ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

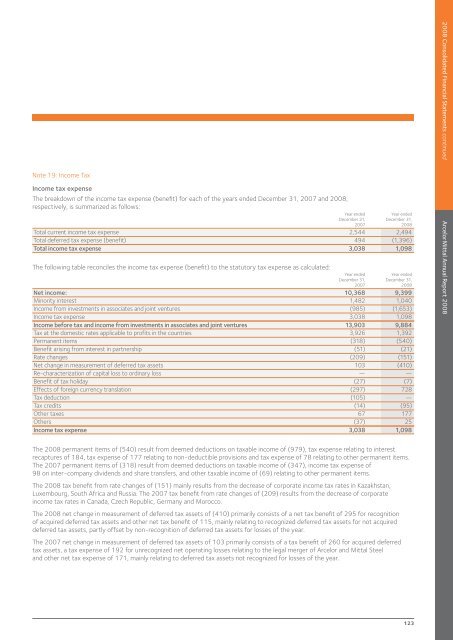

Note 19: Income Tax<br />

Income tax expense<br />

The breakdown of the income tax expense (benefit) for each of the years ended December 31, 2007 and <strong>2008</strong>,<br />

respectively, is summarized as follows:<br />

The following table reconciles the income tax expense (benefit) to the statutory tax expense as calculated:<br />

Year ended Year ended<br />

December 31, December 31,<br />

2007 <strong>2008</strong><br />

Total current income tax expense 2,544 2,494<br />

Total deferred tax expense (benefit) 494 (1,396)<br />

Total income tax expense 3,038 1,098<br />

Year ended Year ended<br />

December 31, December 31,<br />

2007 <strong>2008</strong><br />

Net income: 10,368 9,399<br />

Minority interest 1,482 1,040<br />

Income from investments in associates and joint ventures (985) (1,653)<br />

Income tax expense 3,038 1,098<br />

Income before tax and income from investments in associates and joint ventures 13,903 9,884<br />

Tax at the domestic rates applicable to profits in the countries 3,926 1,392<br />

Permanent items (318) (540)<br />

Benefit arising from interest in partnership (51) (21)<br />

Rate changes (209) (151)<br />

Net change in measurement of deferred tax assets 103 (410)<br />

Re-characterization of capital loss to ordinary loss — —<br />

Benefit of tax holiday (27) (7)<br />

Effects of foreign currency translation (297) 728<br />

Tax deduction (105) —<br />

Tax credits (14) (95)<br />

Other taxes 67 177<br />

Others (37) 25<br />

Income tax expense 3,038 1,098<br />

The <strong>2008</strong> permanent items of (540) result from deemed deductions on taxable income of (979), tax expense relating to interest<br />

recaptures of 184, tax expense of 177 relating to non-deductible provisions and tax expense of 78 relating to other permanent items.<br />

The 2007 permanent items of (318) result from deemed deductions on taxable income of (347), income tax expense of<br />

98 on inter-company dividends and share transfers, and other taxable income of (69) relating to other permanent items.<br />

The <strong>2008</strong> tax benefit from rate changes of (151) mainly results from the decrease of corporate income tax rates in Kazakhstan,<br />

Luxembourg, South Africa and Russia. The 2007 tax benefit from rate changes of (209) results from the decrease of corporate<br />

income tax rates in Canada, Czech Republic, Germany and Morocco.<br />

The <strong>2008</strong> net change in measurement of deferred tax assets of (410) primarily consists of a net tax benefit of 295 for recognition<br />

of acquired deferred tax assets and other net tax benefit of 115, mainly relating to recognized deferred tax assets for not acquired<br />

deferred tax assets, partly offset by non-recognition of deferred tax assets for losses of the year.<br />

The 2007 net change in measurement of deferred tax assets of 103 primarily consists of a tax benefit of 260 for acquired deferred<br />

tax assets, a tax expense of 192 for unrecognized net operating losses relating to the legal merger of Arcelor and Mittal Steel<br />

and other net tax expense of 171, mainly relating to deferred tax assets not recognized for losses of the year.<br />

123<br />

<strong>2008</strong> Consolidated Financial Statements continued<br />

<strong>ArcelorMittal</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>