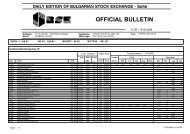

METALAC - AII Data Processing

METALAC - AII Data Processing

METALAC - AII Data Processing

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

May 14, 2013<br />

Metalac - Serbia - Manufacturing<br />

Semi-annual update<br />

ØFX EURRSD 103.04 101.95 113.04<br />

Cash Flow Statement (m RSD) 2010<br />

Inflows from Operating Activities 5,184 114% 5,770 112% 7,165 113%<br />

Growth - - 11% - 24% -<br />

Sale and Received Payments in Advance 5,009 110% 5,589 108% 6,933 110%<br />

Growth - - 3% - 28% -<br />

Outflows from Operating Activities 4,712 103% 5,342 103% 6,634 105%<br />

Growth - - 13% - 24% -<br />

Outflows to Suppliers and Payments in Advance 3,376 74% 3,896 75% 4,856 77%<br />

Growth - - 15% - 25% -<br />

Salaries and other Labor Costs 926 20% 1,066 21% 1,299 21%<br />

CFO 473 10% 428 8% 530 8%<br />

Growth - - -10% - 24% -<br />

Inflows from Investing Activities 29 1% 476 9% 30 0%<br />

Property Sale 1 0% 0 0% 0 0%<br />

Outflows from Investing Activities 528 12% 208 4% 482 8%<br />

Property Purchase 66 1% 208 4% 476 8%<br />

CFI -499 -11% 268 5% -452 -7%<br />

Inflows from Financing Activities 6 0% 0 0% 170 3%<br />

Long and Short-term Loans (net inflows) 0 0% 0 0% 170 3%<br />

Outflows from Financing Activities 272 6% 329 6% 253 4%<br />

Long and Short-term loans and other liabilities (net<br />

outflows)<br />

Com.<br />

Size<br />

2011<br />

Com.<br />

Size<br />

2012<br />

Com.<br />

Size<br />

116 3% 139 3% 0 0%<br />

CFF -266 -6% -329 -6% -82 -1%<br />

NET INFLOWS/OUTFLOWS -292 -6% 367 7% -4 0%<br />

Growth - - - - - -<br />

Source: Sinteza Research, Metalac<br />

MAIN INDICATORS 2010 2011 2012<br />

LIQUIDITY<br />

Current Ratio 2.30 2.03 2.44<br />

Quick Ratio 1.45 1.23 1.40<br />

Cash Ratio 0.22 0.37 0.39<br />

SOLVENCY<br />

Debt-to-Equity 0.36 0.29 0.31<br />

Debt-to-Capital 0.26 0.23 0.24<br />

Debt-to-Assets 0.22 0.19 0.19<br />

Financial Leverage 1.61 1.58 1.64<br />

PROFITABILITY<br />

EBITDA Margin 17.7% 15.3% 15.8%<br />

EBIT Margin 13.1% 11.4% 12.1%<br />

Profit Margin 10.2% 9.8% 9.4%<br />

Operating Return on Assets – ttm 21.4% 10.1% 12.1%<br />

Return on Assets (ROA) – ttm 8.3% 8.7% 9.4%<br />

Return on Equity (ROE) – ttm 13.4% 14.0% 15.1%<br />

Return on Capital (ROTC) – ttm 25.4% 12.2% 15.0%<br />

Cash Return on Assets (CFROA) – ttm 8.4% 7.5% 8.5%<br />

SINTEZA INVEST GROUP | MTLC 2012 8