TANJUNG OFFSHORE BERHAD

TANJUNG OFFSHORE BERHAD

TANJUNG OFFSHORE BERHAD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>TANJUNG</strong> <strong>OFFSHORE</strong> <strong>BERHAD</strong> (662315-U)<br />

ANNUAL REPORT 2009<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2009<br />

17. SHARE CAPITAL (continued)<br />

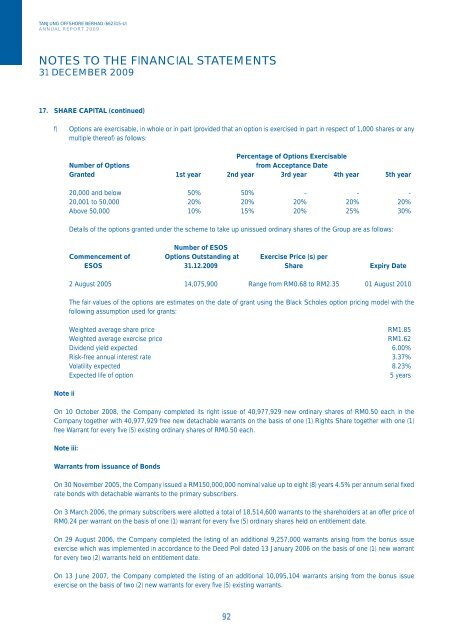

f) Options are exercisable, in whole or in part (provided that an option is exercised in part in respect of 1,000 shares or any<br />

multiple thereof) as follows:<br />

Note ii<br />

Percentage of Options Exercisable<br />

Number of Options from Acceptance Date<br />

Granted 1st year 2nd year 3rd year 4th year 5th year<br />

20,000 and below 50% 50% - - -<br />

20,001 to 50,000 20% 20% 20% 20% 20%<br />

Above 50,000 10% 15% 20% 25% 30%<br />

Details of the options granted under the scheme to take up unissued ordinary shares of the Group are as follows:<br />

Number of ESOS<br />

Commencement of Options Outstanding at Exercise Price (s) per<br />

ESOS 31.12.2009 Share Expiry Date<br />

2 August 2005 14,075,900 Range from RM0.68 to RM2.35 01 August 2010<br />

The fair values of the options are estimates on the date of grant using the Black Scholes option pricing model with the<br />

following assumption used for grants:<br />

Weighted average share price RM1.85<br />

Weighted average exercise price RM1.62<br />

Dividend yield expected 6.00%<br />

Risk-free annual interest rate 3.37%<br />

Volatility expected 8.23%<br />

Expected life of option 5 years<br />

On 10 October 2008, the Company completed its right issue of 40,977,929 new ordinary shares of RM0.50 each in the<br />

Company together with 40,977,929 free new detachable warrants on the basis of one (1) Rights Share together with one (1)<br />

free Warrant for every fi ve (5) existing ordinary shares of RM0.50 each.<br />

Note iii:<br />

Warrants from issuance of Bonds<br />

On 30 November 2005, the Company issued a RM150,000,000 nominal value up to eight (8) years 4.5% per annum serial fi xed<br />

rate bonds with detachable warrants to the primary subscribers.<br />

On 3 March 2006, the primary subscribers were allotted a total of 18,514,600 warrants to the shareholders at an offer price of<br />

RM0.24 per warrant on the basis of one (1) warrant for every fi ve (5) ordinary shares held on entitlement date.<br />

On 29 August 2006, the Company completed the listing of an additional 9,257,000 warrants arising from the bonus issue<br />

exercise which was implemented in accordance to the Deed Poll dated 13 January 2006 on the basis of one (1) new warrant<br />

for every two (2) warrants held on entitlement date.<br />

On 13 June 2007, the Company completed the listing of an additional 10,095,104 warrants arising from the bonus issue<br />

exercise on the basis of two (2) new warrants for every fi ve (5) existing warrants.<br />

92