ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements continued<br />

<strong>ArcelorMittal</strong> and Subsidiaries<br />

(millions of U.S. dollars, except share and per share data)<br />

The effects of foreign currency translation of 297 and 728 at December 31, 2007 and <strong>2008</strong>, respectively, pertain to certain<br />

entities with the U.S. dollar as functional currency and the local currency for tax purposes.<br />

The tax deduction of 105 in 2007 relates to federal governmental incentives granted to CST in Brazil as part of a program<br />

to promote the development of the Brazilian northeast region.<br />

The <strong>2008</strong> tax credits of 95 are mainly attributable to our Operating Subsidiaries in Spain. They relate to credits claimed on research<br />

and development, credits on investment and to tax sparing credits.<br />

Other taxes include withholding taxes on dividends including Secondary Taxation on Companies (“STC”), which is a tax levied<br />

on dividends declared by South African companies. STC is not included in the computation of current or deferred tax as these<br />

amounts are calculated at the statutory company tax rate on undistributed earnings. On declaration of a dividend, the South African<br />

Operating Subsidiary includes the STC tax in its computation of the income tax expense. If the South African Operating Subsidiary<br />

distributed all of its undistributed retained earnings of 2,978 million and 3,015 million in <strong>2008</strong> and 2007, respectively, it would<br />

be subject to additional taxes of 271 million and 274 million, respectively. STC on dividends declared in <strong>2008</strong> and 2007 were<br />

31 million and 67 million, respectively.<br />

Others of (37) in 2007 consists of a tax expense of 110, due to a change in Mexican tax law, a tax expense of 92 for deferred<br />

tax liabilities recorded on investments, a tax benefit of 193 due to a release of tax liabilities following the finalization of tax audits,<br />

and other tax benefits of 46.<br />

Tax agreements<br />

Certain agreements relating to acquisitions and capital investments undertaken by the Company, provides reduced tax rates,<br />

or, in some cases exemption from income tax. Such arrangements expire over various fiscal years through 2014.<br />

The net deferred tax benefit (expense) recorded directly to equity was 286 and (789) as of December 31, 2007 and <strong>2008</strong>,<br />

respectively. The net current tax benefit (expense) recorded directly to equity was 119 and (67) as of December 31, 2007<br />

and <strong>2008</strong>, respectively.<br />

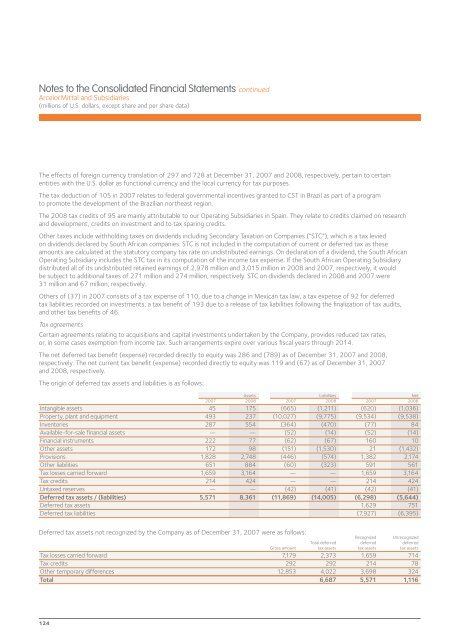

The origin of deferred tax assets and liabilities is as follows:<br />

Intangible assets 45 175 (665) (1,211) (620) (1,036)<br />

Property, plant and equipment 493 237 (10,027) (9,775) (9,534) (9,538)<br />

Inventories 287 554 (364) (470) (77) 84<br />

Available-for-sale financial assets — — (52) (14) (52) (14)<br />

Financial instruments 222 77 (62) (67) 160 10<br />

Other assets 172 98 (151) (1,530) 21 (1,432)<br />

Provisions 1,828 2,748 (446) (574) 1,382 2,174<br />

Other liabilities 651 884 (60) (323) 591 561<br />

Tax losses carried forward 1,659 3,164 — — 1,659 3,164<br />

Tax credits 214 424 — — 214 424<br />

Untaxed reserves — — (42) (41) (42) (41)<br />

Deferred tax assets / (liabilities) 5,571 8,361 (11,869) (14,005) (6,298) (5,644)<br />

Deferred tax assets 1,629 751<br />

Deferred tax liabilities (7,927) (6,395)<br />

Deferred tax assets not recognized by the Company as of December 31, 2007 were as follows:<br />

Tax losses carried forward 7,179 2,373 1,659 714<br />

Tax credits 292 292 214 78<br />

Other temporary differences 12,853 4,022 3,698 324<br />

Total 6,687 5,571 1,116<br />

124<br />

Assets Liabilities Net<br />

2007 <strong>2008</strong> 2007 <strong>2008</strong> 2007 <strong>2008</strong><br />

Recognized Unrecognized<br />

Total deferred deferred deferred<br />

Gross amount tax assets tax assets tax assets