ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

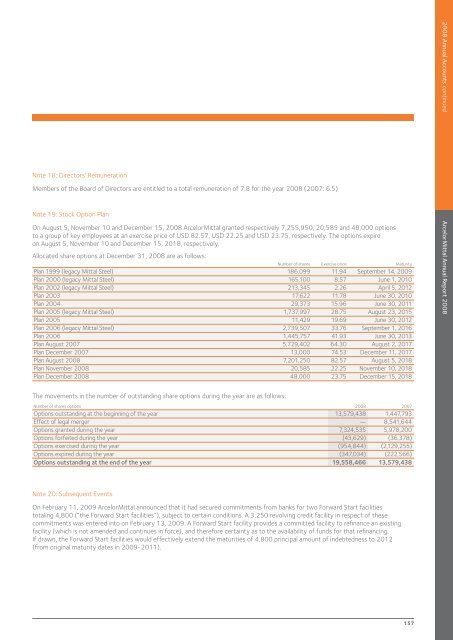

Note 18: Directors’ Remuneration<br />

Members of the Board of Directors are entitled to a total remuneration of 7.8 for the year <strong>2008</strong> (2007: 6.5)<br />

Note 19: Stock Option Plan<br />

On August 5, November 10 and December 15, <strong>2008</strong> <strong>ArcelorMittal</strong> granted respectively 7,255,950, 20,585 and 48,000 options<br />

to a group of key employees at an exercise price of USD 82.57, USD 22.25 and USD 23.75, respectively. The options expire<br />

on August 5, November 10 and December 15, 2018, respectively.<br />

Allocated share options at December 31, <strong>2008</strong> are as follows:<br />

Number of shares Exercise price Maturity<br />

Plan 1999 (legacy Mittal Steel) 186,099 11.94 September 14, 2009<br />

Plan 2000 (legacy Mittal Steel) 165,100 8.57 June 1, 2010<br />

Plan 2002 (legacy Mittal Steel) 213,345 2.26 April 5, 2012<br />

Plan 2003 17,622 11.78 June 30, 2010<br />

Plan 2004 29,373 15.96 June 30, 2011<br />

Plan 2005 (legacy Mittal Steel) 1,737,997 28.75 August 23, 2015<br />

Plan 2005 11,429 19.69 June 30, 2012<br />

Plan 2006 (legacy Mittal Steel) 2,739,507 33.76 September 1, 2016<br />

Plan 2006 1,445,757 41.93 June 30, 2013<br />

Plan August 2007 5,729,402 64.30 August 2, 2017<br />

Plan December 2007 13,000 74.53 December 11, 2017<br />

Plan August <strong>2008</strong> 7,201,250 82.57 August 5, 2018<br />

Plan November <strong>2008</strong> 20,585 22.25 November 10, 2018<br />

Plan December <strong>2008</strong> 48,000 23.75 December 15, 2018<br />

The movements in the number of outstanding share options during the year are as follows:<br />

Number of shares options <strong>2008</strong> 2007<br />

Options outstanding at the beginning of the year 13,579,438 1,447,793<br />

Effect of legal merger — 8,541,644<br />

Options granted during the year 7,324,535 5,978,200<br />

Options forfeited during the year (43,629) (36,378)<br />

Options exercised during the year (954,844) (2,129,255)<br />

Options expired during the year (347,034) (222,566)<br />

Options outstanding at the end of the year 19,558,466 13,579,438<br />

Note 20: Subsequent Events<br />

On February 11, 2009 <strong>ArcelorMittal</strong> announced that it had secured commitments from banks for two Forward Start facilities<br />

totaling 4,800 (“the Forward Start facilities”), subject to certain conditions. A 3,250 revolving credit facility in respect of these<br />

commitments was entered into on February 13, 2009. A Forward Start facility provides a committed facility to refinance an existing<br />

facility (which is not amended and continues in force), and therefore certainty as to the availability of funds for that refinancing.<br />

If drawn, the Forward Start facilities would effectively extend the maturities of 4,800 principal amount of indebtedness to 2012<br />

(from original maturity dates in 2009-2011).<br />

157<br />

<strong>2008</strong> <strong>Annual</strong> Accounts continued<br />

<strong>ArcelorMittal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>