br />

that it enjoys within China. Fur<strong>the</strong>rmore <strong>the</strong> questi<strong>on</strong><br />

marks that have begun to appear over <strong>the</strong> seemingly<br />

inexorable growth of <strong>the</strong> Chinese ec<strong>on</strong>omy and<br />

Chinese banks’ significant exposure to dangerous<br />

Chinese local government debt have also c<strong>on</strong>tributed<br />

negatively to ICBC’s brand value.<br />

12. Barclays<br />

2012 2011<br />

<strong>Brand</strong> Ranking 12 7<br />

<strong>Brand</strong> Value (US$m) 13,552 17,358<br />

<strong>Brand</strong> Rating AA+ AA<br />

Market Cap (US$m) 26,845 50,683<br />

Domicile UK<br />

Barclays extended its global reach in 2008 when<br />

it acquired <strong>the</strong> investment banking operati<strong>on</strong>s of<br />

Lehman Bro<strong>the</strong>rs during <strong>the</strong> global financial crisis.<br />

Led by <strong>the</strong> charismatic CEO Bob Diam<strong>on</strong>d, Barclays<br />

had to fight hard in 2011 to maintain its profit levels<br />

battling <strong>the</strong> seemingly endless financial disasters<br />

which have ravaged global markets.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> brand has come under fire from all sides as<br />

public support for banks has waned amid ubiquitous<br />

allegati<strong>on</strong>s of malpractice and corporate greed;<br />

politicians have even interrogated Diam<strong>on</strong>d himself<br />

over banking practices and criticised <strong>the</strong> b<strong>on</strong>us<br />

culture which exists in many banks.<br />

Despite a rocky ride, Barclays has managed to<br />

outperform all o<strong>the</strong>r British banks bar HSBC in terms<br />

of its brand value. In recent years <strong>the</strong> Barclays brand<br />

has gained a reputati<strong>on</strong> for being innovative and this<br />

was certainly dem<strong>on</strong>strated in <strong>the</strong> way it navigated<br />

<strong>on</strong>e of its toughest years to date.<br />

key Facts:<br />

Down: 22%<br />

Rating: AA+<br />

BV: $13,552m<br />

19 © <strong>Brand</strong> <strong>Finance</strong> plc 2012<br />

© <strong>Brand</strong> <strong>Finance</strong> plc 2012<br />

20