The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

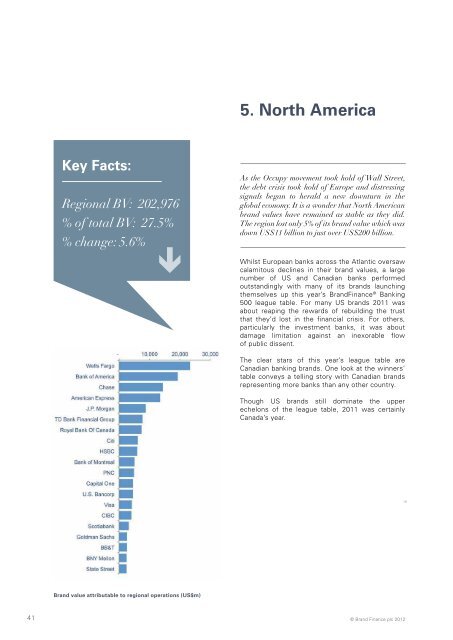

key Facts:<br />

Regi<strong>on</strong>al BV: 202,976<br />

% of total BV: 27.5%<br />

% change: 5.6%<br />

<strong>Brand</strong> value attributable to regi<strong>on</strong>al operati<strong>on</strong>s (us$m)<br />

5. north america<br />

As <strong>the</strong> Occupy movement took hold of Wall Street,<br />

<strong>the</strong> debt crisis took hold of Europe and distressing<br />

signals began to herald a new downturn in <strong>the</strong><br />

global ec<strong>on</strong>omy. It is a w<strong>on</strong>der that North American<br />

brand values have remained as stable as <strong>the</strong>y did.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> regi<strong>on</strong> lost <strong>on</strong>ly 5% of its brand value which was<br />

down US$11 billi<strong>on</strong> to just over US$200 billi<strong>on</strong>.<br />

Whilst European banks across <strong>the</strong> Atlantic oversaw<br />

calamitous declines in <strong>the</strong>ir brand values, a large<br />

number of US and Canadian banks performed<br />

outstandingly with many of its brands launching<br />

<strong>the</strong>mselves up this year’s <strong>Brand</strong><strong>Finance</strong> ® Banking<br />

500 league table. For many US brands 2011 was<br />

about reaping <strong>the</strong> rewards of rebuilding <strong>the</strong> trust<br />

that <strong>the</strong>y’d lost in <strong>the</strong> financial crisis. For o<strong>the</strong>rs,<br />

particularly <strong>the</strong> investment banks, it was about<br />

damage limitati<strong>on</strong> against an inexorable flow<br />

of public dissent.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> clear stars of this year’s league table are<br />

Canadian banking brands. One look at <strong>the</strong> winners’<br />

table c<strong>on</strong>veys a telling story with Canadian brands<br />

representing more banks than any o<strong>the</strong>r country.<br />

Though US brands still dominate <strong>the</strong> upper<br />

echel<strong>on</strong>s of <strong>the</strong> league table, 2011 was certainly<br />

Canada’s year.<br />

6. south and<br />

central america<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> ec<strong>on</strong>omy of South and Central America is<br />

dominated by that of Brazil. <str<strong>on</strong>g>The</str<strong>on</strong>g> Goldman Sachsanointed<br />

“BRIC” nati<strong>on</strong> has been <strong>the</strong> main driver<br />

of growth in <strong>the</strong> regi<strong>on</strong>. Brazilian banking brands<br />

have seen <strong>the</strong>ir values soar as <strong>the</strong> “country of <strong>the</strong><br />

future” begins to come into its own. Such is <strong>the</strong><br />

disparity between <strong>the</strong> wealth of Brazil and <strong>the</strong> rest<br />

of <strong>the</strong> regi<strong>on</strong> that it is <strong>the</strong> <strong>on</strong>ly country to have a<br />

presence in <strong>the</strong> top 100.<br />

However, even <strong>the</strong> BRIC’s have seen <strong>the</strong>ir<br />

development slowing as a result of myriad factors<br />

ranging from buckling c<strong>on</strong>fidence due to <strong>the</strong><br />

European debt crisis to falling demand owing to a<br />

faltering China. This has had a tangible impact up<strong>on</strong><br />

South and Central American brands.<br />

Despite <strong>the</strong> regi<strong>on</strong>’s significant presence in this<br />

year’s <strong>Brand</strong><strong>Finance</strong>® Banking 500 study, its brands<br />

have not had a successful year with <strong>the</strong> total amount<br />

of brand value generated <strong>the</strong>re falling by 9% to<br />

US$71 billi<strong>on</strong>. <str<strong>on</strong>g>The</str<strong>on</strong>g> three largest Brazilian banks in<br />

particular were severely impacted; <strong>the</strong> brand values<br />

of Bradesco, Itaú and Banco do Brasil fell by US$9<br />

billi<strong>on</strong>, a combined loss of al<strong>most</strong> 20%.<br />

key Facts:<br />

Regi<strong>on</strong>al BV: 70,961<br />

% of total BV: 9.6%<br />

% change: 8.7%<br />

<strong>Brand</strong> value attributable to regi<strong>on</strong>al operati<strong>on</strong>s (us$m)<br />

41 © <strong>Brand</strong> <strong>Finance</strong> plc 2012<br />

© <strong>Brand</strong> <strong>Finance</strong> plc 2012<br />

42