ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

ArcelorMittal Annual Report 2008

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements continued<br />

<strong>ArcelorMittal</strong> and Subsidiaries<br />

(millions of U.S. dollars, except share and per share data)<br />

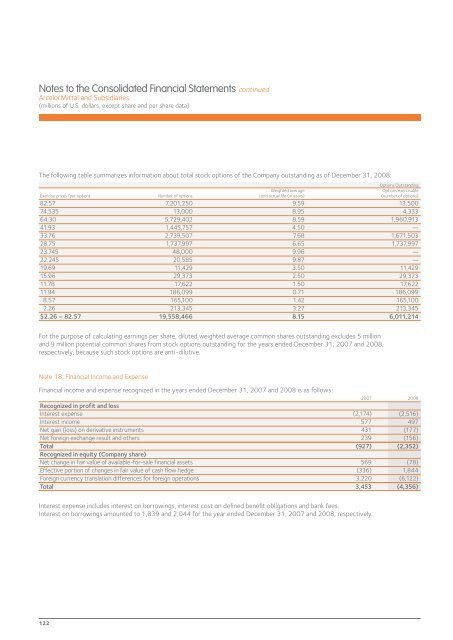

The following table summarizes information about total stock options of the Company outstanding as of December 31, <strong>2008</strong>:<br />

Options Outstanding<br />

Weighted average Options exercisable<br />

Exercise prices (per option) Number of options contractual life (in years) (number of options)<br />

82.57 7,201,250 9.59 13,500<br />

74.535 13,000 8.95 4,333<br />

64.30 5,729,402 8.59 1,960,913<br />

41.93 1,445,757 4.50 —<br />

33.76 2,739,507 7.68 1,671,503<br />

28.75 1,737,997 6.65 1,737,997<br />

23.745 48,000 9.96 —<br />

22.245 20,585 9.87 —<br />

19.69 11,429 3.50 11,429<br />

15.96 29,373 2.50 29,373<br />

11.78 17,622 1.50 17,622<br />

11.94 186,099 0.71 186,099<br />

8.57 165,100 1.42 165,100<br />

2.26 213,345 3.27 213,345<br />

$2.26 – 82.57 19,558,466 8.15 6,011,214<br />

For the purpose of calculating earnings per share, diluted weighted average common shares outstanding excludes 5 million<br />

and 9 million potential common shares from stock options outstanding for the years ended December 31, 2007 and <strong>2008</strong>,<br />

respectively, because such stock options are anti-dilutive.<br />

Note 18: Financial Income and Expense<br />

Financial income and expense recognized in the years ended December 31, 2007 and <strong>2008</strong> is as follows:<br />

2007 <strong>2008</strong><br />

Recognized in profit and loss<br />

Interest expense (2,174) (2,516)<br />

Interest income 577 497<br />

Net gain (loss) on derivative instruments 431 (177)<br />

Net foreign exchange result and others 239 (156)<br />

Total (927) (2,352)<br />

Recognized in equity (Company share)<br />

Net change in fair value of available-for-sale financial assets 569 (78)<br />

Effective portion of changes in fair value of cash flow hedge (336) 1,844<br />

Foreign currency translation differences for foreign operations 3,220 (6,122)<br />

Total 3,453 (4,356)<br />

Interest expense includes interest on borrowings, interest cost on defined benefit obligations and bank fees.<br />

Interest on borrowings amounted to 1,839 and 2,044 for the year ended December 31, 2007 and <strong>2008</strong>, respectively.<br />

122