The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

The annual report on the world's most valuable ... - Brand Finance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

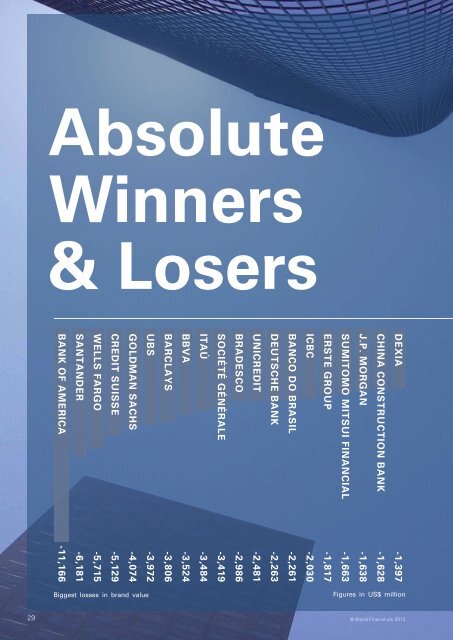

absolute<br />

Winners<br />

& losers<br />

Bank oF aMerica<br />

-11,166<br />

sanTander<br />

-6,181<br />

Wells Fargo<br />

-5,715<br />

crediT suisse<br />

-5,129<br />

goldMan sachs<br />

-4,074<br />

Biggest losses in brand value<br />

uBs<br />

-3,972<br />

Barclays<br />

-3,806<br />

BBVa<br />

-3,524<br />

iTaú<br />

-3,484<br />

sociéTé générale<br />

-3,419<br />

Bradesco<br />

-2,986<br />

unicrediT<br />

-2,481<br />

deuTsche Bank<br />

-2,263<br />

Banco do Brasil<br />

-2,261<br />

icBc<br />

-2,030<br />

ersTe grouP<br />

-1,817<br />

suMiToMo MiTsui Financial<br />

-1,663<br />

J.P. Morgan<br />

-1,638<br />

china c<strong>on</strong>sTrucTi<strong>on</strong> Bank<br />

-1,628<br />

dexia<br />

-1,397<br />

Figures in US$ milli<strong>on</strong><br />

Biggest gains in brand value<br />

29 30<br />

407<br />

anZ<br />

413<br />

naTi<strong>on</strong>al Bank oF canada<br />

444<br />

chuo MiTsui<br />

© <strong>Brand</strong> <strong>Finance</strong> plc 2012 © <strong>Brand</strong> <strong>Finance</strong> plc 2012<br />

459<br />

kkr<br />

532<br />

Visa<br />

561<br />

QnB<br />

614<br />

shanghai Pud<strong>on</strong>g deVeloPMenT Bank<br />

646<br />

agriculTural Bank oF china<br />

709<br />

rBs<br />

Canada and <strong>the</strong> United States have dominated <strong>the</strong><br />

absolute winners list this year with no less than<br />

12 North American brands placing <strong>on</strong> <strong>the</strong> brands<br />

that gained <strong>the</strong> <strong>most</strong> in dollar terms. Despite <strong>the</strong><br />

hordes of western banks whose brand values have<br />

fallen dramatically in 2011, many have been able to<br />

hold <strong>the</strong>ir own in an envir<strong>on</strong>ment which is arguably<br />

<strong>the</strong> toughest that banks have ever faced. Four of<br />

<strong>the</strong> US brands that have made <strong>the</strong> cut specialise<br />

in card services and this may be as a result of <strong>the</strong><br />

greater value rewards being offered by card brands.<br />

Undoubtedly, <strong>on</strong>e of <strong>the</strong> highlights of this year’s<br />

results is <strong>the</strong> emergence of a number of Canadian<br />

brands as some of <strong>the</strong> str<strong>on</strong>gest in <strong>the</strong> banking<br />

world. <str<strong>on</strong>g>The</str<strong>on</strong>g>ir prudent approach to banking has been<br />

