ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

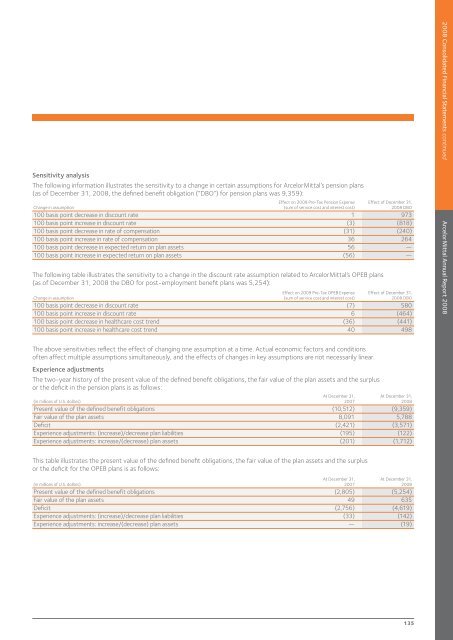

Sensitivity analysis<br />

The following information illustrates the sensitivity to a change in certain assumptions for <strong>ArcelorMittal</strong>’s pension plans<br />

(as of December 31, <strong>2008</strong>, the defined benefit obligation (“DBO”) for pension plans was 9,359):<br />

Effect on 2009 Pre-Tax Pension Expense Effect of December 31,<br />

Change in assumption (sum of service cost and interest cost) <strong>2008</strong> DBO<br />

100 basis point decrease in discount rate 1 973<br />

100 basis point increase in discount rate (3) (818)<br />

100 basis point decrease in rate of compensation (31) (240)<br />

100 basis point increase in rate of compensation 36 264<br />

100 basis point decrease in expected return on plan assets 56 —<br />

100 basis point increase in expected return on plan assets (56) —<br />

The following table illustrates the sensitivity to a change in the discount rate assumption related to <strong>ArcelorMittal</strong>’s OPEB plans<br />

(as of December 31, <strong>2008</strong> the DBO for post-employment benefit plans was 5,254):<br />

Effect on 2009 Pre-Tax OPEB Expense Effect of December 31,<br />

Change in assumption (sum of service cost and interest cost) <strong>2008</strong> DBO<br />

100 basis point decrease in discount rate (7) 580<br />

100 basis point increase in discount rate 6 (464)<br />

100 basis point decrease in healthcare cost trend (36) (441)<br />

100 basis point increase in healthcare cost trend 40 498<br />

The above sensitivities reflect the effect of changing one assumption at a time. Actual economic factors and conditions<br />

often affect multiple assumptions simultaneously, and the effects of changes in key assumptions are not necessarily linear.<br />

Experience adjustments<br />

The two-year history of the present value of the defined benefit obligations, the fair value of the plan assets and the surplus<br />

or the deficit in the pension plans is as follows:<br />

At December 31, At December 31,<br />

(in millions of U.S. dollars) 2007 <strong>2008</strong><br />

Present value of the defined benefit obligations (10,512) (9,359)<br />

Fair value of the plan assets 8,091 5,788<br />

Deficit (2,421) (3,571)<br />

Experience adjustments: (increase)/decrease plan liabilities (195) (122)<br />

Experience adjustments: increase/(decrease) plan assets (201) (1,712)<br />

This table illustrates the present value of the defined benefit obligations, the fair value of the plan assets and the surplus<br />

or the deficit for the OPEB plans is as follows:<br />

At December 31, At December 31,<br />

(in millions of U.S. dollars) 2007 <strong>2008</strong><br />

Present value of the defined benefit obligations (2,805) (5,254)<br />

Fair value of the plan assets 49 635<br />

Deficit (2,756) (4,619)<br />

Experience adjustments: (increase)/decrease plan liabilities (33) (142)<br />

Experience adjustments: increase/(decrease) plan assets — (19)<br />

135<br />

<strong>2008</strong> Consolidated Financial Statements continued<br />

<strong>ArcelorMittal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>