ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

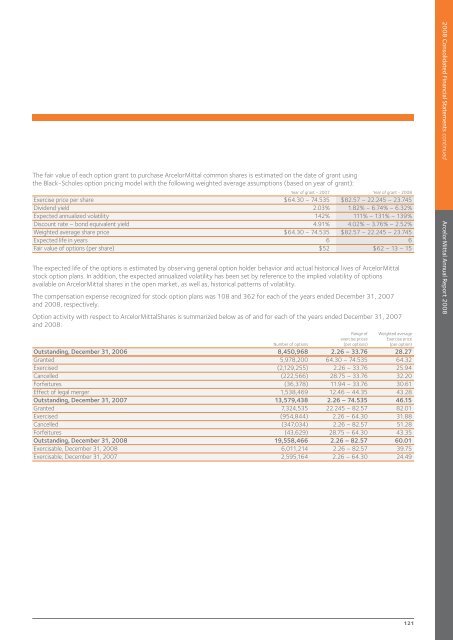

The fair value of each option grant to purchase <strong>ArcelorMittal</strong> common shares is estimated on the date of grant using<br />

the Black-Scholes option pricing model with the following weighted average assumptions (based on year of grant):<br />

Year of grant - 2007 Year of grant - <strong>2008</strong><br />

Exercise price per share $64.30 – 74.535 $82.57 – 22.245 – 23.745<br />

Dividend yield 2.03% 1.82% – 6.74% – 6.32%<br />

Expected annualized volatility 142% 111% – 131% – 139%<br />

Discount rate – bond equivalent yield 4.91% 4.02% – 3.76% – 2.52%<br />

Weighted average share price $64.30 – 74.535 $82.57 – 22.245 – 23.745<br />

Expected life in years 6 6<br />

Fair value of options (per share) $52 $62 – 13 – 15<br />

The expected life of the options is estimated by observing general option holder behavior and actual historical lives of <strong>ArcelorMittal</strong><br />

stock option plans. In addition, the expected annualized volatility has been set by reference to the implied volatility of options<br />

available on <strong>ArcelorMittal</strong> shares in the open market, as well as, historical patterns of volatility.<br />

The compensation expense recognized for stock option plans was 108 and 362 for each of the years ended December 31, 2007<br />

and <strong>2008</strong>, respectively.<br />

Option activity with respect to <strong>ArcelorMittal</strong>Shares is summarized below as of and for each of the years ended December 31, 2007<br />

and <strong>2008</strong>:<br />

Range of Weighted average<br />

exercise prices Exercise price<br />

Number of options (per options) (per option)<br />

Outstanding, December 31, 2006 8,450,968 2.26 – 33.76 28.27<br />

Granted 5,978,200 64.30 – 74.535 64.32<br />

Exercised (2,129,255) 2.26 – 33.76 25.94<br />

Cancelled (222,566) 28.75 – 33.76 32.20<br />

Forfeitures (36,378) 11.94 – 33.76 30.61<br />

Effect of legal merger 1,538,469 12.46 – 44.35 43.28<br />

Outstanding, December 31, 2007 13,579,438 2.26 – 74.535 46.15<br />

Granted 7,324,535 22.245 – 82.57 82.01<br />

Exercised (954,844) 2.26 – 64.30 31.88<br />

Cancelled (347,034) 2.26 – 82.57 51.28<br />

Forfeitures (43,629) 28.75 – 64.30 43.35<br />

Outstanding, December 31, <strong>2008</strong> 19,558,466 2.26 – 82.57 60.01<br />

Exercisable, December 31, <strong>2008</strong> 6,011,214 2.26 – 82.57 39.75<br />

Exercisable, December 31, 2007 2,595,164 2.26 – 64.30 24.49<br />

121<br />

<strong>2008</strong> Consolidated Financial Statements continued<br />

<strong>ArcelorMittal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>