vindicated this year. Royal Bank of Canada (RBC)<br />

was <strong>the</strong> <strong>most</strong> <strong>valuable</strong> Canadian banking brand,<br />

and it gained <strong>the</strong> fourth <strong>most</strong> of any banking brand<br />

worldwide.<br />

North American dominance aside, certain Asian<br />

banks had a very good year. Three Chinese and two<br />

Japanese banks have been able to make it into <strong>the</strong><br />

list. Over <strong>the</strong> past decade Chinese banks have seen<br />

a seemingly inexorable growth in <strong>the</strong>ir brand values.<br />

Even in <strong>the</strong> face of c<strong>on</strong>cerns regarding <strong>the</strong> stability<br />

of China’s ec<strong>on</strong>omy a number of Chinese banks<br />

have performed excepti<strong>on</strong>ally well and eased <strong>the</strong>ir<br />

way into <strong>the</strong> list of this year’s finest performers.<br />

791<br />

china MerchanTs Bank<br />

978<br />

Bank oF Tokyo-MiTsuBishi uFJ<br />

1,246<br />

MasTercard<br />

1,281<br />

ciBc<br />

1,363<br />

caPiTal <strong>on</strong>e<br />

1,505<br />

ciTi<br />

1,563<br />

Bank oF M<strong>on</strong>Treal<br />

Figures in US$ milli<strong>on</strong><br />

1,578<br />

royal Bank oF canada<br />

1,598<br />

scoTiaBank<br />

1,895<br />

Td Bank Financial grouP<br />

2,701<br />

aMerican exPress<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> 20 worst performing banks in this year’s<br />

<strong>Brand</strong><strong>Finance</strong> ® Banking 500 study collectively lost<br />

US$82,501 billi<strong>on</strong> worth of brand value in <strong>the</strong> last<br />

year. This is US$70 billi<strong>on</strong> more than <strong>the</strong> 20 worst<br />

performing banks of 2011, which shows <strong>the</strong> true<br />

extent of <strong>the</strong> current ec<strong>on</strong>omic situati<strong>on</strong>.<br />

Many European banking brands have suffered as<br />

a result of high exposure to European sovereign<br />

debt. Of <strong>the</strong> 20 worst performing banks in this year’s<br />

study, 8 of <strong>the</strong>m are from Europe. As <strong>the</strong> European<br />

debt crisis c<strong>on</strong>tinues to drag <strong>on</strong> so too does <strong>the</strong><br />

poor performance of <strong>the</strong>se banking brands.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> United States provided 3 of <strong>the</strong> 20 worst performing<br />

banks: Bank of America, Wells Fargo and Goldman<br />

Sachs. <str<strong>on</strong>g>The</str<strong>on</strong>g>se brands have suffered high levels of reputati<strong>on</strong>al<br />

damage for <strong>the</strong>ir involvement in subprime mortgages.<br />

Three of Brazil’s big four banks also found <strong>the</strong>mselves<br />

in <strong>the</strong> bottom twenty. <str<strong>on</strong>g>The</str<strong>on</strong>g> reas<strong>on</strong> for <strong>the</strong> fall of such<br />

large banks in a so-called emerging market is that<br />

up until fairly recently, Brazil had experienced str<strong>on</strong>g<br />

growth which had allowed investors to overlook <strong>the</strong><br />

risk of operating business within Brazil. That growth<br />

in Brazil has now flat lined making Banking brands in<br />

<strong>the</strong> country far less attractive.<br />

<str<strong>on</strong>g>The</str<strong>on</strong>g> worst performing brand terms of absolute value<br />

loss was Bank of America. Not <strong>on</strong>ly did <strong>the</strong>y perform<br />

badly this year but <strong>the</strong>y did so by a l<strong>on</strong>g way. <str<strong>on</strong>g>The</str<strong>on</strong>g><br />

brand lost nearly double <strong>the</strong> amount of brand value<br />

as Santander, <strong>the</strong> sec<strong>on</strong>d worst performing brand.