TANJUNG OFFSHORE BERHAD

TANJUNG OFFSHORE BERHAD

TANJUNG OFFSHORE BERHAD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>TANJUNG</strong> <strong>OFFSHORE</strong> <strong>BERHAD</strong> (662315-U)<br />

ANNUAL REPORT 2009<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

31 DECEMBER 2009<br />

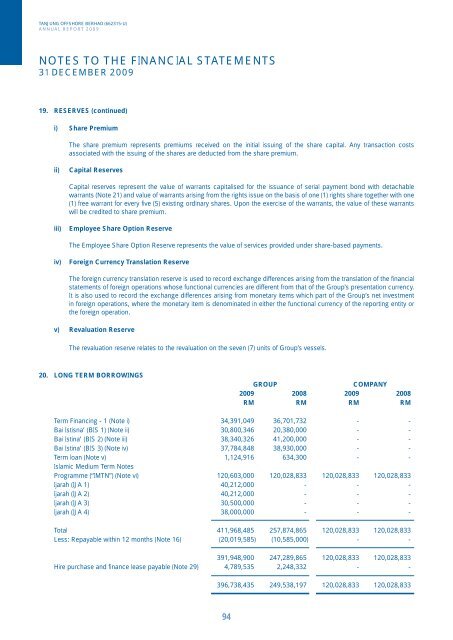

19. RESERVES (continued)<br />

i) Share Premium<br />

The share premium represents premiums received on the initial issuing of the share capital. Any transaction costs<br />

associated with the issuing of the shares are deducted from the share premium.<br />

ii) Capital Reserves<br />

Capital reserves represent the value of warrants capitalised for the issuance of serial payment bond with detachable<br />

warrants (Note 21) and value of warrants arising from the rights issue on the basis of one (1) rights share together with one<br />

(1) free warrant for every fi ve (5) existing ordinary shares. Upon the exercise of the warrants, the value of these warrants<br />

will be credited to share premium.<br />

iii) Employee Share Option Reserve<br />

The Employee Share Option Reserve represents the value of services provided under share-based payments.<br />

iv) Foreign Currency Translation Reserve<br />

The foreign currency translation reserve is used to record exchange differences arising from the translation of the fi nancial<br />

statements of foreign operations whose functional currencies are different from that of the Group’s presentation currency.<br />

It is also used to record the exchange differences arising from monetary items which part of the Group’s net investment<br />

in foreign operations, where the monetary item is denominated in either the functional currency of the reporting entity or<br />

the foreign operation.<br />

v) Revaluation Reserve<br />

The revaluation reserve relates to the revaluation on the seven (7) units of Group’s vessels.<br />

20. LONG TERM BORROWINGS<br />

94<br />

GROUP COMPANY<br />

2009 2008 2009 2008<br />

RM RM RM RM<br />

Term Financing - 1 (Note i) 34,391,049 36,701,732 - -<br />

Bai Istisna’ (BIS 1) (Note ii) 30,800,346 20,380,000 - -<br />

Bai Istina’ (BIS 2) (Note iii) 38,340,326 41,200,000 - -<br />

Bai Istina’ (BIS 3) (Note iv) 37,784,848 38,930,000 - -<br />

Term loan (Note v) 1,124,916 634,300 - -<br />

Islamic Medium Term Notes<br />

Programme (“IMTN”) (Note vi) 120,603,000 120,028,833 120,028,833 120,028,833<br />

Ijarah (IJA 1) 40,212,000 - - -<br />

Ijarah (IJA 2) 40,212,000 - - -<br />

Ijarah (IJA 3) 30,500,000 - - -<br />

Ijarah (IJA 4) 38,000,000 - - -<br />

Total 411,968,485 257,874,865 120,028,833 120,028,833<br />

Less: Repayable within 12 months (Note 16) (20,019,585) (10,585,000) - -<br />

391,948,900 247,289,865 120,028,833 120,028,833<br />

Hire purchase and fi nance lease payable (Note 29) 4,789,535 2,248,332 - -<br />

396,738,435 249,538,197 120,028,833 120,028,833