ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

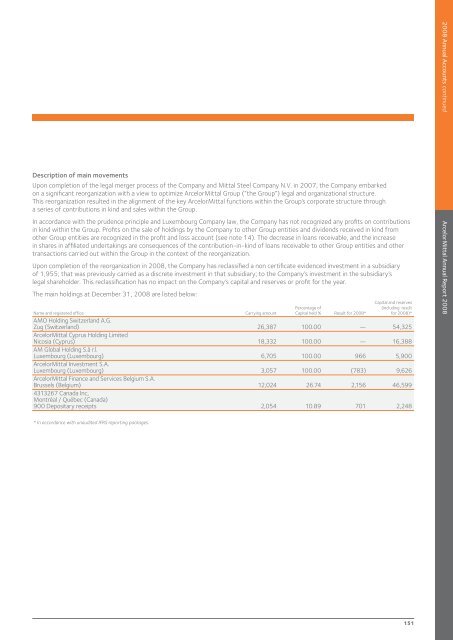

Description of main movements<br />

Upon completion of the legal merger process of the Company and Mittal Steel Company N.V. in 2007, the Company embarked<br />

on a significant reorganization with a view to optimize <strong>ArcelorMittal</strong> Group (“the Group”) legal and organizational structure.<br />

This reorganization resulted in the alignment of the key <strong>ArcelorMittal</strong> functions within the Group’s corporate structure through<br />

a series of contributions in kind and sales within the Group.<br />

In accordance with the prudence principle and Luxembourg Company law, the Company has not recognized any profits on contributions<br />

in kind within the Group. Profits on the sale of holdings by the Company to other Group entities and dividends received in kind from<br />

other Group entities are recognized in the profit and loss account (see note 14). The decrease in loans receivable, and the increase<br />

in shares in affiliated undertakings are consequences of the contribution-in-kind of loans receivable to other Group entities and other<br />

transactions carried out within the Group in the context of the reorganization.<br />

Upon completion of the reorganization in <strong>2008</strong>, the Company has reclassified a non certificate evidenced investment in a subsidiary<br />

of 1,955; that was previously carried as a discrete investment in that subsidiary; to the Company’s investment in the subsidiary’s<br />

legal shareholder. This reclassification has no impact on the Company’s capital and reserves or profit for the year.<br />

The main holdings at December 31, <strong>2008</strong> are listed below:<br />

Capital and reserves<br />

Percentage of (including result<br />

Name and registered office Carrying amount Capital held % Result for <strong>2008</strong>* for <strong>2008</strong>)*<br />

AMO Holding Switzerland A.G.<br />

Zug (Switzerland) 26,387 100.00 — 54,325<br />

<strong>ArcelorMittal</strong> Cyprus Holding Limited<br />

Nicosia (Cyprus) 18,332 100.00 — 16,388<br />

AM Global Holding S.à r.l.<br />

Luxembourg (Luxembourg) 6,705 100.00 966 5,900<br />

<strong>ArcelorMittal</strong> Investment S.A.<br />

Luxembourg (Luxembourg) 3,057 100.00 (783) 9,626<br />

<strong>ArcelorMittal</strong> Finance and Services Belgium S.A.<br />

Brussels (Belgium) 12,024 26.74 2,156 46,599<br />

4313267 Canada Inc,<br />

Montréal / Québec (Canada)<br />

900 Depositary receipts 2,054 10.89 701 2,248<br />

* In accordance with unaudited IFRS reporting packages.<br />

151<br />

<strong>2008</strong> <strong>Annual</strong> Accounts continued<br />

<strong>ArcelorMittal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>